Its an imperative, not an option

Investors have piled onto Meta and Zuck for spending recklessly. While it could have been timed better, I think a lot of it is an imperative, not an option.

“Building in public” feels like an overused phrase that originated straight out of lingua franca of the Tech-VC world. Roughly translating to keeping the world in the loop every step along the way, it glorifies your highs and magnifies your lows to keep the world aware that you’re still around doing something meaningful.

After the astonishing market reaction to Meta’s latest earnings report, I wondered whether large public companies should even be “building in public” anymore. Recently, they’ve being increasingly punished for sharing their vision in the form of massive share price drops destroying swaths of shareholder value.

Meta came out with its Q3 earnings update a couple of weeks ago and was met with a 20% drop in share price taking the YTD drawdowns to more than 70%!

The market was taken aback by the company’s willingness to spend and spend this big on what is viewed as a speculative project driven by a founder CEO who has total control.

Meta’s capex touched $9bn this quarter as the company declared that the capex spend will be meaningfully higher at least until the next year.

For context, here are some other snippets from the event.

On capex:

"Our current surge in Capex is largely due to building out our AI infrastructure, and we would expect capex to come down as a percent of revenue over the long term. We expect reality labs expenses will increase meaningfully again in 2023”

On growth:

"We are still behind where I think we should be but we believe that we will return to healthier revenue growth trends next year. It is not clear that the economy has stabilized yet so we're planning our budget somewhat more conservatively”

On Reels and the discovery engine:

And finally the question everyone wanted the answer to. h/t The Transcript

The reaction to what the management said and the arguments against the company and Zuckerberg seemed quite biased and lacked substance in my opinion, and lot of the beating down the stock has endured might be unwarranted.

There are a lot of myths around the company

Meta’s history has always been riddled with widespread myths that end up hurting the overall sentiment around the business and the stock. For example, Facebook has been dead for years (”Nobody uses FB anymore!!”) and yet the blue app alone has 1.98 billion Daily Active Users and 2.96 billion Monthly Active Users which still slightly increasing even at a mammoth base.

Then, TikTok is killing the company’s growth, which is true and has been touched upon by Zuckerberg himself this year. But its not like TikTok is lapping up everything thats out there for grabs in the short-video segment. Instagram is still a monster with 2 billion users and Reels alone generates about $3bn in revenue (as compared to TikTok’s 4bn in 2021). Engagement on Reels is up significantly with more than 140bn Reels plays across Facebook and Instagram daily, and the management mentioned it is gaining share against TikTok in term of overall time spent.

These questionable arguments crack when they’re put up against facts and data. Ben Thompson of Stratechery did an excellent job explaining these myths (and some more) in detail.

Are we all playing the same game?

Meta, outside its Metaverse vision, is facing real existential threats. First, TikTok burst onto the scene as a real competitor for attention (which is the foundation of the entire industry) and had been pulling eyeballs away from Instagram Stories at an increasing rate. Users got hooked onto its AI recommended short-form video content and the app became a phenomenon.

Second, Apple changed the rules of the game by introducing its ATT tracking policy, which, to put it simply, does not allow Facebook and other apps on iPhones to track third-party cookies (which forms the basis of the entire targeted advertising system). Meta admitted this would come as a $10bn hit to its revenues (for now) and it would need to build another way for advertisers to target their customers better and ensure a decent return on their ad spend.

These two gigantic threats to Meta’s core business meant that it has to spend big to build its own data centres and deploy its AI models as it works its way around building a recommendation engine that is at least as good as TikTok’s. Then it needs to build and redeploy its ad targeting and attribution system that can still deliver the results for ad publishers at the costs they are used to incurring.

Meta has no choice but to forego short-term financial gains for long-term viability of its core business. It cannot grow in the long-term if it doesn’t survive that long in the first place. Shareholders who are in it for the long term would get this, but looks like a lot of them are not even playing the same game as the company's. The focus seems to have shifted too much on the near-term results, and this short-term game that goes from one quarter to the next has pushed the stock down the cliff.

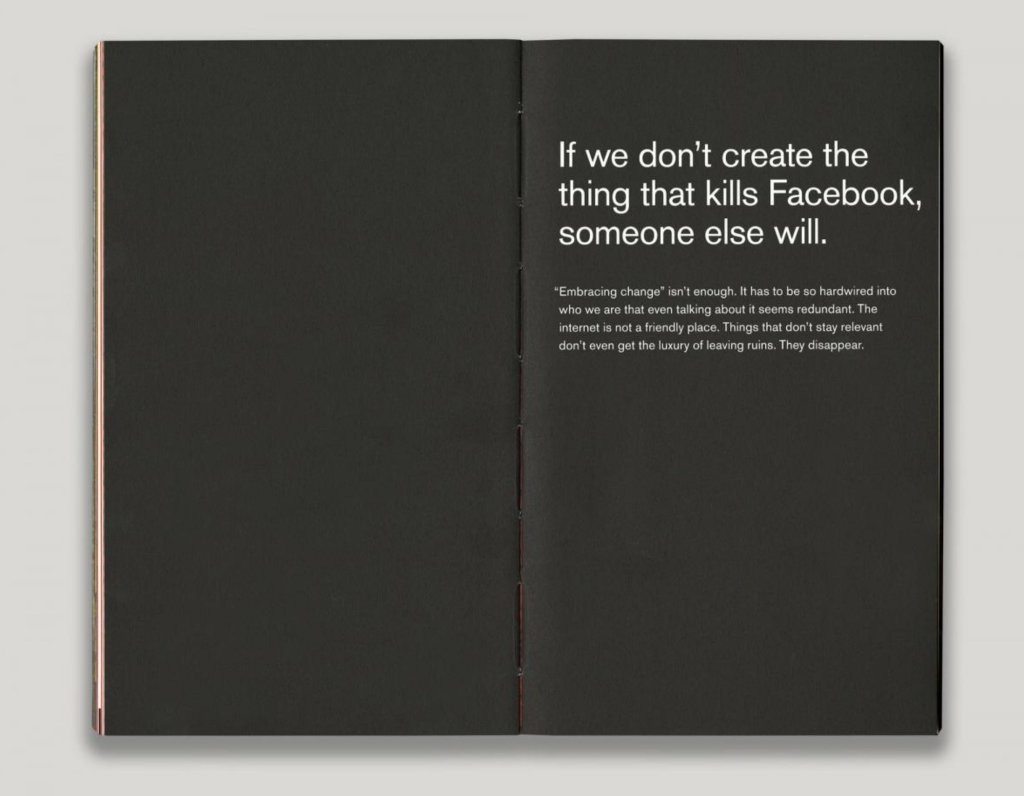

Innovation is an imperative not an option

For companies which build for decades in the future, investments that define the next frontier in technology could be as important as the current business over the long-term. Not all of them succeed, but this tinkering is fundamental to the company’s progress. Microsoft had many bets that didn’t pay off - like Mobile, Bing etc. and then some that paid off incredibly well like Azure and 365. Amazon had multiple failed ideas that didn’t make it to the front, so did Apple (it is working on an automotive project right now for example). A lot of these companies are what they are because innovation is an imperative for them, not an option.

For Meta, this is a substantially big investment to be called 'tinkering' or a project on the side. And unfortunately, it has been punished for being too transparent too early. Investors are already asking questions about the “cumulative losses” and “ROI” on these investments which they clearly do not believe in and are labelling it as “unproven bets” (if they were proven wouldn’t everyone else be rushing in too?!).

Zuckerberg has been thinking about Meta's dependence on its main tech rivals since as early as 2016, as this thread explains.

He wants to be early on what he thinks would be the next tech frontier after mobile where every most of our work and personal conversations and connections will take place. And he wants Meta to be what Apple is to iOS or Google is to Android (for a detailed background on this here’s another Stratechery piece). As a long-term shareholder, you would agree these are steps in the right direction, even if the ride is going to be rough for a while.

This is not the first time

This is not the first time the company is facing an uphill ask. It was questioned at the time of the IPO if it was ready for the shift to mobile. It came under the scanner again as it bought Instagram, when the market doubted the price it paid for it and the app's potential. Then again in 2018 when the markets were worried about saturating markets for social networks and the dying engagement on its apps. Ever since it was founded, Zuckerberg has overcome unsurmountable challenges (both business related and otherwise).

A CEO is as good as the decisions he takes and Zuckerberg has had a decent track record of taking the right ones, even if the timing was not that helpful (especially for the most recent pivot).

This is the power CEOs have. They cannot do all the work, and they cannot impact industry trends beyond their control. But they can choose whether or not to accept reality, and in so doing, impact the worldview of all those they lead. - Ben Thompson in When CEOs Matter

No one else can do what Meta is trying to

Meta is not the only social media or tech company that is reliant on advertising facing these issues mentioned above. But it is probably the only one that can spend $30bn+ a year to get out of this hole. A majority of the spend is still on AI and data centres building all that compute needed for its platforms, and is being funded by its own cash flows. Not via equity issuance and not via unsustainable leverage.

While it has an impact on the Free Cash Flows in the short term, it might enhance the long-term cash generation ability if they get it right. As long as they know when to quit the project if it is not working, I as a long-term shareholder should be aboard.

Other thoughts and counter-arguments:

Some concerns from a capital discipline and timing perspective

Out of its peer group, Meta is, by far, leading the pack when it comes to capex and R&D spend (as a % of revenues).

While necessary, there’s been some concerns that Meta has lost capital allocation discipline, and has failed to read the room. The environment has changed from when it embarked on this new Metaverse pivot, and now there is a real opportunity cost to spending that much with the returns far off into the future.

When the CEO controls more than half of voting rights through a super-voting share structure, and has a vision he ardently believes in, the concerns around spending and the feeling of “losing control” are understandable. Investors would rather have the extra cash returned to them via buybacks, which in my opinion does not make much sesne if there are projects that need that level of investment and need it now. The Covid disruption and the shift to more hybrid and digital workspaces probably pulled forward a lot of that spending, and sadly for investors, it is going to be lumpy and huge, and not smooth and linear which fits right into their excel sheets.

The narrative shift went against the company

While it is true that it is leading the Metaverse pivot from the front, its core social media business is still massive. The narrative shift went against the company as it coincided with a thesis changing shift in the macro environment, which makes it look more like a speculative and wasteful project led by the CEO in total control. As mentioned above, a majority of its investments are still related to fending off the threats to the core business, but the Metaverse narrative, especially in this environment is hurting the stock even more so.

Not caring about the stock could have some unwanted consequences

The stock price is that last thing Mark Zuckerberg might care about. Neither did the visionary CEOs like Steve Jobs or Jeff Bezos had stock price as an indicator of how well they are doing. But Meta’s employees might have a significant proportion of net worth in equity.

The prospects of increasing stock prices and the upside for your net worth with it has a positive impact on recruiting talent. In the long run might start causing problems for the company.

While there are a ton of arguments against the company’s investments and it sticking to the Metaverse vision, I still believe Meta is taking steps in the right direction. The market is wrought with short-terminism all over the place, and CEOs like Zuckerberg are not made for this quarterly game of beats and raises. Building in public has hurt the company but whether it sticks to doing it or not, innovation is an imperative for Meta, not an option.

Until next time,

The Atomic Investor