Off the sidelines

Looking at the current state of Private Equity from a Listed PE lens. PE got off the sidelines, but here comes volatility again

Private Equity has been going through its ebbs and flows driven by short term economic cycles, some important secular trends in the investment management industry, and now the accelerated pace at which the tech cycle is advancing.

2024 was a net positive year for the industry. The macro situation improved with rates trending down and inflation subsiding.

The markets were ebullient, pricing in the new government’s unleashing of animal spirits via lowering regulatory barriers and pushing dealmaking and M&A, which started to pick up after a 2 year lull.

The largest publicly listed U.S PE stocks, more exposed to increasing capital markets activity were up north of 20% (and some as much as 50%) from August last year to end of January this year, while the main indices returned between 10-15%.

A different lens for PE

I also like looking at the industry from a “Listed PE” lens, and see how the mega caps of this world have been faring. I believe it is a fare proxy for the overall industry and sentiment (not to mention they manage more than a quarter of global AUM and captured more than 60% of new funds raised in 2024, also being at the forefront of the most important trends in the alternatives space).

The megacap PE basket: BX, KKR, BAM, EQT, CG, APO, ARES (also the Mag 7 of PE) now manage $4.8T in assets across asset classes.

The market saw increasing activity last year and some signs of getting PE getting off the sidelines:

Dealmaking: Megacap PE deployments increased considerably in 2024 - 18.6% YoY increase, whereas Private Credit deployments continued to go from strength to strength with 94% YoY growth.

More benign macro environment definitely helped, along with the buyer-seller valuation mismatches somewhat normalising, where buyers and sellers could be willing to transact without much hand wringing.

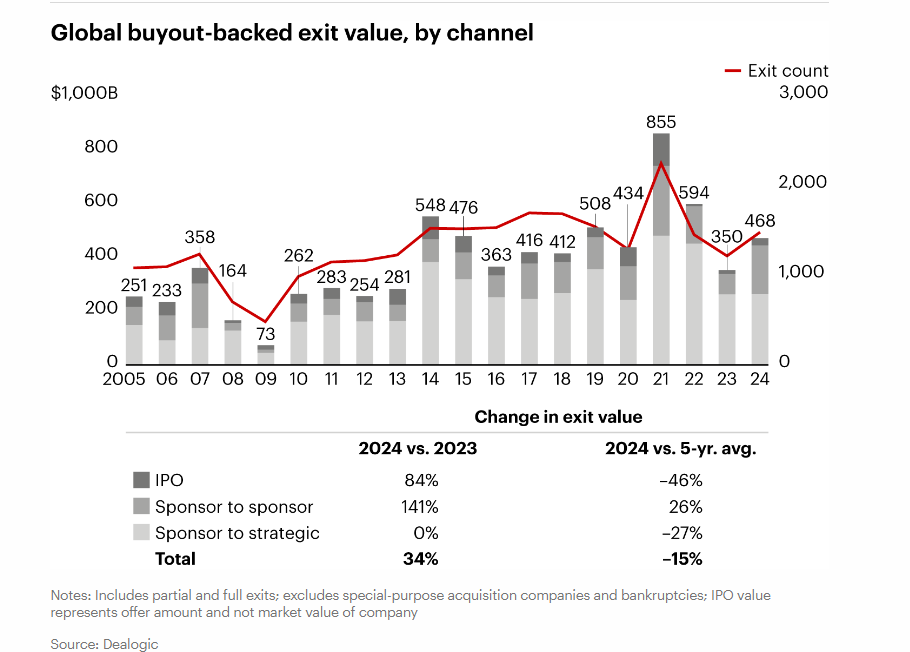

Exits: Realizations (in value terms) were up by 33% as well after a tough couple of years.

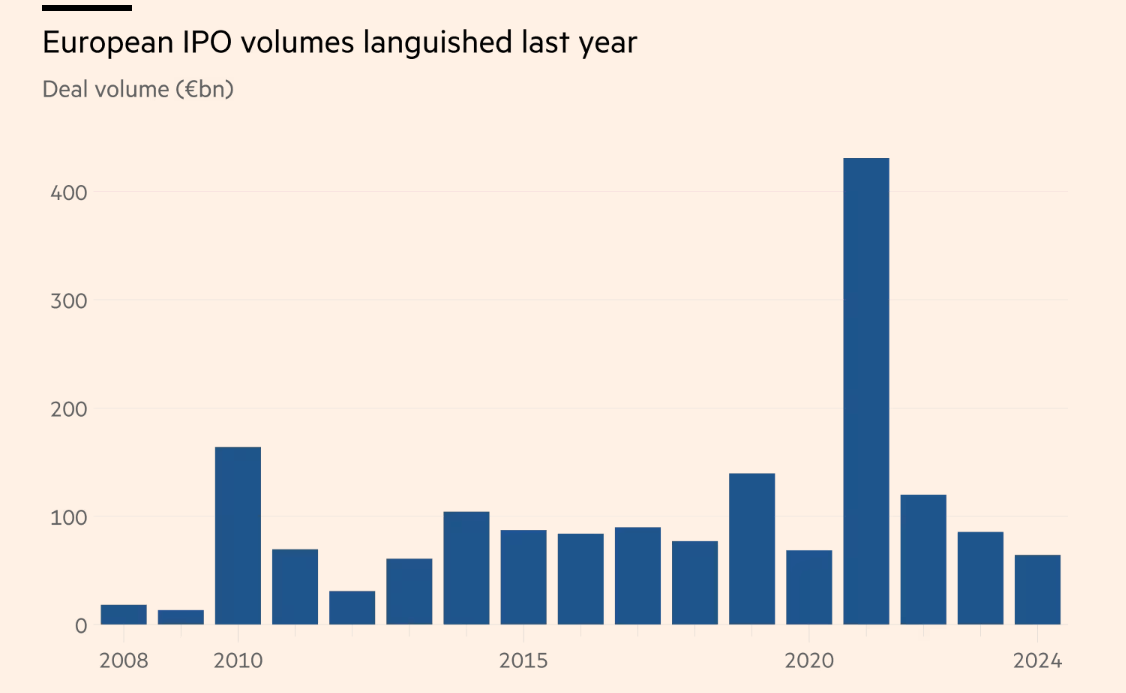

The market slowly started to open up more, especially during the later stages of the year. But exit strategies have changed quite substantially. IPO markets are still quite dormant, which historically were the primary source of realizations.

Sponsor-to-sponsor deals continue to increase (especially in Europe) which may be a consequence of the dire need to deploy (and earn fees) for the buyers, and to exit (and realize the carry) for the sellers.

It also begs to be asked if and how the next sponsor can do enough to create value in an asset that has gone through multiple sponsor holds.

Like a football club changing managers very often and is stuck with a squad that is not theirs. Reminds me of my club at the moment.

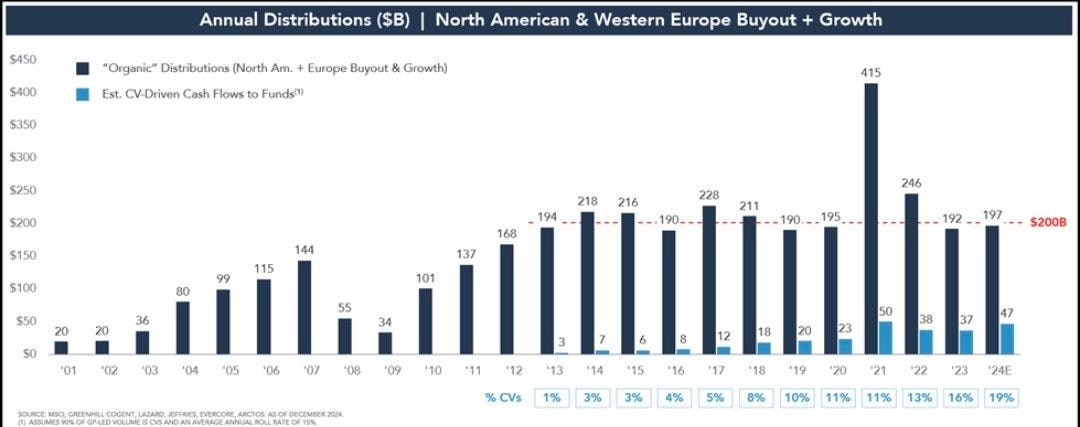

Liquidity: Liquidity continues to be a challenge with GPs not distributing enough capital back to LPs or not soon enough the consequence of declining deal activity and exits in the past. This naturally stops the PE flywheel in its tracks as LPs cannot recycle capital back as step-ups into flagships or newer funds.

Distributions as a % of NAV continues to be around 10% (lowest it has ever been) with recent vintages moving much slower along the typical J-curve, increasing payback on commitments for LPs.

Lack of organic distributions has led to other avenues, like Continuation vehicles which are now almost 20% of total distributions.Skeptics will argue about it being a circular flow of money (which theoretically is true). But given an increasing proportion of new fund inflows are coming from the “retail”/private wealth channel into “evergreen” funds or perpetual capital, continuing to hold some assets for very long could be more aligned to this new setup.

How do you continue to create value through the cycles to create liquidity for your LPs in that vehicle? Dividend Recaps? NAV loans? Sell smaller stakes in the asset? None of this seems very sustainable. But an interesting dynamic to follow nonetheless.

Macro musings and the AI conundrum

Although we are past the rate hike and inflationary regime of the last 3 years, economic growth is sluggish in most regions and we are now in late stage slowdown part of the cycle.

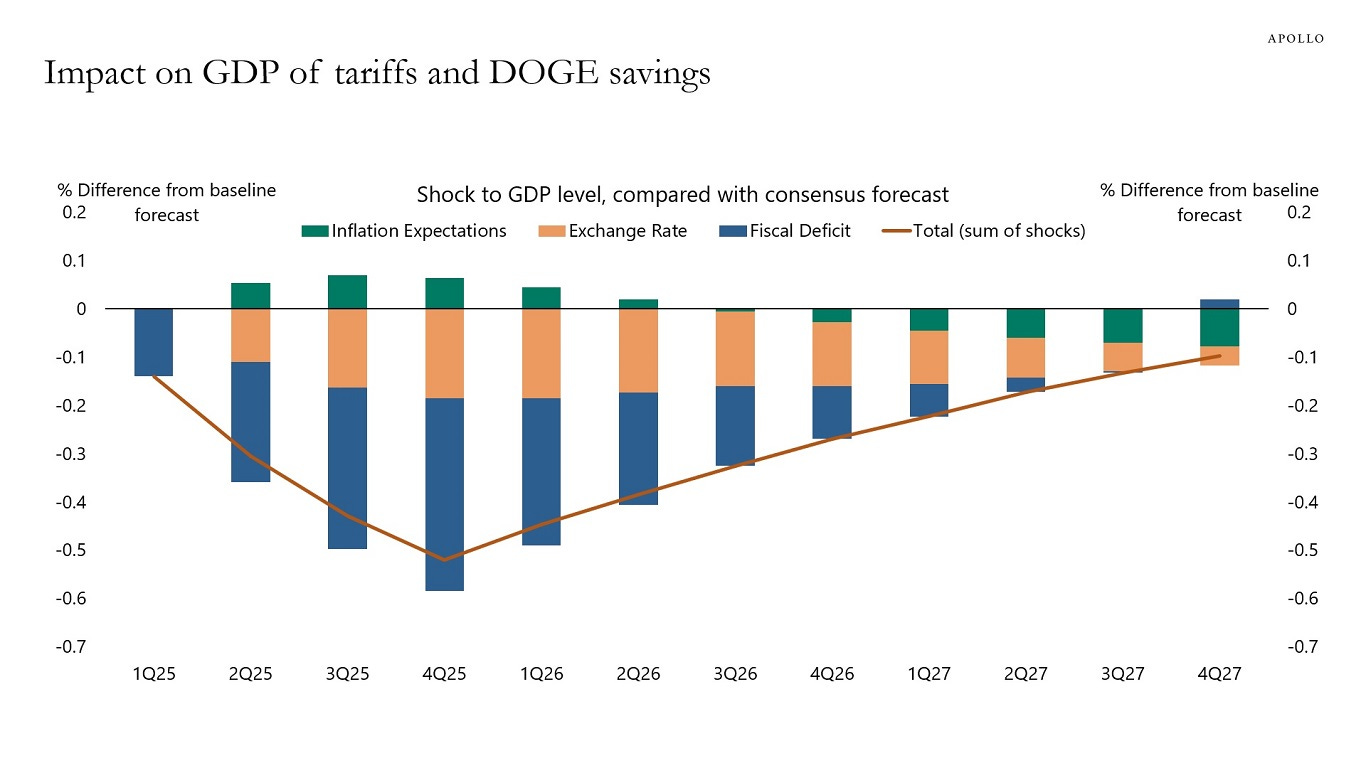

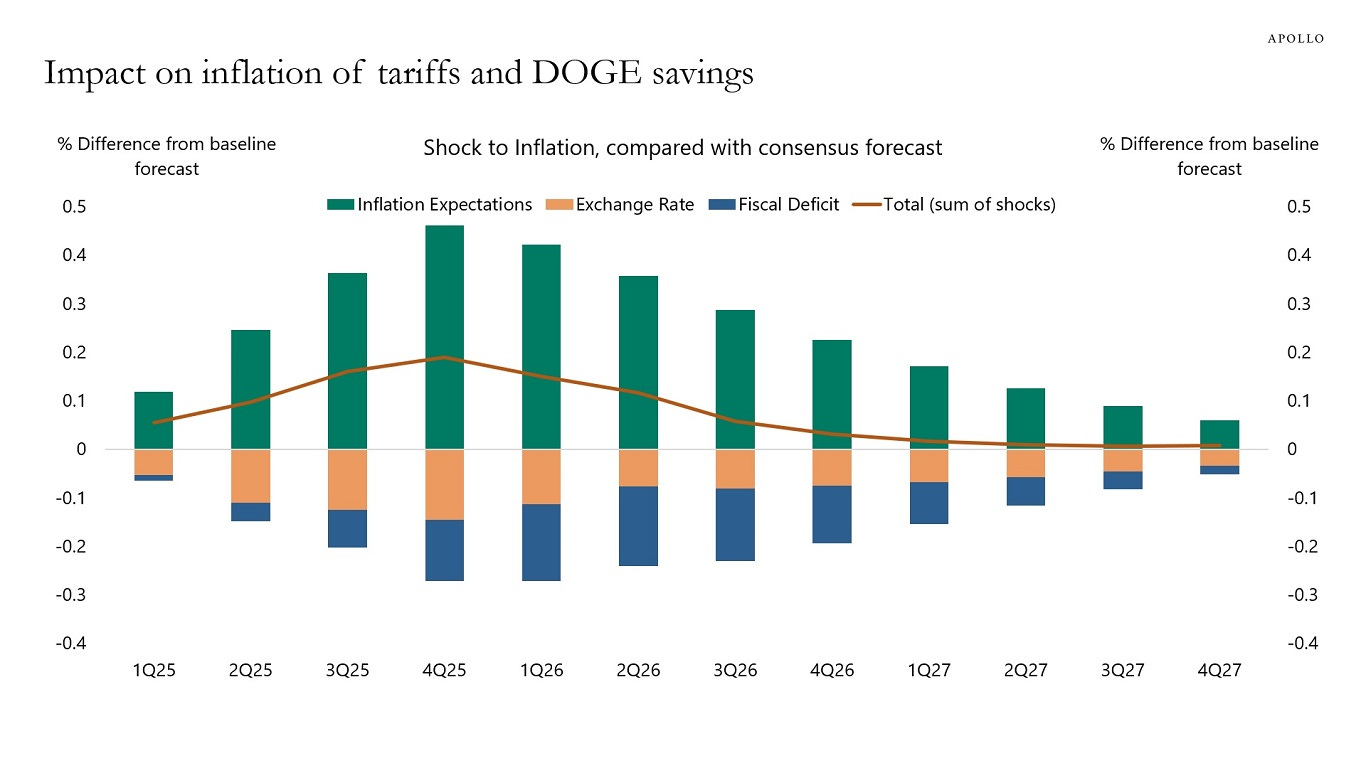

And now to top that off, threat of tariffs and geopolitical tensions is adding a further layer of complexity and uncertainty in the short term with a negative impact on GDP and rising inflation.

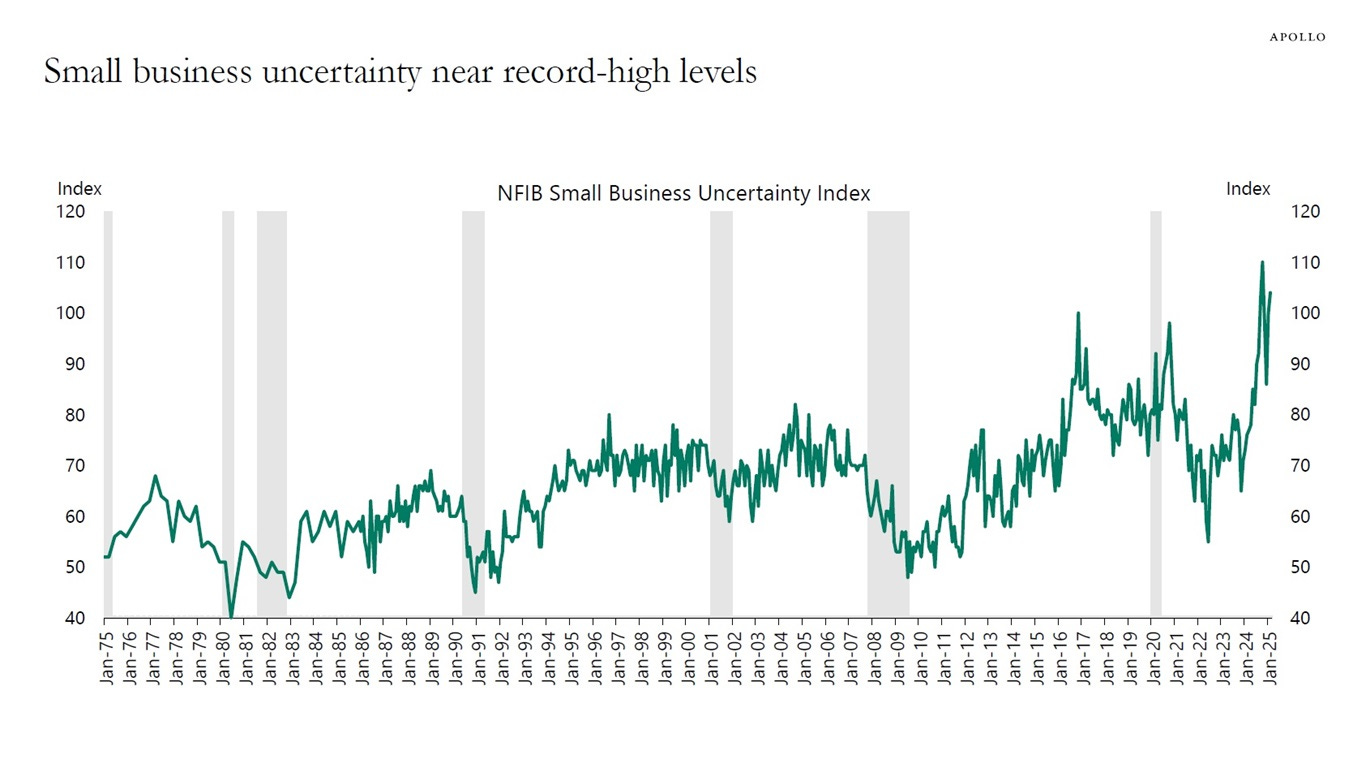

Public markets have taken a thump since the start of Feb (S&P 500 down 6%, Nasdaq 100 down 8%, Mag 7 down 14%). Consumer and business confidence is hitting new lows.

There has been clear shift in sentiment as the markets realized that asset prices are not the priority.

“Nothing to do with the market,”... “I’m not even looking at the market, because long term the United States will be very strong with what is happening here.” - Donald Trump

Does not look like M&A is either.

“Maga doesn’t stand for ‘Make M&A great again’” - Scott Bessent, U.S Treasury Secretary

But the opportunities loom large

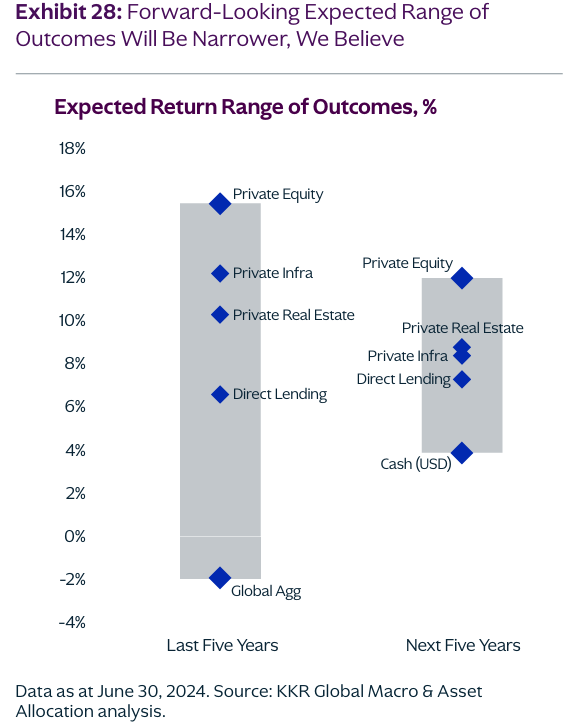

Private market returns now look more compressed than from past cycles putting further pressure on GPs, given that the opportunity costs are higher with higher base rates.

This is pushing PE managers more towards opportunities arising from the current tech cycle, the range of outcomes (and consquently returns) for which is much wider than what PE might be used to.

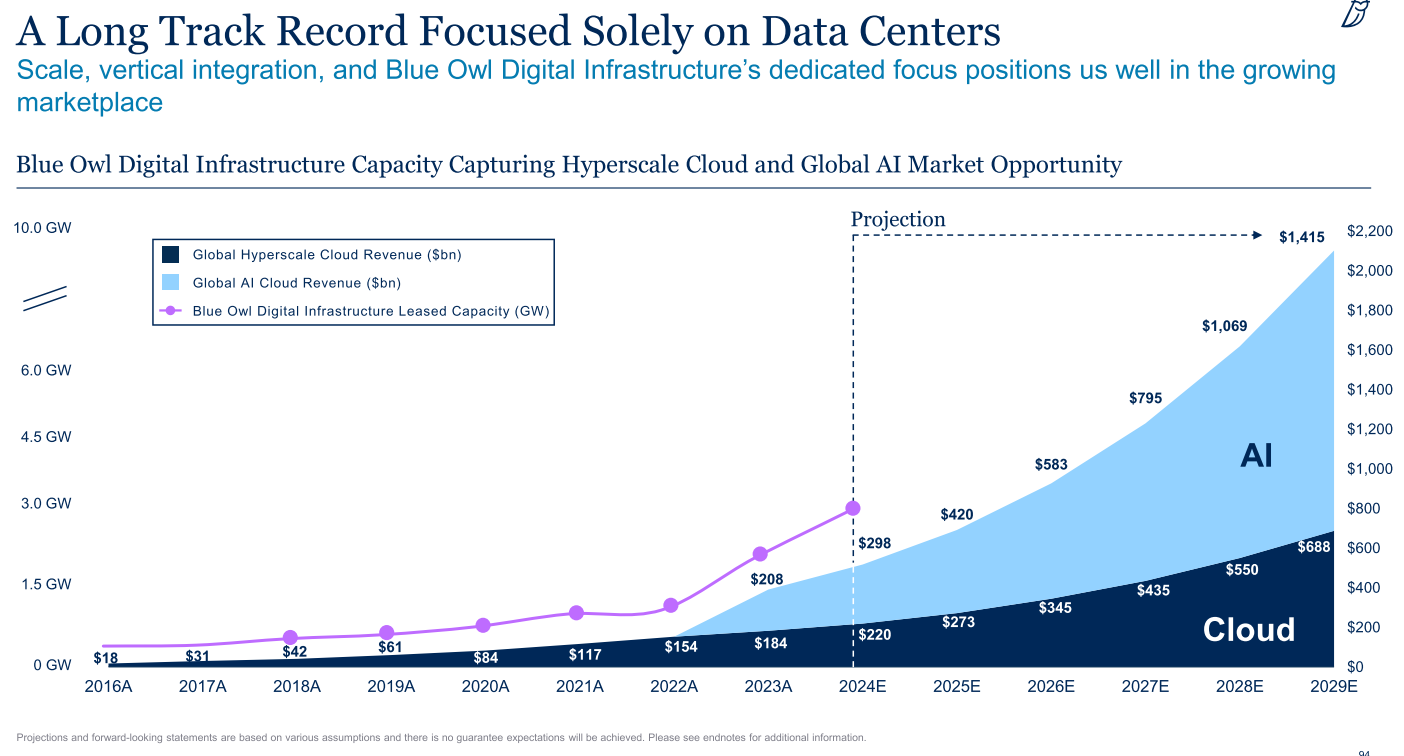

But AI is still a looming opportunity that both public and private market investors cannot afford to miss out on.

The world still needs to build out the compute and energy infrastructure of massive proportions, especially now when we are moving towards real world use cases across the consumer and enterprise applications.

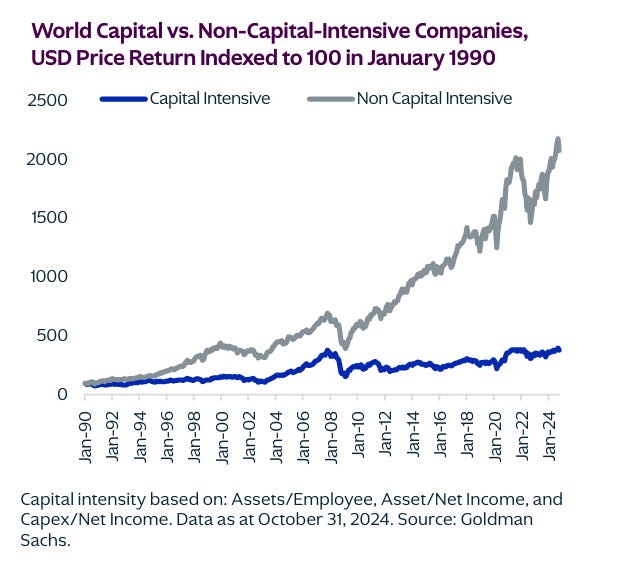

PE managers see this as a massive opportunity to deploy capital across the tech and infrastructure landscape. But would the ROIC be enough when capital light businesses are the ones that have outperformed over last decades?

“As we all know, the rise of AI is transforming industries and companies and has a potential to create tremendous value, and is already doing that. At EQT, with our Motherbrain team, we are going after opportunities both for efficiencies and costs, et cetera, but also to drive revenues across our entire portfolio sector by sector, and of course starting there with tech as we talked about before” - EQT 2024 Q4 earnings call

“Some of it may change. And the good news for our investors is we're not doing things speculatively. It's based on the demand signals from our tenants. That's when we go out and spend the big dollars to build these things” - Blackstone on how they deploy capital to build out AI infrastructure

Where does this leave Listed PE?

It all comes down to earnings quality

Listed PE’s fundamentals continue to improve. Fee related earnings (FRE) were up 20.4% in 2024 while Distributable earnings (DE), a proxy for shareholder cash flow were up 17%.

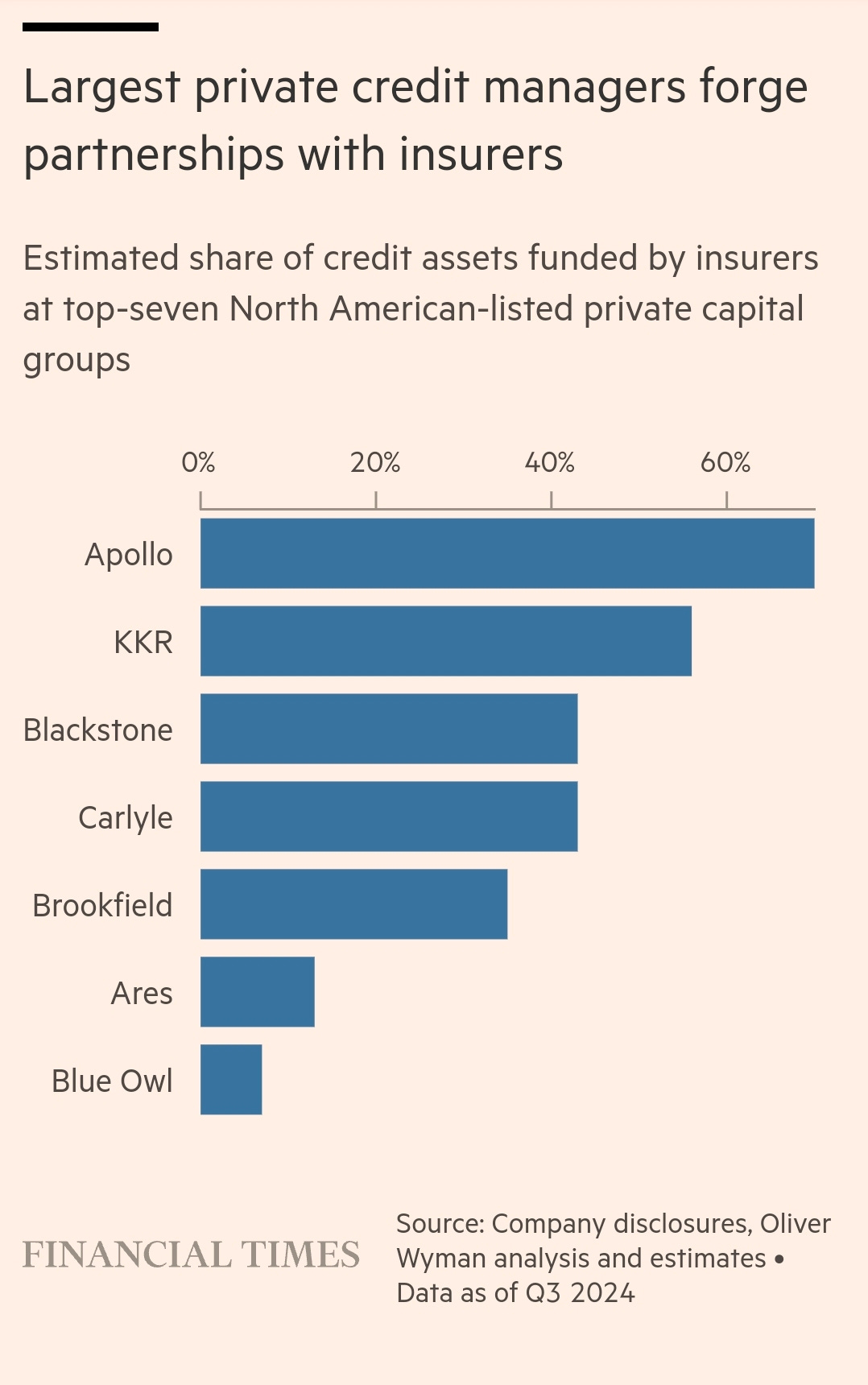

Private market managers are no longer playing the traditional PE game. The fundamentals are very clear about this now being about scale and permanent, more durable sources of capital.

FRE, a less cyclical and more stable source of earnings now make up a substantial source of DE for these GPs, and for some all of DE is FRE.

FRE naturally grows more visibly as GPs scale and diversify their capital base.

Insurance and Private Wealth channels are now contributing an increasing amount to the marginal dollar raised by Listed PE.

This continues to reduce the exposure of Listed PE earnings to the cyclicality of capital markets but there still might be some near term impact.

“We expect the capital markets environment to remain relatively more challenged over the near-term, pressuring the group’s PRE (carry and realization related earnings) recovery and to some degree weighing on FRE growth amid risks of slower capital deployment, more elongated capital raising campaigns and moderation in retail flows - resulting in a mid-single digit negative EPS revisions across the group.” - Alex Blostein, Goldman Sachs”

The stocks have already been clobbered since the tariff threats became a reality.

Sentiment shift works both in your favour and against it as we can clearly see.

2025 seems to be another year where macro and industry specific challenges as above might continue to keep growth somewhat muted. However, scaled managers with differentiated solutions, like Listed PE seem better positioned than ever to deploy under distressed market conditions, if and when they arrive.

Until next time,

The Atomic Investor