Its different but still the same (II)

History doesn’t repeat itself exactly. But it gives us enough insights to see how we respond to the emotions of fear, panic, greed and the like.

In part I of the post last week I tried to highlight how this time it looks quite different.

History doesn’t repeat itself exactly. An economic crisis is different from the one before it. A pandemic is different from the previous one. A conflict is not the same as the one 70 years ago. Different times, different situations and a completely different environment. So its very hard to predict what would happen this time around based on past events. But history gives us enough insights to see how we respond to the emotions of fear, panic, greed and the like.

Here are a few things that are here to stay:

Nobody knows anything

We saw it in 2020 and we are seeing it now. The armchair immunology and virology experts are now turning into military strategists and geopolitics professionals. You will see it time and time again - newfound ‘experts’ are christened during these shock events trying predict what comes next. But in this world where chance plays a massive role and which is wrought with uncertainty, nobody knows what comes next.

The night before the D-Day Invasion, Franklin Roosevelt asked his wife Eleanor how she felt about not knowing what would happen next. “To be nearly sixty years old and still rebel at uncertainty is ridiculous isn’t it?” she said.

“What a world” by Morgan Housel

A “show” of support

Public opinion has always been around but it tends to get amplified during the times like we are in today. But something that is relatively recent (as compared to lets say 50 years ago) is Virtue Signaling - a grand show of support for the “current” thing. Maybe it was always there, just that signaling mediums were not as strong as they are today. Individuals, Corporates, groups, organisations are now obliged to join the “now” movement, regardless of any real efforts to do something that might help. Elon Musk snatched the words from my mouth quite literally with this tweet.

This looks like its here to stay. Its great to be able to tap into the support of the community, but virtue signaling stops helping when we wouldn’t try to understand the true gravity of the situation or form well-thoughtout opinions. As the lines between your online offline lives become blurry, a “show” of support gains more value than actually doing something. Words > Actions.

Some narratives get violated

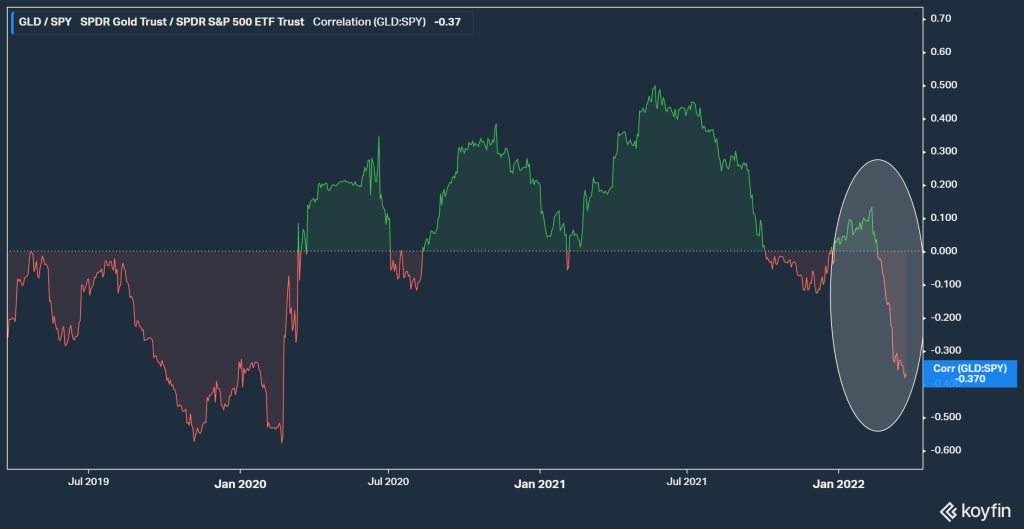

It is easier to believe in narratives when the market environment is all bright and sunny. The roaring post-Covid financial markets were something of that sort which allowed a lot of these narratives about the future to prosper. The Gold vs Bitcoin narrative was one them - that Gold is no longer as shiny at it used to be and a shinier Bitcoin can act as “digital gold”. It is now touted as a a hedge against market volatility and downturns and a protection for your portfolio in an inflationary environment (a role that gold has played pretty well in the past). The narrative was strong enough for institutional investors to start adding some Bitcoin exposure in place of Gold.

But as they say, when push comes to the shove, people try to latch on to things that are Lindy - things that have stood the test of time. Gold has a history of 500 years, and has a long standing track record of being both a currency and a store of value. In times like these, it has historically glittered the most providing investors a hedge against both inflation and uncertain outcomes.

Here’s how the relative performance stacks up for both Bitcoin and Gold recently.

Investors are pouring in their money into Gold ETFs as well, and the largest ones are seeing huge spikes in inflows, which is driving the spot price of physical gold higher.

If your narrative was based on Bitcoin being a hedge against uncertainty and higher inflation, that certainly has been quashed. It might still prove to be the case in the future, but Bitcoin (and the entire crypto asset class) is being driven more by liquidity than a demand for inflation hedging. Crypto has gained some acceptance on the institutional side, but it acts more like a high beta tech stock being increasingly correlated to ‘risk-on’ strategies like high growth tech and consumer stories.

Here's the 63-day correlation between Bitcoin and QQQ (Nasdaq-100 ETF)

Gold tends to have negative correlation with the market in a sell-off, which is what you are looking for here.

The promise of uncorrelated returns seems to have taken a backseat as liquidity driven money flows has become a dominant factor for Bitcoin. It is like a beast with two wolves inside - the high growth tech stock and the inflation hedge/digital gold asset class. At the moment the former looks like it is dominating leaving Bitcoin to behave more like ‘Fool’s gold’ than the digital gold it aspires to be.

Some narratives always get violated in times of duress.

Money finds a way

We saw the post-Covid and higher inflation recovery take over the markets where money was being pulled out of the tech and high growth stocks and being piled into the old economy value stocks. But this economic recovery story turned bearish this year as the shock of an escalated conflict led to big drawdowns at the main index levels, with them losing 10-15% from YTD up until beginning of March.

Bonds and Treasuries would usually act as a ballast in this kind of environment and provide some cover for the investors. But given this cocktail of high inflation and tighter monetary policy, investors took out money from fixed income as well with treasury yields jumping to levels not seen July 2019 in a span of a few weeks.

The money taken out from equities fearing higher rates and inflation is now no longer moving into bonds (due to the same reasons), and is finding its way back into equities (for now). Mark Haefele from UBS very rightly called this TINA or bust. There Is No Alternative. Large companies with inflationary pricing power in their industries and a growing pile of cash flows with dominant market positions are the new safe havens in this new inflationary environment.

For people who turned bearish last month, money has to go somewhere. It always finds a way.

Different versions of truth

As is always the case, events of this nature are rarely binary. There’s always shades of grey instead of just black and white. There are many versions of the truth about this conflict floating around, driven by different agendas and end-goals. This leads to us believing in different versions of the same truth, even when we have the same facts. In most cases, your echo-chamber social feeds are designed to show you only what you more likely to like and leave out the stuff that is conflicting with who are you are.

Benedict Evans says, “The more the Internet exposes people to new points of view, the angrier people get that different views exist.”

“What a world” by Morgan Housel

Its better to be fastidious than just accept everything you are shown at face value, and make sure you get the right version.

As I mentioned at the beginning of the post, we study the history of the world and the markets not to predict outcomes, but human behavior. The outcomes and certain events will always be different, but how we respond and react will still somewhat be the same.

Until next time,

The Atomic Investor