Benchmarking the Atomic Portfolio

Putting the ideas to work Part II.

In the previous post of the Atomic Portfolio series, I discussed some of my favourite first principles to construct a long-term Atomic Portfolio. This time, I'll take you through how I am thinking about asset allocation and portfolio construction going forward.

Asset allocation

Asset allocation decisions are one of the most important calls you have to make while managing your wealth. The investment management industry has commonly used "The 60/40 approach" to asset allocation to construct a simple stock and bond portfolio. While this approach simplifies portfolio construction, in an ever changing investment environment this might not yield the best results going forward.

Why? First, the "40" of your portfolio has unattractive forward returns, given where rates are at the moment. This piece by Corey Hoffstein does an excellent job to explain how the yield today has the largest contribution to forward fixed income returns. Second, although there's no dearth of opportunities in equities, stretched valuations in parts of the market and significantly top heavy market indices could lead to sub-optimal returns in the "60" of your portfolio.

Building upon the first principle of "diversified uncorrelated returns in most environments", I would move away from the 50/50 and 60/40 and allocate to multiple asset classes to capture additional upsides and ensure downside protection.

A lot of asset allocation depends on your willingness and ability to take on risk. The allocation itself could evolve over a period of time as either of these two (willingness or ability) changes.

I still believe equities provide the best long-term compounding opportunities and would allocate a highest percentage to the asset class. This could be between 60-70% (you could pick your own percentage here depending upon the long-term outlook for the asset class) depending upon market conditions and opportunities available.

Next, I would reduce the fixed income allocation to 10-15% to allocate to alternative asset classes that offer a better risk-reward opportunity. This includes real estate, commodities and crypto for now.

Here's what the asset allocation could look like:

While this is a starting allocation for the Atomic Portfolio, major incremental allocation decisions would depend upon the investment environment at the time.

Creating a benchmark

The asset allocation provides you with a starting point for broad based asset classes. A portfolio benchmark allows you to go one step further in constructing your portfolio using allocations inside each of those asset classes. It also guides your portfolio management decisions on an ongoing basis, and provides you with your opportunity cost depending upon how you chose to allocate in the first place.

Major market indices like the S&P 500 or MSCI All Country World Index are commonly used as benchmarks in the industry. For a multi-asset portfolio, its necessary to have a benchmark that is suited to your investment strategy - A globally diversified, multi-asset benchmark.

Here are some of the characteristics you should look for when selecting an appropriate benchmark:

Investable: you should be able to easily invest in your benchmark components

Compatible: it should be compatible with your investment strategy and goals. A low risk portfolio benchmark against the Nasdaq 100 does not make much sense.

Unambiguous and transparent: benchmark components should be free of any ambiguity and be transparent with disclosures regarding the methodology, rebalancing etc.

Constructed in advance: the portfolio benchmark should be constructed in advance, before you start measuring your investment performance.

Easily available risk and returns info: historical info regarding the risk and returns of the benchmark should be easily available.

The idea here is to not hug the benchmark passively but rather use the benchmark as a guide to incorporate the barbell strategy I discussed here.

Benchmark selection

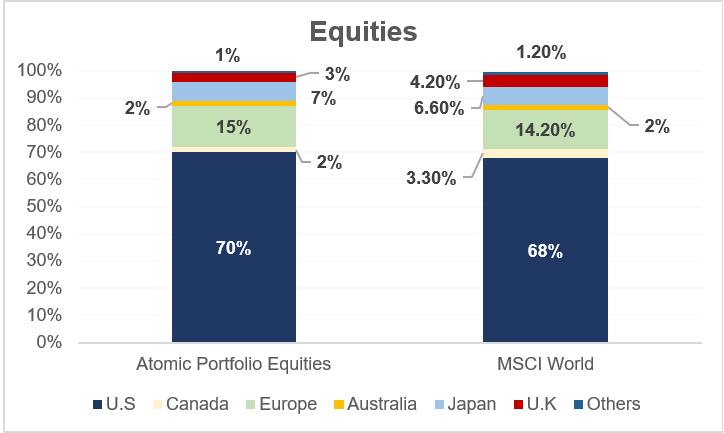

Equities: To stick to a globally diversified equities allocation, MSCI World index could be apt here. This is a cap-weighted developed markets index with exposure to U.S, European and APAC markets. Global diversification, spreading the risk and reducing overall equity correlation all in one go.

In case of emerging markets exposure, one could choose the MSCI ACWI index as the benchmark, which is a cap weighted all country global index.

Here's one way to allocate to the equities portion of your Atomic Portfolio using your benchmark:

Fixed income:

This component is the income generating part of your portfolio and to cut through the complexity and avoid navigating FX exposures, the U.S aggregate bond index could be suitable. It provides you an exposure to publicly issued U.S dollar denominated debt including treasuries, corporate, munis etc.

To reduce duration risk (due to rates moving up), this portion could be over-layed with short duration products and other yield generating proxies like preference shares and high dividend yield ETFs.

Real estate:

A global real estate portfolio consisting of different real estate sectors - FTSE EPRA Nareit Global index which can be over-layed with other real-estate sector ETFs or REITs for a short-medium term tactical tilt. For example, the outlook for Industrial real-estate looks attractive, but as the economy reopens, commercial and residential should start picking up. Sector or company specific REIT ETFs could allow you to capture that on top of your benchmark allocation.

Alternatives:

For the rest of the allocation, we can use alternatives like commodities, precious metals and crypto to add a layer of diversified uncorrelated returns. Due to the inherent volatility here, we restrict the allocation to 10% and use alternative benchmarks like the S&P GSCI commodity index or a simple all world stock market fund (like VTI) performance as your opportunity cost.

Now that we have some benchmarks for all asset classes, you can construct your final benchmark using your starting asset allocation weight:

Benchmark = 70% MSCI World + 5% U.S Aggregate bond + 15% Nareit global REIT + 10% S&P GSCI/VTI

The next post in the series would take you through security selection using this asset allocation and benchmark and the barbell strategy in action! Stay tuned.

Until next time,

The Atomic Investor