Charts of the year

Tried to capture some of the stories that caught my attention this year. Charts to highlight the data and the narrative, accompanied by some questions to ponder upon for this year.

Another year and another bagful of stories in the markets and the economy. 2019, already 4 years ago now seems like ‘boring’ by 2020-2023 standards. A barrage of narratives and stories in 2023 - inflation, interest rate hikes, wars, AI and OpenAI, regional bank failures in the U.S, FTX bust, bond market crisis in the UK, recession talks, and plenty more. Some were a continuation of what we saw in 2022 and some were new. A few prevailing trends reversed while others accelerated.

I tried to capture the ones that caught my attention in this post. Charts to highlight the data and the narrative, accompanied by some questions to ponder upon for this year.

Before we dig in, a quick update. The Atomic Investor turned three! More than 75 posts with countless drafts and ideas that never made the cut. And I have enjoyed every bit of it.

For those who have been reading and following the updates on here, thank you! If you like what you saw, share it with your friends.

If you are here for the first time, feel free to hit subscribe 🙂

It was a good year for the stock markets

Not just good. It was a great year for the markets. After one of the worst drawdowns in 2022 driven by interest rate hikes and inflation, the markets came back to life pretty much everywhere.

The S&P500 was up by 26%, Nasdaq100 55%, Euro Stoxx 600 15.5%, Emerging Markets ex-China 19% and Japan 28%. They surged even higher when major central banks started talks of rate cuts and pauses in rate hikes.

It was hard to lose money if you were a passive index fund or ETF buyer in these main indices. Except China, which is still dealing with the government crackdown and geopolitical tensions, leading to foreign investors rushing for the exits.

Interestingly, Japan is attractive for both public and private market buyers again after a long, long time. The regulators have pushed for corporate governance changes over the past years, making the markets more shareholder friendly, forcing companies to improve capital allocation policies, reduce cross-holdings and return more cash back to shareholders.

The main public markets index is only 0.4% away from its peak going back 20 years ago and 13% away from its all-time high during the 80’s bubble.

Private markets deals have also continued to increase as investors look for high quality assets at attractive prices.

A great year for the markets everywhere even in the face of a whole lot of bad news and an impending recession.

Can this run continue into this year? A lot of the good news (lower inflation, rate cuts, no recession) seems to be priced in already, and what if that good news is delayed or is not as good?

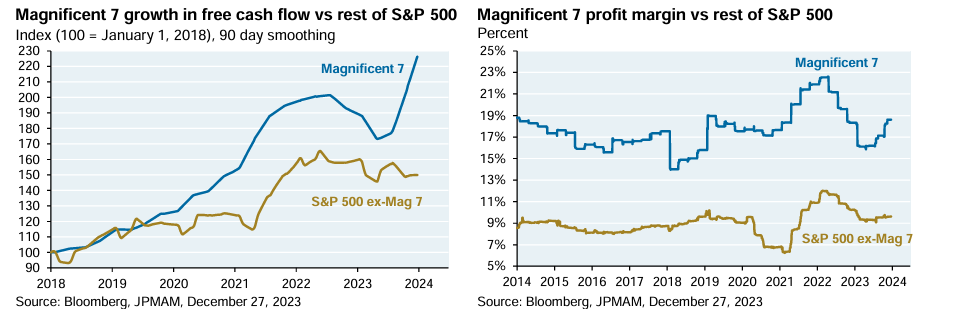

Magnificent 7 continued to deliver big time

The Magnificent 7, the biggest tech stocks - Apple, Microsoft, Google, Meta, Amazon, Tesla and Nvidia, were on fire last year and drove the markets higher. Nvidia’s terrific Q2 numbers where demand for GPUs was through the roof made the markets come to terms with AI’s potential impact on Mag 7.

It was not just hype. These companies were at the forefront of investing in AI and had the capital and labour resources to outcompete everyone else. Their positioning in the compute heavy infrastructure layer and existing user base in the application layer is a natural moat for them. Most of them were therefore solving for the model layer, investing in/partnering with startups or building them in-house. They, unlike many other large corporations, were shipping at startup speed. A lot of ideas combined with impressive execution. The markets had no choice but to reward them with higher share prices as they became the best publicly listed AI plays.

Higher valuations than the rest of the market are also backed by much higher free cash flows and earnings.

Now that a lot of the future gains in revenues and earnings might already be reflected in the stock prices, there is very little room for disappointment. Can the Mag 7 keep beating high expectations and build on the progress made during last year?

Inflation came back to down to levels that allowed central banks to take a breather

The biggest story of 2022 that continued into 2023. “The great inflation” as everyone was calling it roiled the markets and the economy as central banks led one of the steepest rate hiking cycle in history.

As the impact of it trickled through, labour market cooled down, wage inflation stabilised, energy and commodity prices came down and supply chain pressures eased. Inflation in the developed world was on its way back to the target levels.

Central banks started hinting pausing and even cutting rates in 2024 giving a major boost to both stock and bond markets. The “soft landing” scenario, bringing inflation down without pushing the economy into a recession, started seeming like a reality. 85% of the economists were predicting a recession in 2023. No one knows anything.

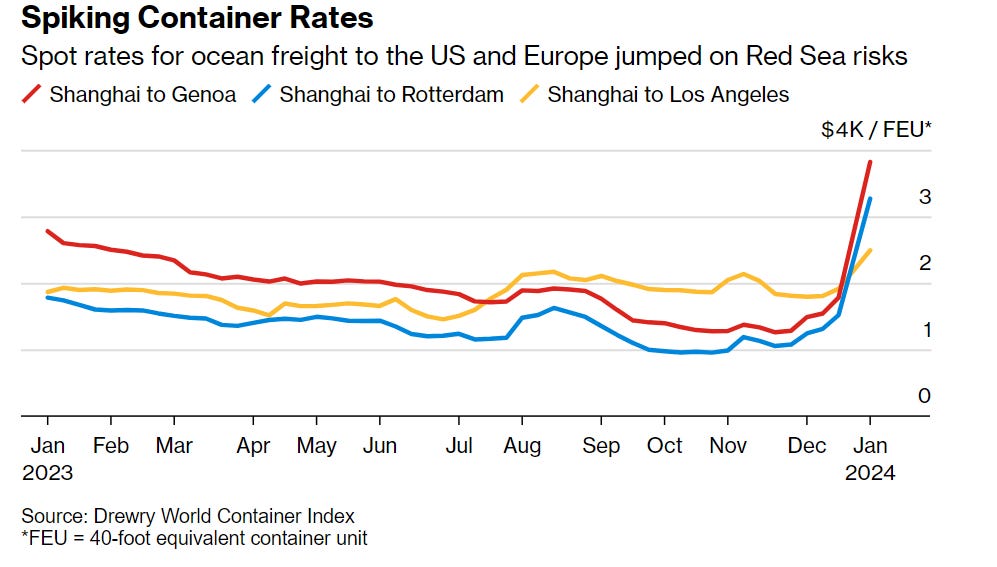

But supply chain pressures might already be coming back to haunt us. Container shipping rates for routes from Europe to Asia spiked 173% in December as ships started diverting away from the Red Sea due to conflict in the region.

Have investors positioned themselves for lower inflation and rate cuts prematurely? Will “higher for longer” become “higher for even longer”?

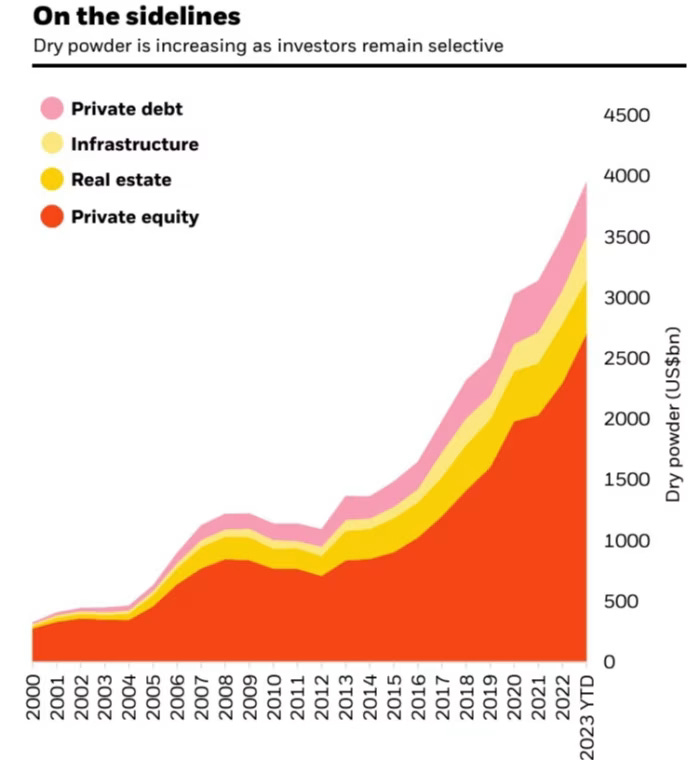

Dry powder continues to remain dry

It was not an easy year for Private Equity. Higher rates made financing very expensive, while economic pressures posed another challenge for valuations and growth for portfolio companies. Dealmaking was tepid most of the year which made exiting existing investments tough.

Dry powder, the committed capital not yet called for investing, is now close to $4tn and continues to increase.

But lack of exits has made distributions to LPs scarce, the rate of which is down to 11% from mid 30’s before 2022. Companies are being held for longer, which is forcing PE firms to undertake a whole host of new measures to keep holding onto them or extending their runway.

They have a lot of work on their hands to kickstart the PE flywheel again.

Will PE dealmaking recover in 2024? Will GPs adapt their approach to operate in a higher rate environment or continue to play the waiting game for rates to come down?

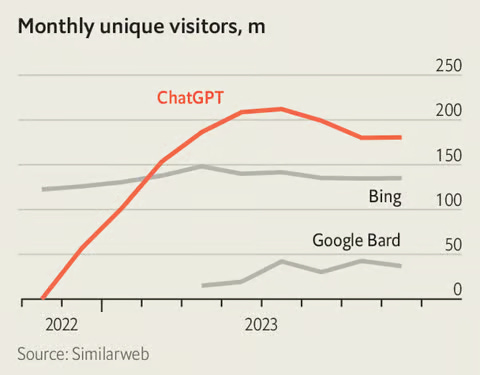

Gen AI takes a big leap forward

Some media publications named LLM the word of the year. Maybe rightly so. Generative AI took a big leap forward last year as AI became a mainstream phenomenon. Enterprises across the world started charting out their Gen AI plans. The world realised its potential and its implications on work, life and society in general.

Investors, including Big Tech, continued to fund startups building in the space, with some massive cheques being written for OpenAI, Anthropic, Mistral and other LLM providers.

New, improved models were launched by most companies involved in the space. AI progressed on an accelerated timeline. Expectations are now riding high, especially for the largest firms like Nvidia which crossed a trillion dollars in market cap last year.

However, generalist chat bots have lost some momentum after the initial spike in demand. Consumers and enterprises might now be looking for applications and tools that address specific problems.

Will business models mature to convert ideas into sustainable revenues and profits? Will new players emerge that can capture/create differentiated value?

Weight loss drugs - The Gen AI of healthcare

GLP-1 drugs like Wegovy (Novo Nordisk) and Zepbound (Eli Lilly) were all the hype last year as they showed great efficacy against obesity and diabetes and related co-morbidities. They are almost like the Gen-AI of healthcare, with significant implications on human behaviour and society. These drugs could also be potentially used to treat addictive behaviours, extending their impact from consumer foods and beverages to alcohol and gaming industries.

The markets started to price in winners and losers from this breakthrough with GLP-1 drugmakers gaining as much as Magnificent 7 or AI stocks, while fast food, food retailers, beverage manufacturers, Insulin pump makers heavily underperformed the markets.

How fast will these drugs penetrate the U.S and the rest of the world? What first order-second/third order impacts could this have given the expected changes in human behaviour?

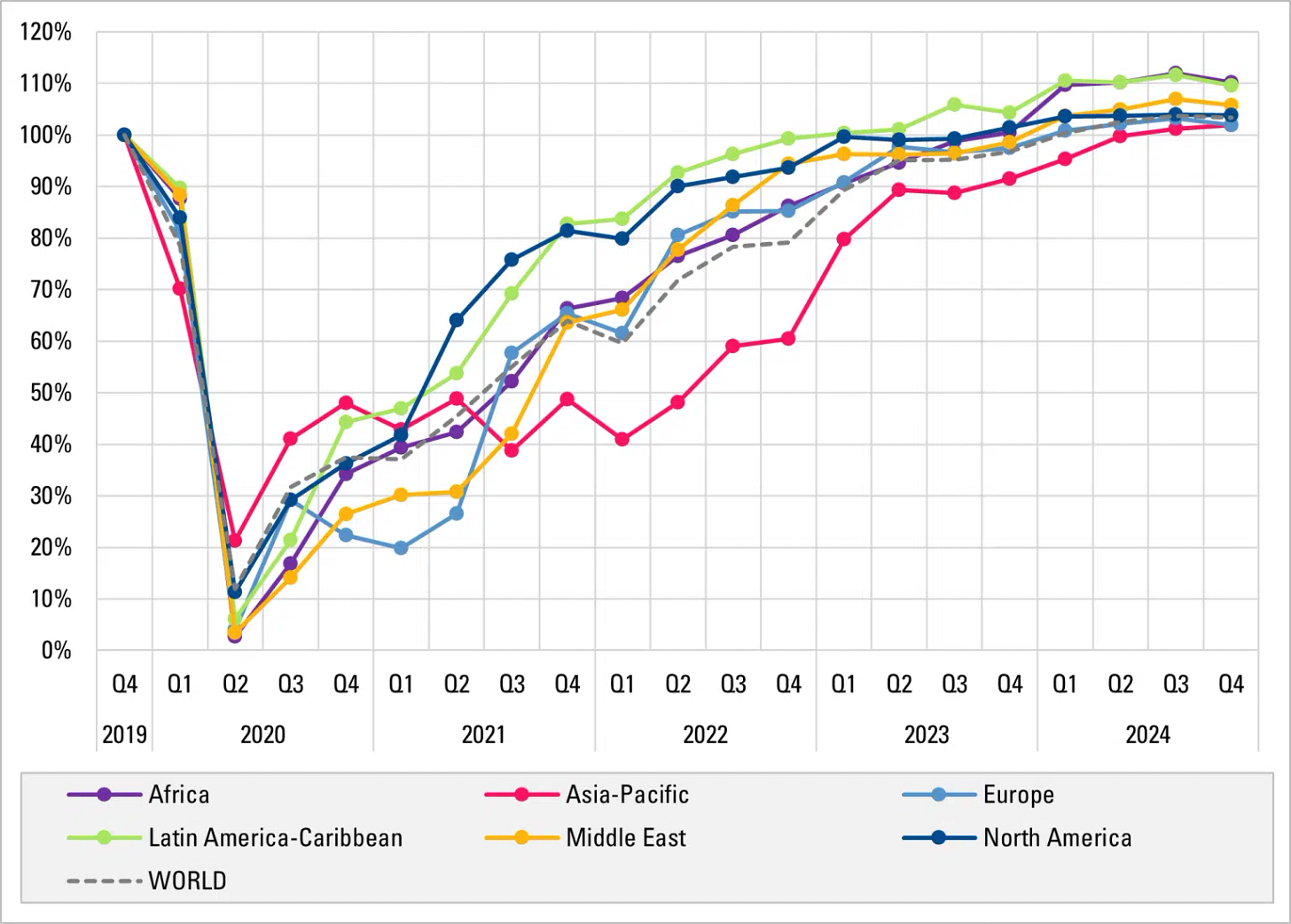

We’re not over travelling yet

2022 was all about “Revenge travel” post the pandemic. 2023 saw international travel fully recover to pre-pandemic levels as the world still kept travelling for tourism and live events.

Travel stocks did exceptionally well too as companies posted a recovery in their numbers with improving outlook for next years.

As extra consumer savings come back to pre-pandemic levels next year (expected H1 2024), do we still keep travelling as much as we have over the last two years?

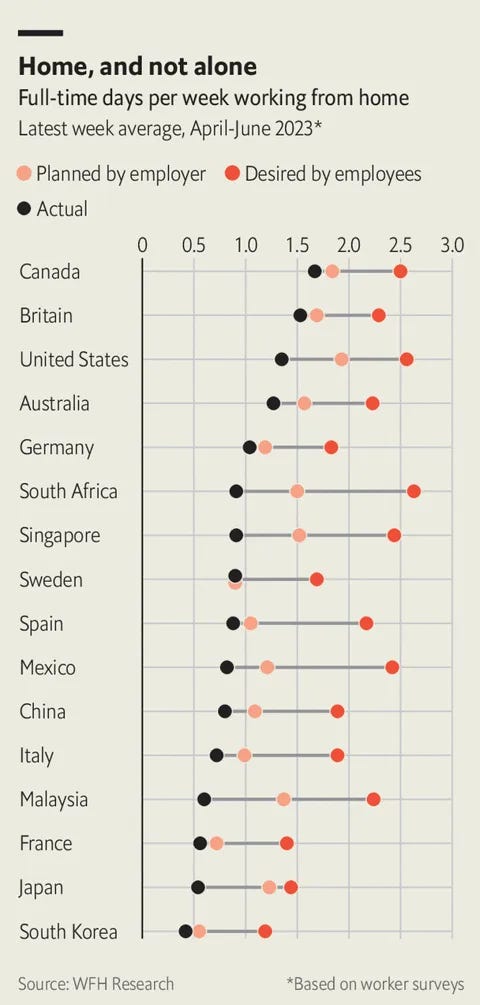

Remote work is here to stay

A contentious topic for employers and employees. A new model of work was put to test during the pandemic and there are still debates on whether it worked or not. Employers and employees have different ideas and might have to meet in the middle on this.

The pandemic tilted the balance of power towards the workers which is now reversing again as the economy slows down again and unemployment starts to pick up.

Will we ever go back to full-time office work? The trends suggest otherwise.

Guess who’s back, back again

And finally, something that was a star of 2020-2021 ZIRP bubble came back strongly this year. Bitcoin was one of the best performing assets of the year, racking most of its gains after the Fed’s rate cut hints.

The impending approval of the Bitcoin ETF in the U.S also kept a floor on Bitcoin prices.

But what does the future hold for Bitcoin and crypto? It is no inflation hedge, nor is it alternative gold or a currency replacement. Then what is it?

A very eventful year, to say the least and a lot to look forward to for 2024. What are we putting our moneys and our mouths on?

Until next time,

The Atomic Investor

Keep enlightening us with ur bagful of ideas

Way to go happy 3rd @ atomic investor 👏