Big Tech passes the first test

After a phenomenal last decade, Big tech was put up to a big test of delivering profitable growth at scale. They seem to be up passing it for now.

Any development related to Big tech, the likes of Apple, Amazon, Google, Microsoft and Meta rarely flies under the radar. Being so deeply embedded in our lives, in the tech, and the corporate world makes sure they’re always in the news. I’d say they warrant all the attention they get.

These companies won everything in this past decade. Their core businesses became unstoppable juggernauts, and their non core experiments became as important as the former, adding growth and profitability avenues to maturing segments.

Amazon with AWS and Prime, Apple with Services, Google with Google Cloud and Mobile OS, Microsoft with Azure, and Meta with the shift to mobile and Instagram could be remembered as defining moments in their respective corporate lifecycles. As a result, they solidified their dominant positions and went on to generate more than $1tn in revenues and $250bn in operating profits combined over the decade.

Not only they were quick to latch onto the shift in demand, they executed their strategy to almost perfection, shutting competition out and using their strong positioning and cash flow gushers from the core businesses to fund growth and innovation.

Building moats around the businesses at that scale costs a mammoth amount, and Big tech spent almost $150bn in R&D and almost half a trillion in capex over the decade. They built their own data centres, distribution systems, ad platforms, streaming services, payment networks, chips and a whole array of consumer products in the process.

These were big wins for the brand, innovation and the business. Shareholders were not far behind either. These stocks returned handsomely over the decade and at their peak in 2021, each one of them was valued at $1-$3tn. You can blame it on the low rates, the Fed, passive investing, index concentration et all, but this was a massive win for these companies.

They built, executed and delivered growth, which got noticed by the market pushing their stock price and valuations up. This in turn allowed them to use the stock as a currency to buy other innovators and attract talent, hence kickstarting a positive feedback loop creating a ton of value in the process for everyone involved.

The biggest test in a while

After a decade of growth and rampant success, some say big tech had got too big. Regulators are on their tail and constantly complaining about and looking into their anti-competitive behaviour. Shareholders, now preferring profitability versus growth, baulked last year when they saw how much money Big tech had been spending on projects which were unlikely to be profitable in the short term and that they’d been hiring incessantly without any clear direction for those employees. They complained Big tech had got too complacent and inefficient and had lost focus. The disruptors and innovators had now become the incumbents.

Some of these stocks got clobbered last year losing trillions in market cap combined. The market started questioning whether they can deliver profitable growth in this new environment.

Big tech faces the biggest test in a long while: if they can keep growing at that scale without growing their cost base considerably and can still innovate profitably. A substantial part of the narrative surrounding each of these stocks hinges on the test and this quarterly earnings was a peek into if they are up for it.

Meta: We back up

Meta was one of the big names that was going through constant narrative shifts. In Its an imperative, not an option, I argued that the narrative that the company had lost its way burning billions on the metaverse was misunderstood and that a large part of the increasing spend was to defend its core business against the issues it was facing.

Over the last two quarters, it has reversed the decline in its user base and has improved its ad impressions growth. Engagement on its apps is up, user base is still growing and the company has increased its focus on efficient growth by slowing down hiring, reducing workforce and optimising capex spend.

“Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram.”

“Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last 6 months.”

Revenue growth and margins seem to be picking back up as a result, which the market really likes.

From November-22 to date, the stock is up a whopping 145%, going from trading at 8.5x LTM earnings to 29x currently.

Vying for profitability

The other companies from the bunch also hit a similar tone during their respective earnings calls, emphasising on prudent capital allocation decisions and a renewed focus on efficiency and profitability.

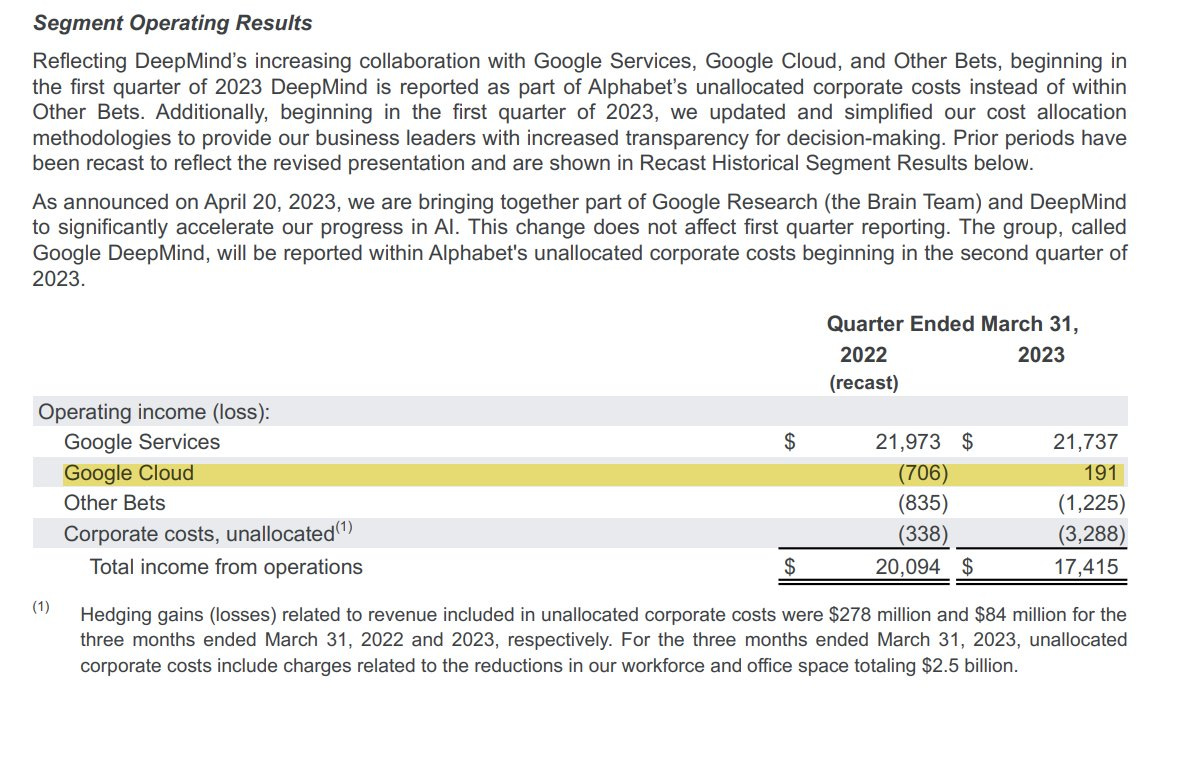

Google announced that its cloud segment Google Cloud is finally profitable after years of losses and continues to grow at a decent rate.

"Over the past three years, GCP's annual deal volume has grown nearly 500% with large deals over $250M growing more than 300%. Nearly 60% of the world's 1000 largest companies are our Google Cloud customers”

For Amazon, its North American segment (which includes Retail, Marketplace and Prime in NA) returned to profitability after four consecutive quarters of losses. The International segment also showed getting onto the path to profitability, narrowing losses.

The narrative for the company had shifted as it had to expand its logistics footprint rapidly during the pandemic due to the surge in demand, which shot its investments on the fulfillment network up substantially. It is now reducing its capex spend on it and optimising its cost structure overall in addition.

"For FY 23, we expect capital investments to be lower than our $59Binvestment level in 2022, primarily driven by an expected YoY decrease in fulfillment network investments...We continue to invest in infrastructure to support AWS customer needs, including investments to support large language models and generative AI”

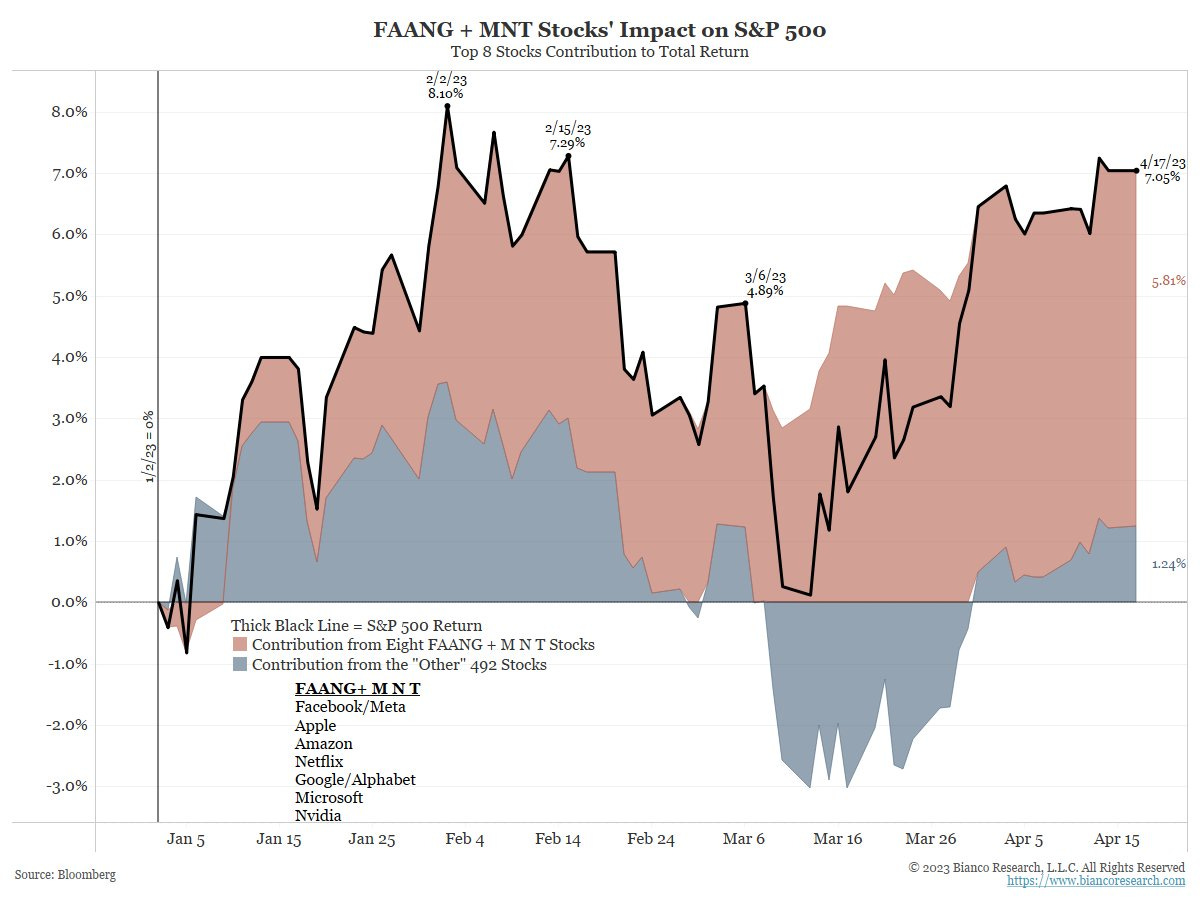

Big tech seems to be passing the test and the market looks like it is quite happy with what it sees. All of the stocks mentioned here and other big names have been rallying this year, contributing to most of the S&P 500’s overall gains.

Given that they make up almost 25% of the index, passing this big test for big tech was crucial.

The second test could be even bigger

AI has been the hottest topic in town and investors have high expectations from the biggest tech companies to deliver, especially after Microsoft seems to have taken an apparent lead in building an AI product and introducing the tech across its ecosystem.

This second test could be of paramount importance. The AI market is moving at a lightening fast clip and big tech has a lot riding on them to play a part, given their strength and the track record in being at the forefront of the biggest tech cycles. Big tech seems to be wanting to set the narrative already, that they are there and are working with AI to improve what they have and launch new products.

The market will be keeping an eye out for both these tests and and will be setting the prices and the narrative for the biggest tech companies in the world. This could considerably shape both the markets and our lives in the foreseeable future.

Until next time,

The Atomic Investor