Breaking up with the past

Breaking up with the past is never easy when you get conditioned so strongly to your environment. Businesses, investors and people are coming to terms with this now.

Change, as they say, is hard to overcome. We are hardwired to resist change as we get accustomed to the existing set of conditions that define our environment. Adapting to a new set means rewiring and reconditioning ourselves. This comes with its own set of risks, as some of us might not adapt and recondition better than the rest, and risk falling behind. This is probably why we love stability and certainty and change and uncertainty makes us uncomfortable.

The pace of change over the past few months in the markets, and the world in general, has left people, businesses, investors, governments feeling like they’re on shaky grounds. We were firmly conditioned to our environment - people, by falling or stable prices and living in an era of abundance; businesses, by easy availability of labour, cheap credit and access to global supply chains; investors by falling interest rates, easy money, low inflation and abundant liquidity; and governments by geopolitical stability, global cooperation and access to resources.

We’re now facing a new environment where we might have to shrug off decades of conditioning. The first response is usually denial. Then comes the realisation and scampering to make sense of what comes next, followed by the low of grief and depression because of “things coming to an end” and finally the concerted effort to recondition, adapt and survive.

The recent set of events might have done their best to tip us on from denial phase to realisation. A few of them came to mind when I tried thinking this through.

Sub-zero rates are saying goodbye

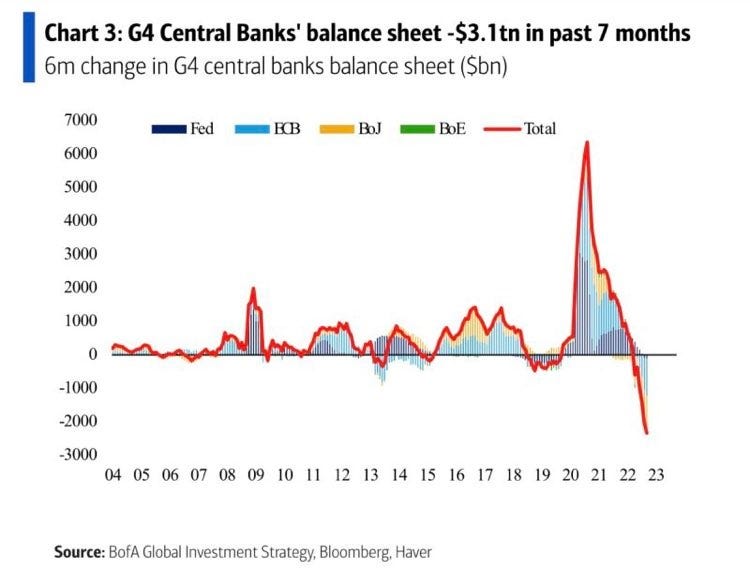

After the one-way downward ride for global interest rates in the last two decades, we’ve entered a new rate hike cycle led by the Federal Reserve in the U.S. The energy crisis and the inflationary period we find ourselves in has put the brakes on the monetary experiment of zero and sub zero rates, for now.

The idea was to push savers towards higher spending to stimulate growth. But rates that low for so long penalised savers and slowly conditioned them to take more risks. People saw their asset values steadily climb higher every year, and buying large assets with more debt became commonplace. Businesses and investors increasingly relied on cheap debt to fuel growth and create more value.

Now in the span of a year they’re being forced to rethink as they digest a sudden change in the interest rate environment. Mortgage payments are now double of what they used to be, companies are finding it difficult to finance their growth, and investors, both public and private, are contending with this new volatility where buying ‘growth and tech’ (the environment they were conditioned to) is not going to work anymore.

The safe assets might not be the safest

The energy crisis and recession fears has made developed market currencies look like emerging market assets. The Euro is now below parity with the USD whereas the British pound has taken a massive pounding to get within touching distance those levels.

This kind of fall in two of the world’s reserve currencies has taken a lot of people off guard. The Euro and the British Pound make up 20.6% and 4.78% respectively of global reserves, whereas they have a share of 35% and 7% in the global payments system. A quarter of the world’s reserves and more than 40% of payments are valued much less than they used to be. This is likely to create all sorts of problems for international businesses and investors who now have to think about currency risks even for developed markets like the UK or Europe. The second and third order effects are likely to surface later, when imports are much more expensive, growth is hard to come by and so on…

Then, this week we saw a Bank of England stepping into the market to prevent pension funds from blowing up. They were caught swimming naked by a spike in bond yields, and faced hundreds of millions in margin calls forcing them to sell their liquid assets. Those assets were the government bonds themselves, driving the prices even lower and therefore turning into a feedback loop of catastrophic proportions. The UK’s pension assets are worth 120% of their GDP, and a substantial proportion of that was close to being wiped out. (detailed story here)

Pension funds, at the lowest end of the risk spectrum and responsible for pension liabilities of millions of people, were conditioned by ultra low rates for so long that the environment drove them to use higher risk strategies and blinded them against this ‘unprecedented’ event. Saved by the skin of their teeth, they need a reset making sure they not only survive but meet those return targets.

The scarce energy environment

After decades of reliance on Russian gas, Europe is now grappling with energy shortages and scrambling to secure supplies to fill the gaping hole as big as 40% of energy supplies. Developed countries have hardly ever had to worry about regulating energy use. Now, the governments are suggesting and advising people on adjusting thermostats to lower ease the strain on tight supplies. Businesses are paying record amounts to ensure they will have the energy they need a year down the line. Electricity prices are already soaring. The governments in the UK and EU are laying out hundreds of billions to subsidise energy costs for people.

It took a tragic war for the the policy makers to realise the seriousness of energy security and sustainable energy transition. But are people prepared to condition themselves and live in this scarce energy environment?

Show me the money

The last decade saw both young and mature tech companies spend endlessly for growth. Founders were accustomed to raise easy money at eye watering valuations. Companies adapted their playbook on the premise that they could spend into infinity until they raise the next round and press repeat again. Now even larger, well establised public and private tech companies, which financed themselves at record valuations are now seeing their values cut in more than half (they’re calling it the Down 80% club).

Hiring is already slowing down, expansion plans are being put aside and companies are trying to adjust to an environment they might not have seen in their lifetime. Even Meta, Microsoft and Google are having to readjust. VCs, who encouraged them to spend recklessly are now asking these young companies to show them the cash.

Some early stage founders are still in denial I’m hearing. But this might be the time to move on to the next step in the cycle and update their playbooks.

Breaking up with the past is not easy. Especially when our behaviour is strongly conditioned to the past environment. As the realisation sets in and we prepare for the “new normal”, it might take more than a concerted effort to get going again. But we’ll get there, as we always do.

Until next time,

The Atomic Investor