A different kind of recession

For the ones looking in the rear view mirror for the signs of a recession, you might not find much. It is quite different this time around.

Recession talks are making the rounds again. Individuals, investors, corporates and policymakers are increasingly getting wary of the impending downturn in the economy. Some of us might think that we are already in a recession. Inflation is at a multi-decade high, consumer sentiment is weakening, and energy prices are breaking everything.

We might be trying to refresh our vague memories of the 2008 crash and the subsequent recession, when the S&P 500 was cut in half from Jan 08 to 09, house and real prices collapsed all over the world and millions lost their jobs.

Google search trends suggests an increasing interest in inflation and recession too.

The markets started to show some worrying signs. Global stock markets lost a quarter of their value till June, with a ton of froth and speculative stuff being cleared out completely this year.

A stagflationary environment in which growth is slowing down and inflation is high, is bad for equities. Economic growth encourages capital allocation towards risk assets, but with a bleak growth outlook investors are at a historical low when it comes to risk taking. They are increasingly bearish and underweighting equities and risk assets.

Cyclical sectors, which tend to do well in a growth cycle have experienced consistent equity outflows with expectations of a demand slowdown, thus driving prices lower.

Commodities are off the highs along the same lines.

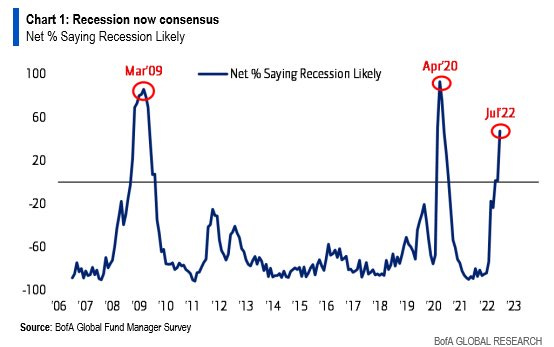

Recession is slowly creeping towards becoming a consensus with growth optimism down in the dumps.

The market is not the economy, but this sentiment and level of wealth destruction could have a wealth-effect in reverse. Just like soaring housing and stock markets can have a psychological effect on the consumer’s spending habits, it can also work in reverse. Falling asset prices can start a vicious feedback loop where a slowing economy and inflation leads to risk aversion and lower stock prices, leading to paring back of consumer spending, therefore feeding into this down cycle.

But this recession, if it ever arrives, is going to be a quite different. Here's why.

We’re well prepared

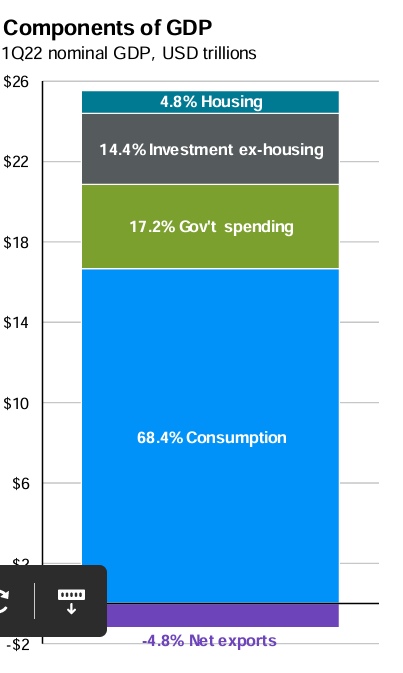

Given that GDP growth is highly weighted towards consumer spending (see charts below), the health of the consumer can tell you a lot about economic growth and slowdowns.

Banks earnings results are always interesting as they give you a lens to look into the health of the economy, consumer finances and businesses, and we got some interesting data points that seem quite contradictory to what we might see heading into a recession.

J.P Morgan said consumers are spending 10% more than last year and 30% more than pre-COVID levels. Travel and dining spends are up 34% YoY with spending growing faster than incomes. Citi corroborated with the same trends adding that spending has shifted far more towards travel and entertainment, and is outpacing 2019 levels. Delinquency rates are still below high risk levels and loan growth is positive.

U.S consumer finances are still strong, with over $2tn in excess savings left to spend. According to the WSJ,

Federal Reserve data show that as of the end of the first quarter, U.S. households held $17.9 trillion in cash and cash equivalents, up a bit from the fourth quarter and much higher than the $13.7 trillion they had at the end of the first quarter of 2020. Indeed, before the pandemic, U.S. households never experienced anything like the increase in cash they have experienced over the past two years, and this remains true even after adjusting for the run up in inflation.

On the other side of the Atlantic, consumer spending is slowing down both in the UK and EU driven by increasing living costs. Spending fell 2% on a weekly basis in June in the UK and is now level with Feb 2020 levels. In the Eurozone, consumers cut back their spending by 0.7% in the first quarter, but have driving their savings rates back to long-term averages. But overall, the region still has EUR384bn of excess savings left to spend.

Not so good as the US consumer, but its not dire yet.

The housing market is showing no signs of slowing down anywhere, with U.S, UK and EU all seeing median house prices at record levels. House prices in the UK rose 12% in Q1 and 5-10% in EU and U.S. Being one of the largest assets in an average person’s net worth, a drop in house prices can have all kinds of repercussions like we saw in 2008, but this time around we’re yet to see any signs of strain here.

The state of the consumer is not what you would usually see when a recession is staring us in our faces.

Jobs are aplenty

Recessions are usually marked with high unemployment rates and a de-growth in wages. We witnessed one of the tightest job markets in a long time in 2021 and till the first half of this year. Unemployment levels fell to record low levels in EU, UK and close to the lows in the U.S, with wages growing in most regions on a nominal basis.

While there has been a wave of layoffs recently in the tech sector, a lot of it is just a normalisation of the excesses of the past two years. Unemployment rates usually tick up well into the recession (being a lagging indicator), but this is far from what we saw in the previous down cycles.

On the other hand, the hospitality, entertainment and travel sector is facing massive staff shortages in Europe and the UK (If you tried travelling in Europe, you would know). Companies are offering pay rises and bonuses to get extra staff. Hundreds of flights have been cancelled, and labour shortages are pushing up prices everywhere, feeding into the inflationary pressures.

A recession where everyone is engaged in revenge travel? Going to be the first.

We’re still investing

An impending recession changes spending patterns meaningfully. Savings rates start ticking up, discretionary spends morph into non-discretionary ones and investment rates start falling. This time around, retail investors have held on though, with flows being fairly stable this year. Surprisingly, their belief in tech stocks has not cratered, and funds like ARKK (The retail darling of last year) are still showing signs of resilience.

We did not have on-demand access to the markets in 2008, when mobile and apps were still in its nascency. Now we have hundreds of brokers and investing apps charging low or no commissions and a much more mature ETFs markets giving retail investors access to low cost products. I believe the pandemic changed investing quite significantly. It introduced millions to the markets (via social media, forums and other channels) and it seems to have made massive strides in seeping into our culture.

Dare not say it

“Its different this time”. I dare not say it I know. But you can clearly find the disparities between how people are feeling (consumer sentiment) and what they are actually doing (consumer spending). The actual data does not show enough signs of a recession yet.

But the markets and professionals have started to make moves in that direction, which could dampen consumer spirits and put a dent in this spending spree. This situation also reminds me of George Soros’ reflexivity principle, which states that participants’ distorted views can influence the real situation to which they relate. Consumers and investors strongly believe that a recession is coming or its already here, which can easily influence how they behave, which drives the economy down into a real recession.

Be it a technical recession to an economic slowdown, it will always be hard to predict. But this one could be a very different kind of recession.

Until next time,

The Atomic Investor