$BX: The king of private markets

Blackstone has gone from strength to stregth over the last couple of decades. My thoughts on the stock, why I like it, and the Q3 2022 update.

It's no secret how private markets investing has become a mainstay of institutional portfolios over the last two decades. Blackstone, the largest private markets investment platform has gone from strength to strength over this time period. Blackstone's recent history has been of scale, transformation, and execution as it amassed an AUM of almost a trillion dollars by Q3 of this year.

The stock has outperformed its peers and the market by a wide margin over the last 5 years.

The company has also returned cash to its shareholders consistently in the form of dividends and buybacks.

Fundamentals have continued to improve,coupled with an increasing amount of cash returned to its shareholders. The recent drawdown in the stock (down more than 30% this year) presents an interesting opportunity to own what I see as the king of private markets investing.

Here's why I believe $BX is positioned attractively from a business growth, industry opportunities, and valuation standpoint.

Blackstone has been like an AUM-guzzling machine over the last decade

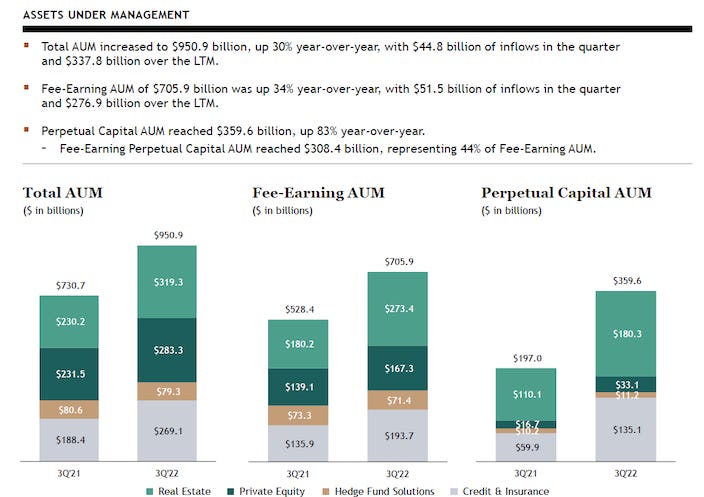

AUM means scale and for any investment manager scale is everything. Blackstone has massively scaled its business and has grown its AUM from $160bn in 2011 to over $950bn in Q3 2022, up 6x from a decade ago and more 2x from 2017 levels. This AUM has been increasingly coming from longer-term sources and a diversified investor base, with an increasing proportion of perpetual capital strategies (44% of fee-earning AUM is perpetual).

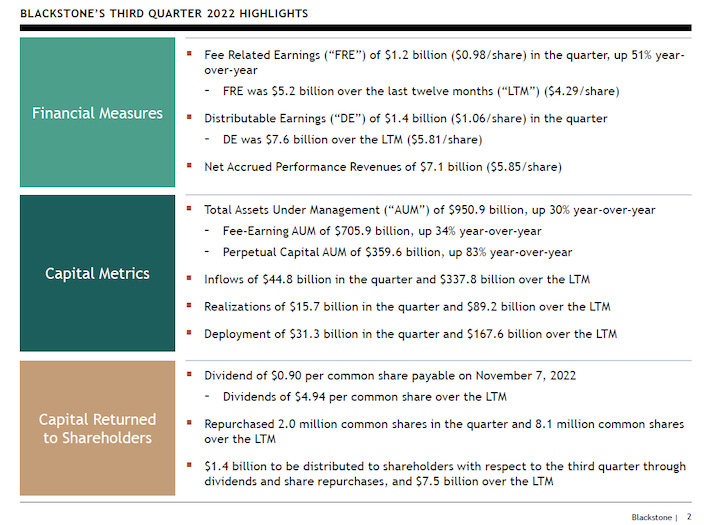

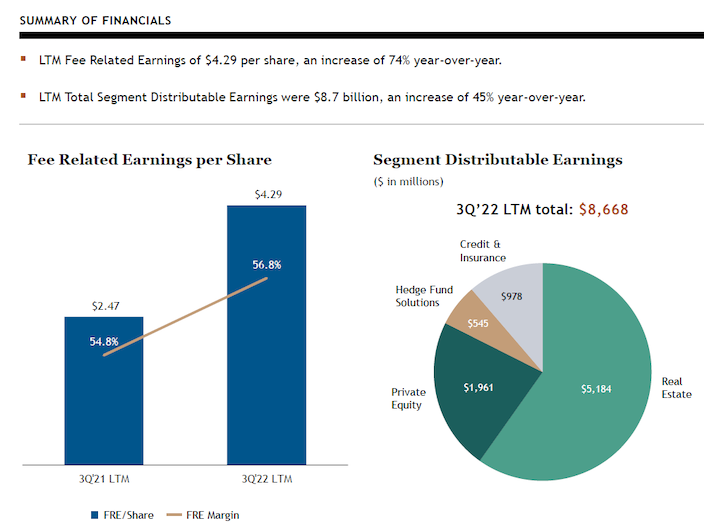

Fee-related earnings now make up a higher proportion of distributable earnings, with considerable gains in fee earning margins

Fee-related earnings (management fee revenues minus related expenses) now make up almost 60% of distributable earnings (a proxy for free cash flows) up from just 32% in 2017. A lower volatility earnings stream, with considerable gains in margins provides a big step up to company's earnings durability.

Blackstone still has $182bn, a mountain of dry powder available which can be deployed at lower prices

Given the strong AUM inflows, Blackstone had a dry powder at record levels as of Q3 2022 - $182bn. This large pile of dry powder (available capital), can be deployed at much lower market prices. This improves long-term prospective returns for its funds which in turn is a direct driver for future fund raises. The macro and market environment is increasingly presenting attractive investment opportunities for all large private market players globally.

The industry has long term secular growth trends despite the short-term macro headwinds

Private markets are facing short-term macro headwinds in the form of rising rates, lower M&A activity, and a lack of easy financing options. However, longer-term secular growth trends, like investing in energy transition and infrastructure should provide growth opportunities for large players given the increasing number of investment mandates from the public sector and private institutions.

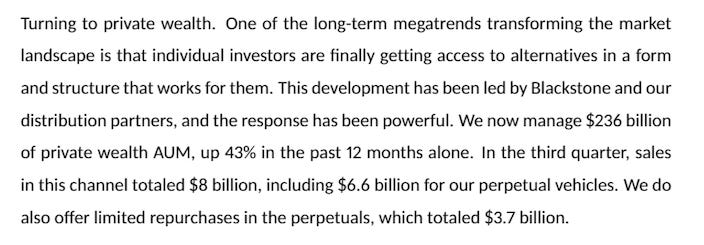

Additionally, retail portfolios are an untapped and underpenetrated market that is likely to expand the addressable market for Blackstone significantly. The company has frequently mentioned this opportunity on recent earnings calls showing its readiness to take it.

Finally, the valuation is at more reasonable levels than it was a few years ago with the business having a more durable earnings base

Investment managers are valued most commonly on their fee-based revenues and overall earnings. Blackstone has traded at a premium to its listed private market players given its higher proportion of FRE and a more diversified platform.

On a DE (Distributed earnings, a proxy for free cash flows) basis it went from being traded at 9.8x in 2017 to 24x in 2021 on an LTM basis when the markets were soaring. The current drawdown has now brought it back to much reasonable levels at 13.7x, despite it having a more durable earnings base.

On an FRE basis as well, we’ve seen come multiple compression, as it went upto a high of a 37x in 2021, and now trades at 20x on an LTM basis.

There were some additional excerpts from the earnings call that I found interesting

Revenues of PE portfolio companies grew 17% YoY in a tough environment

Most of its real estate portfolio companies have increased rents at a higher rate than inflation

Insurance and Private wealth investment solutions and partnerships should continue to provide a larger and stable AUM base

The environment is getting tougher but the company can be patient both at deploying capital and realisations

Blackstone is a massive alternative investments player and continues to grow and scale its business. The management has executed quite well so far, and have returned a decent amount back to shareholders. Its been ticking a lot of boxes for me lately. Those who might be interested in a more detailed write-up may find that below. Long $BX!

Until next time,

The Atomic Investor

If you've read until here, you might be interested in a more detailed write-up on Blackstone's business and Q3 update. I have got you covered!

Overview

Blackstone is the largest private markets investment platform with a market cap of over $100bn and an AUM of $950bn as of Q3 2022. Originally, the company was a real estate and buyouts specialist and has subsequently went onto scaling its core business massively by creating investment platforms for different types of institutional investors. Additionally, it has diversified into private credit (Credit & Insurance) and hedge fund solutions, and the former has played a crucial role in allowing it to raise long term permanent AUM.

Business basics

Blackstone has transformed its business from being a classic private markets fund manager to an investment platform with different products for a range of institutional investors. The four segments - Real estate, Private Equity, Hedge fund solutions and Credit & Insurance provide it a robust AUM base on which it charges its client a management fee and a performance fee for realisations (investment exits) ie. raise institutional capital —> deploy globally —> charge a fee for performance and management.

The business itself has low capital investment needs. Most of the cost base is made of compensation costs for its deal teams and partners, due to which it can deliver attractive top line and cash flow growth while maintaining or improving margins.

The industry faces near-term headwinds but has massive growth potential

Private markets have seen incredible growth over the last decade, with record amounts for funds being raised, record M&A activity and exits leading to even larger funds. Institutional money is allocating higher percentages to private markets, like PE, VC, credit, real estate and infrastructure. Total private markets AUM has gone from $1tn 10 years ago to over $9tn in 2021, and is expected to double to over $18tn by 2027.

The industry has had strong tailwinds at its back with rock bottom interest rates, sky high liquidity, easy financing and rising valuations. A lot of these drivers have softened recently, which has put the largest players like Blackstone, KKR, Carlyle etc. in a strong relative position as compared to smaller peers. Their ability and experience of navigating different kinds of market cycles over the last few decades is likely to allow them to gain incremental AUM share in this market environment wrought with uncertainty.

The largest players usually preemptively raise funds under themes that are gaining traction and for sectors that need capital. Blackstone for example has multiple energy transition investments which allows LPs to get exposure to sectors which have mandates with increasing importance.

Private investment managers reinvests little capital of its own, and redistribute most of cash flows (distributable earnings) to shareholders and partners. Scale allows them to improve margins, as costs are mostly fixed. Wages is an important component to monitor for which it could impact margins.

This industry is harder to disrupt as performance drives subsequent fundraising, which allows the managers to deploy and drive performance further. Being one the largest, BX can deploy at a very large scale (its largest funds could be more than $20bn) to drive future returns. The big money flows to the top decile or quartile funds, and BX is one of the largest in the business.

Private markets investments industry attractive growth opportunities going forward, despite the near-term headwinds. Allocations to infrastructure and areas like renewables, life sciences and energy transition are poised to grow considerably given the size of global public and private mandates to invest in these sectors. Allocations to private markets for retail portfolios is a long term secular trend and provides a massive growth opportunity with trillions of more AUM for the largest players in the industry.

$BX is a different beast from just a few years ago

To understand the evolution of Blackstone’s business performance, one needs to look at four key levers of growth: AUM & fee earning AUM, Management fee & Fee related earnings, Performance fee & Net realisations and Distributable earnings (DE), which is a proxy for free cash flows.

Blackstone has capitalised on industry tailwinds and the market environment in the last decade to increase its AUM significantly. AUM has grown at a CAGR of more than 20% since 2018, reached $950bn in Q3 2022 from $434bn in 2017. Fee earning AUM has grown at a CAGR of 18% since from 2017-2021, and is now 74-75% of total AUM. Partnerships with large insurance companies and private credit solutions has allowed to scale its investment platforms handsomely, allowing its LPs to diversify their private markets exposures.

Increasing AUM is a direct driver of management fee revenues, which have increased in-line with capital it has raised over the years. These revenues have increased from $2.9bn in 2017 (0.9% of fee earning AUM) to $9.1bn in LTM (1.3% of fee earning AUM). FRE (Fee related earnings) have grown at a higher rate and are now almost 57% of Fee revenues (from 45% in 2017).

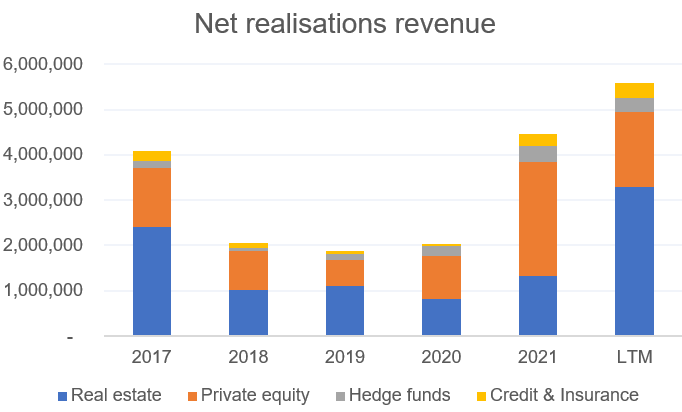

The other revenue component, the realisations performance revenues are more volatile and depend on the overall market environment, M&A activity and valuations. Total performance related earnings (realisations revenue after expenses) was back up above 2017 levels in 2021 at $2.9bn. The margins for these revenues are extremely high at 75%, have stayed in that range since 2017.

Finally, the number that shareholders mostly care about. Distributable earnings on a pre-tax basis are up massively from 2017, even 2019 levels at $8.6bn at an LTM basis growing at more than 40% CAGR since 2019.

A big step-up in earnings durability

Shareholders (and the market) value an earnings stream that is more durable and has lower volatility. Historically, PE investment managers have garnered a lower valuation given their dependence on performance fee, which is impacted by the market cycle, interest rates, liquidity and M&A activity - the whole package.

Blackstone has repeatedly mentioned its goal of establishing a long term investment platform for clients, for which it has raised longer duration capital via insurance providers and has increasingly introduced perpetual drawdown funds for its clients. This has allowed to have an increasing proportion of “permanent capital” which is now 44% of Fee earning AUM.

Additionally, there’s been a complete role reversal for FRE and performance based earnings. FRE (the more stable and permanent component) contributes more than 58% of Distributable earnings, which has reversed in the last 5 years when it was just 32% of earnings. A much more stable source of earnings is now a major driver of distributions, which has led to a premium multiple against the rest of the peers.

This low volatility recurring earnings stream should allow it to maintain its shareholder distributions (dividends and buybacks) and navigate this market environment with a lower impact on its earnings durability.

Q3 2022 update

Despite of the overall markets environment and the reversal in some of the strongest drivers of private markets growth, BX delivered a solid Q3. FRE was up 51% YoY and 74% on an LTM basis. AUM was up more than 30% with inflows of more than $44bn over the quarter. Realisations were down 15% due to current market conditions, due to which Distributable earnings declined 12%, but are still up on an LTM basis. The following images (from the earnings presentation) should provide you more colour.