Not just PE anymore

The largest firms in the business very proudly call themselves “Alternative asset managers” now. The “Alternatives era” is being defined by other private market asset classes.

A yellow “Eras Tour” van, weird dances, lyrics that induce a feeling of cringe and the legendary Steve Schwartzman of Blackstone in a Taylor Swift inspired gleaming pink jacket.

No, this is not a parody but an actual video released this past week by Blackstone called “The Alternatives Eras Tour”. Maybe its the worst take on today’s pop culture. Maybe its just the sign of the times in Private Equity.

PE or Private Equity has almost turned into a misnomer these days. As the video makes it very clear, the largest firms in the business very proudly call themselves “Alternative asset managers” now. They are multi strategy, multi asset private markets investment solutions providers. Yes it is a mouthful. The frequency of mentions of the traditional PE business have increasingly declined as it becomes a much smaller portion of their overall AUM.

It is not just about PE anymore. The “Alternatives era” is being defined by other private market asset classes - credit, real assets (real estate, energy, infrastructure) and now insurance.

AUMs of the largest alt. asset managers paint a very clear picture here.

Incremental inflows are also being dominated by these other asset classes.

The greatest demand today is for private credit solutions, as Steve discussed. And our credit, insurance and real estate credit businesses comprised over 50% of total inflows again in the third quarter. - BX Q3 earnings call.

Apollo, for example, is now more of an originator of credit and retirement services provider (annuities, insurance etc.)

Scale is everything

The rationale behind the shift towards these other asset classes is not that hard to follow. First, as I alluded to in The Magnificent Seven of PE, the largest PE firms (I still call them that) turned into publicly listed corporations to achieve scale, which in an asset management business is more so about growing the investable asset base than investing itself.

This scale can be achieved not only by adding depth in one asset class (exposure to different regions in PE for example) but also by adding breadth - products across asset classes via opportunistic M&A and organic fundraising.

Second, once you go public, to command a better valuation the markets demand your earnings be more predictable and stable. Traditional PE, with its two components - management fee and performance fee can be quite cyclical. The drawdown fund structure - raise, invest, operate, sell, repeat can be impacted in a lot of ways in a market downturn, as we all saw recently. But being a diversified manager allows you to raise capital and find deployment opportunities in all kinds of environments. Therefore, managing more capital via longer term and “perpetual funds” lends stability and predictability to their earnings, with which they can reinvest in the business and also return more capital to shareholders.

As LPs move towards investing beyond traditional buyouts, the firms see this as an attractive opportunity to become a “one stop shop” private markets manager to both increase the wallet share from existing clients and penetrate new client types at the same time.

But the underlying growth driver in achieving even larger scale and entering a new growth phase is the replacement strategy.

The replacement strategy

Institutional investors like pension funds, insurers and other investment companies for a long time used the textbook 60/40 approach to match their duration and return targets, which can be noticed in this snapshot of their allocation from 2001.

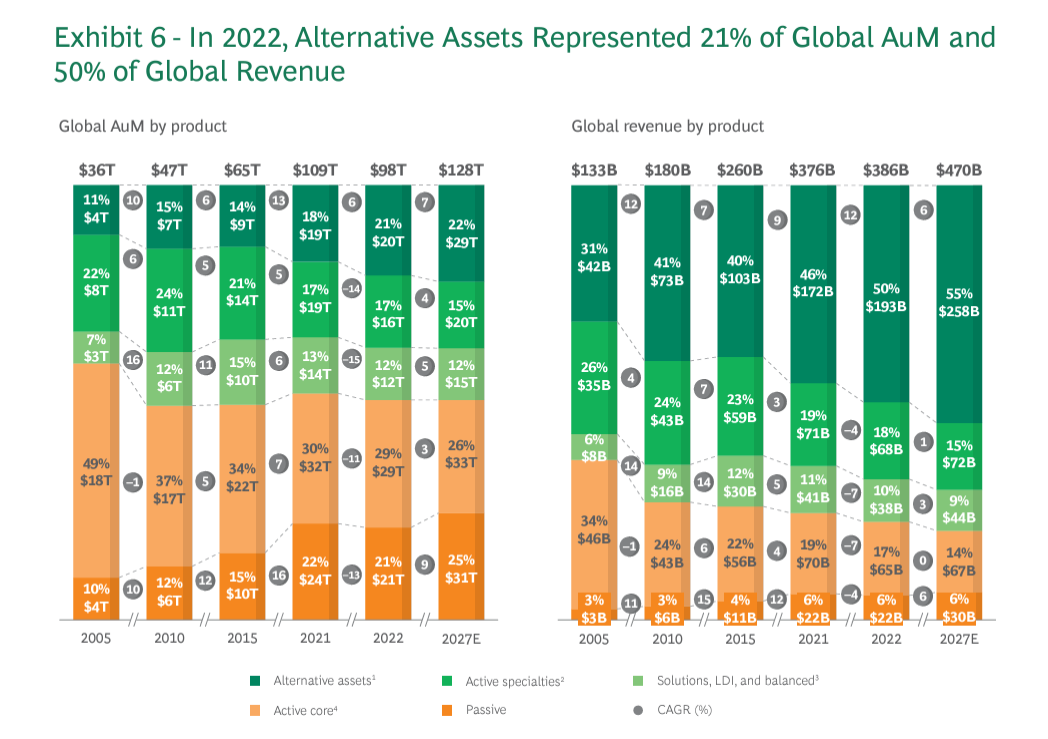

PE firms have been following a replacement or replication strategy ever since. They looked at the public equities portion of pension funds (for example) and provided a private markets solution for it - long term funds with less volatility and smoothed returns, with more control and less correlation with public markets. Everything you need for better risk adjusted returns. PE allocations therefore started replacing a portion of actively managed public market equities, going from ~5% allocation to higher than double digits in a decade. Then Indexation and a shift towards passive in listed marktes accelerated this creation of a barbell of cheaper passive products on one hand combined with alternative assets on the other to target lower correlated return streams.

Something similar is taking place in the world of fixed income investing. Private credit was mostly targeted towards replacing different forms of high yield credit originated by banks - levered loans, direct lending, asset backed financing etc. But now PEs are taking this “debanking” a step further and calling it “fixed income replacement” targeting the big chunk of institutional fixed income portfolios in other investment grade fixed income securities or fixed income funds.

We have, to date, as a financial press and as an industry, talked about private credit as if it meant to be -- if it is levered lending, sometimes called direct lending, was private credit. Let me tell you. This is a fraction of a fraction of what debanking will produce. This piece of the business of lending to buyout sponsors, sometimes it's a very good business.….When I talk about private credit, I'm really talking about the secular change as a result of debanking. I start with the notion that everything on a bank balance sheet is actually private credit. What we've seen so far and what the press is focused on is levered lending, which, as I said, is a fraction of a fraction. I think we're going to be talking about this for the next 10 years. And the vast, vast majority of what we're interested in private credit is actually investment grade. - Marc Rowan, Apollo CEO

That means going from a ~$2 tn market just in U.S and Europe to substantially larger ~$15tn investment grade bond market.

You could use a similar lens to view other specialist investment strategies in Infrastructure, Climate linked, Renewables, Energy transition etc., where they are replacing traditional public sector funding by institutional capital.

This replacement/replication has expanded to Retail (for now only High net worth) portfolios which traditionally had a very low exposure to private markets. $140 tn+ worth of investable assets globally, some of which will increasingly be replaced or replicated by private market products.

As you know, I've said publicly, certainly, for high net worth families, family offices, I think they will be 50% plus alternatives over the next 5 years, and we're seeing that kind of uptake in traction. - Marc Rowan, Apollo CEO

What other large investable asset pool could this strategy have been applied to?

PEs ❤️ Insurance

The global insurance asset pool is more than $40 tn and continues to grow. A majority of these assets are invested in fixed income securities.

This structurally checks a lot of the boxes that PEs like to see. First, it is “permanent capital” in a way. Insurance redemptions are scarce and people and businesses rarely stop paying their premiums for life or property/casualty insurances. Plus there is a huge reinsurance market for insurers to take risk off their books. And all these assets need to be invested to generate a return to match future expected payouts.

Alternative managers have been now investing in insurers to set up their insurance operations where they get a fee to manage these assets. Then they can acquire more blocks of reinsurance assets and invest them to earn a return. As long as the cost of servicing liabilities (payouts) is lower than returns, they can earn the “spread”, adding an additional layer of earnings via the insurance segments.

Since 2021, almost 15 alternative asset managers have entered the space and acquired almost $800 bn in assets. Fee revenues is not the only play here. PEs can replace a portion of insurance assets invested in public fixed income and equity markets with private market products and earn a higher spread. Additionally, the insurance assets can help other areas of the firm reach scale much faster (like Private credit) without them having to go for a fundraise, since majority of insurance assets are invested in fixed return securities and funds.

One analysis found that US PE-backed insurers generated 62 basis points (bps) higher investment yield than the industry average. Within three years of acquisition, 80 percent of these insurers had increased their allocation to asset-backed securities (primarily collateralized loan obligations), and over half of their investments were in private loans (compared with 37 percent for the industry)

KKR last week acquired the remaining 37% of Global Atlantic and has created a new operating segment to report its insurance related earnings. This love for insurance assets and operations seems set to continue for PEs.

Its different than it was a decade ago. The asset classes of the past have matured significantly. The largest firms have achieved scale in multiple product segments and continue to build new ones. Fee earnings are more stable, albeit with a very different profile.

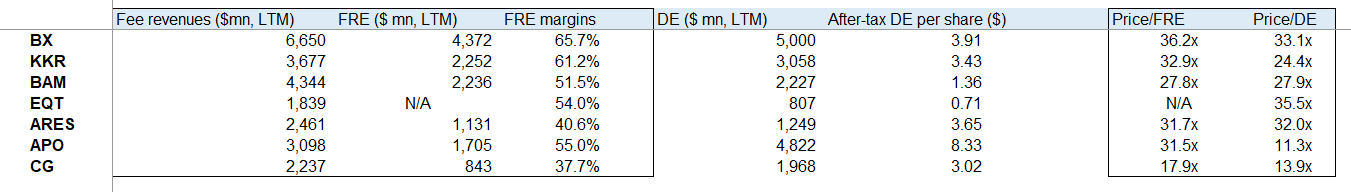

As non-traditional PE continues to contribute a larger proportion of the earnings base, investors are trying to get their head around a new set of risks. Shareholders would also start contending with a different set of implications for the stock price and valuations. The stocks are all currently trading within a narrow range of each other for most of the firms (on Price/FRE).

But what is now clear that it is not just about PE anymore.

Until next time,

The Atomic Investor