Capital One acquires Brex. Win-win?

Huge deal in the Fintech space. Who won? and by how much?

This week we saw a major announcement in the Fintech world. Capital One announced its definitive agreement to acquire Brex for $5.15 billion in a cash-and-stock deal.

Brex was one of its kind back in the day. They started with offering corporate cards to founders who couldn’t get them from traditional banks. In recent years, Brex moved beyond startups to serve massive enterprises like Anthropic, DoorDash, and Roblox, focusing on “AI-native” expense management software rather than just credit limits. They also built their own core ledger and global issuing infrastructure, allowing it to issue cards in 50+ countries.

For Capital One, it can now be their software layer over the tech. enabled banking stack they have been building over the years.

Capital One is already a leader in consumer and small business (SMB) banking. However, it lacked the high-end, software-integrated “spend management” platform that modern CFOs demand.

Having recently integrated Discovery Financial (acquired in 2025), Capital One now owns its own payment network. By adding Brex’s software layer, Capital One can move money across its own rails while providing the best user interface in the business.

They can now target more high growth companies by providing them the all-in-one stack: Cards, expense management and credit with an AI software layer on top. Big W for Capital One.

What about the company and its investors?

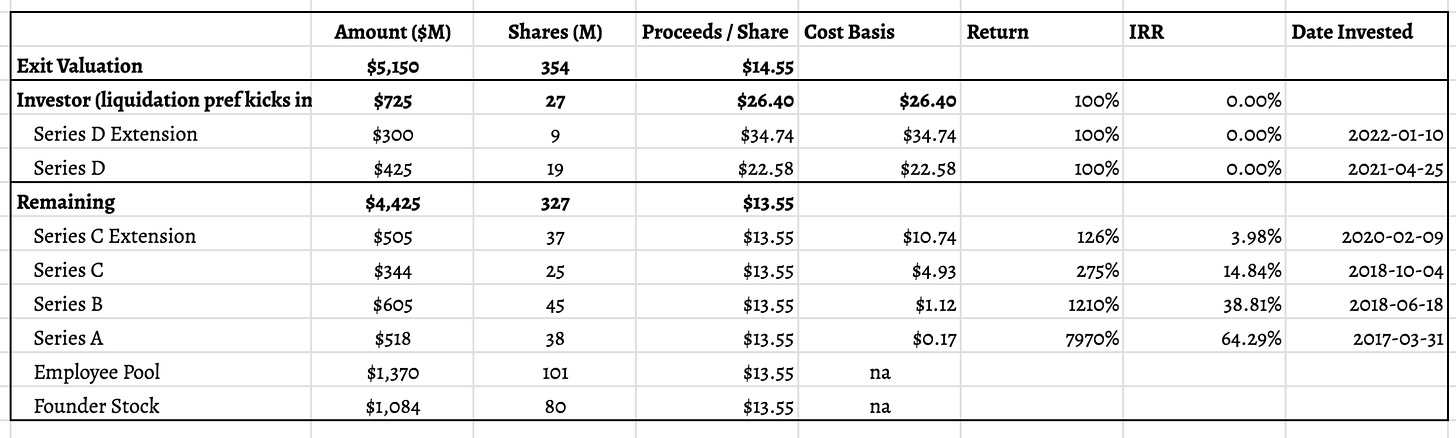

The estimated cap table and returns below might give us an idea. (Shared by Hari Raghavan on X)

The founders? Big W as they take home more than $1B and get to lead Brex as a semi-independent unit inside Capital One.

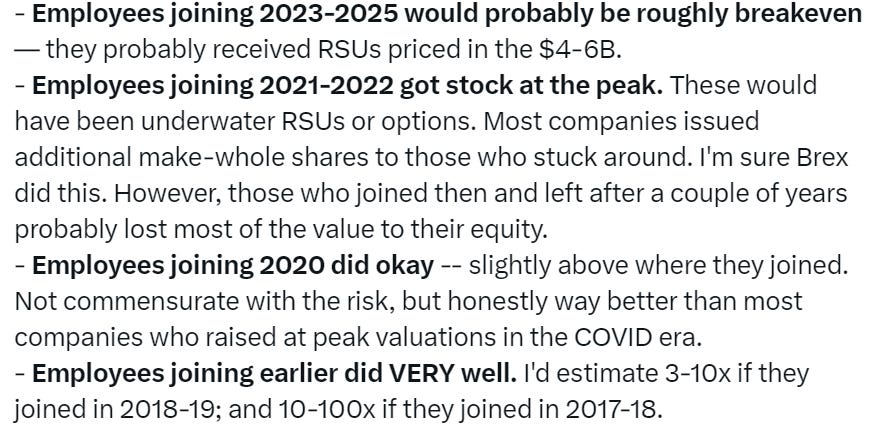

What about the employees? Apparently the deal has minted more than a 100 millionaires, with the employee stock pool taking home $1.3B.

Some of them did not get to see the W as they were issued the stock at the peak of Brex valuation of more than $12B and it ended up being acquired at 40% of that price, meaning their RSUs were underwater at exit. More on the employee share of the proceeds in below.

The investors? Depends when you got on board!

BIG BIG W for YC. According to estimates their first check netted out close to $100M on an $120K check at the time. That is 800x in 9 years = 110% IRR. If you include their second YC continuity check, that is a total of $600M on probably ~$40M invested.

Series A investors did 80x and 64% IRR. Win.

Series B backers did 12x and 39%. Another Win.

Thereafter the returns start looking like more mature assets on the risk return spectrum.

Series C investors in 2018 do okay (2.75x and 15% IRR). This is more PE like.

Series C+ investors in 2020 with 1.3x but suboptimal IRR (4%). 2020-21 was the everything bubble.

Series D and D+ investors get nothing, apart from their money back thanks to the liquidation preference. 0% IRR but “at least they didn’t lose anything!!”.

This shows how different the dynamics are for different stages of venture, and it increasingly gets harder and more competitive (impacting the price you end up paying for your investment).

Venture lately has been looking like “go-early or go home” kind of a game. Mega cap IPOs might still make some large late stage investors some $$ but the rest in the middle will probably not be compensated for the risk they took.

2020-21 is far behind the rear view mirror and is probably never coming back. Late stage cross over pre-IPO arbitrage is gone with it.

Entry price matters. Backing great founders early is starting to be fashionable again.

You win some, you lose some. But when you win its a generational home run.

Until next time,

The Atomic Investor

This article comes at the perfect time, awesome read! You're so spot on with this analysis. I'm curious, how do you see the 'AI-native' expense management really transforming things for Capital One's existing tech stak?