Lessons from a bear market

Its good to pause and reflect on what went over the past two years, and think about the broad lessons you can take away.

When so much is happening around you, its always hard to pause and reflect. The inertia of moving forward and keeping up with the ongoing series of events does its best to prevent you from taking it all in. From 2020 till now, we’ve gone through everything that you would probably witness over a decade long (maybe more) market cycle. We’ve had:

one of the worst global pandemics in history bringing along the sharpest bear market and subsequent recoveries,

a record amount of monetary and fiscal stimulus and ultra-tight labour markets

acceleration of secular trends in technology and our lifestyle, completely altering the way we look at our life, health and work

a raging bull market driven by record low rates filled with rampant speculation

a breakdown of global supply chains and supply side inflationary pressures

a catastrophic war leading to a loss of human and physical capital, leading to global commodity and food shortages (I wrote a bit about it here and here)

a sharp spike up in inflation driven by everything mentioned above, leading to an eventual course correction by central banks to end the free money era (some more thoughts here)

and finally, a total clear-out of the excesses and froth from the markets, trillions of dollars of wealth vanishing with falling asset prices and with it a 20+% decline in the main indices leading us to the dreaded bear-market territory.

We’re always tempted to open up history books to navigate the “now” and update our current playbooks for specific scenarios for the future. But given that today’s events are highly unlikely to unfold the same way, it might be better idea to take away some broad lessons from all that has happened over the past two years or so. Here are a few of them that I’ve been thinking about:

Too much of anything is bad news

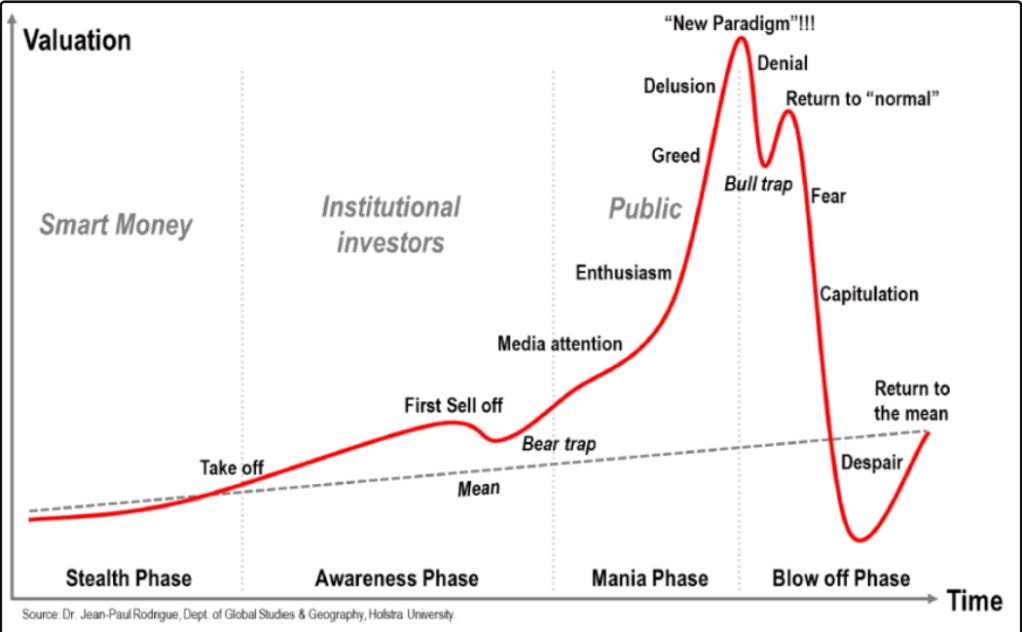

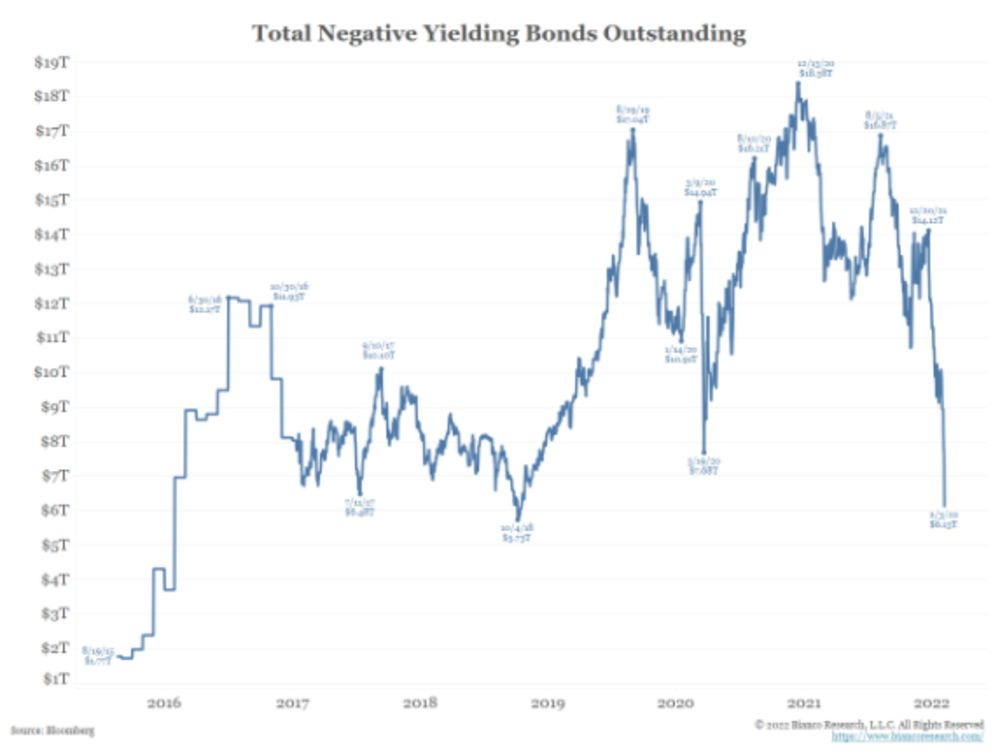

Too much optimism was abound in the markets over the last two years. It started off with too much liquidity and stimulus, leading to investors being pushed too far out the risk curve and record low rates, stratospheric valuations, filthy amount of capital being raised in the riskiest parts of the market leading to unsustainable growth plans charted out by both large firms and small.

Good as it feels when you have it, an excess of anything over a meaningful amount of time leads to second and third order consequences that hurt us over the long term. The pendulum likely swings back to realism when you extend it too much to the other side, or it breaks.

Too much of anything is not healthy neither in the markets, nor in your lives.

(Here’s a great read on the Everything bubble)

History might rhyme, but its never easy to get it right

This game is hard. Even if you have the perfect playbook from the past, it id never easy to get “today” right. You see countless investors turning the pages back to high inflationary periods of the past, trying to predict what could happen in the current environment. As I wrote here, the world is nowhere close to what it was in the 80’s. Our spending habits have completely changed, with some discretionary and non-discretionary subscriptions and purchases being a big part of our life. SaaS wasn’t existent back in the day, so we do not know how enterprises could react to higher costs.

You could argue that some events have higher likelihoods of occurrence, which is fair. But its never going to be easy to get the what, the when and the how right.

(Aswath Damodaran with an insightful explainer on the impact of inflation and the current environment)

After abundance comes scarcity

We’re accustomed to living in a society of abundance. Abundant resources, belongings, gadgets, apps, access, networks and of course capital. After decades of expansion in abundant choices, we’ve probably stepped into a period of scarcity. The two shocks in the last two years might have pushed this cart into motion.

The basic resources we thought were abundant are now getting scarcer. Global trade flows are being reset. Countries are serious about onshoring manufacturing capabilities. Energy supplies are tight and rules are being re-written to secure them for the future.

What gave us this abundance is now pushing us to get used to this new scarcity.Capital is getting scarcer already and our attention, the most important resource we have, is the scarcest it can be. After abundance comes scarcity.

Price drives narratives

This has probably been in existence the beginning of time. Crypto is great until it only goes up and to the right, but its worthless when its down in the dumps. Meta is a brilliant company with a visionary founder, until its down 50%, after which Zuck doesn’t know what he’s doing. Cathy Wood is a genius attracting billions of inflows into her ARK funds but is a speculator who got lucky when the fund prices are down 70%. Energy companies are un-investable, until the stocks are the up 50%, which is when they are fit to be added to ESG indices again. Our stories and narratives are driven predominantly by the headline stock prices.

There are countless examples of this happening everyday, everywhere. Price has always driven narratives and it will most likely continue to do so.

Regime shifts usually change how the game is played

After a decadent decade long rally where all you got is gains, the way how the game is played has changed. “Growth at all costs” is now called “path to profitability”. Cash flows right now are more valuable than the ones 20 years into the future. Liquidity dependent strategies relying on falling rates are going bust. Easy gains have been easily lost in the span of just half a year. A regime shift is underway, where a new normal might be different than what we are used to. Inflation might stabilise at a level higher than previously imagined. Valuations might not reach nose-bleed levels again. It might get harder for your business and business model to get funded. You might have to think of more ways to create value for your investors, customers and shareholders.

What looks like an end to the easy money regime is mostly a reversal towards a normal world. But it has certainly changed the way the game should be played.

Sometimes you do a lot by not doing anything

For us humans, inaction is equivalent to no productivity. When we feel we are not being productive, we believe we are not growing. Growth for us a proxy for success, both in knowledge and capital. After a drop in our portfolio values, its very normal to feel the need to do something, buy what’s working and sell what is not. You find yourself checking your brokerage account all day, even when there is nothing to see. A lot of us dabbled into speculative crypto and stocks and other asset classes looking at others around us doing a lot out of this frenzy. Not doing anything is hard both on the way up and the way down. But sometimes, by not doing anything you avoid doing the deterrents that could put you off course.

It also allows you room to take stock of what is going on, what you need to focus on and your long-term goals and objectives - the “whys” of your investing.

We rarely learn when we are winning, but mostly when we are losing

Its funny how long the losses stay with us for much longer and much vividly. These are all the could-haves and should-haves moments that we think could have changed the outcomes, or helped us avoid this one. Winning on the other hand brings confidence, which is easily turned into complacency. Conducting post-mortems on wins is a rarity both in life and the markets. It is our losses which make us better and push us to think better. A loss is a perfect teacher, and a lot of investors got plenty of opportunities to learn from in this bear market.

Hope we all are learning.

Until next time,

The Atomic Investor