Playing different games

What worked in the past does not seem to working anymore. This is the end of free money.

The year is 2010. The economy is just starting to get back on its feet after the 2008 recession. The young millennials are worried as they finish school and enter college. They are hearing about the tough times their seniors are facing getting a job that they want. Their parents share anecdotes from their friends and friends of friends, about the apparent wealth destruction, job losses and everything else. A ton of savings are underwater, house prices have collapsed and jobs are not secure anymore. The young millennials are learning valuable life lessons, as they get exposed to the investing and the markets, the economy and professional lives in real-time.

But things are getting better as they always do. The rate cuts are working as job numbers start to improve. The markets meanwhile, are up more than 50% in two years as central banks embark on long-term quantitative easing programs. Millennials, both young and old, hear people on CNBC and Bloomberg talking about tech platforms and the next big thing. Mobile commerce, streaming, social media and the like. This is exciting. They’ve just seen people buying the new iPhones and they love it. They’re starting to invest in the markets and are increasingly impressed by how the exciting tech companies, that are a big part of their lives, are performing. NASDAQ 100 is up 70% since 2012 and their perspectives about investing are right about being formed at that time. It is quite normal they learned to play the game that became the only game in town.

It was not just the young investors. Professionals who tried playing a different game got their hands burnt. Tech became a large part of the main indices in the last decade which, coupled with the wave of passive flows, delivered breathtaking returns year after year.

That meant higher inflows for tech stocks, which gave them an even larger weight in the indices, pushing the markets higher. Seeing that this game worked and worked best, professionals, like retail investors became pseudo-active. Their portfolios started to all look alike with the largest tech stocks in each one of them. And it was not just big tech in the public markets. Careers were made on the back of this wild bull-run as swaths of capital shifted to private markets inlcuding growth equity, venture capital and until very recently, crypto.

Tech became the name of the game. You invested in them because they were clear winners, and their stock prices became clear winners because you invested in them.

The rules are changing (for now)

The game that was being played for the last decade got amped up a notch during the pandemic. So much so that everyone thought it was easy. Robinhood, Reddit, TikTok, Discord, you saw the newly crowned winners proliferating everywhere.

But the recent rate hikes, inflation scare and geopolitical troubles put the brakes on the opulence of the past 2-3 years. The rough start to 2022 in the markets just got a LOT more rougher. The global markets are down 15% this year, with the tech heavy NASDAQ 100 down 24%.

This does not seem disastrous given the mammoth bull run we were in. But a look under the hood might present a better picture. The mega-cap tech, the stocks we all love, sold-off big on recent earnings as investors questioned the growth stories they were attaching to these names just a year ago. While the fundamentals were not as bad, a slowdown in growth rates with higher costs in an inflationary environment is making the market rethink its assumptions.

(Big tech is down a lot, but the S&P is okay(ish) as other sectors which were long forgotten have rallied. Big W for diversification.)

The price the market was willing to pay for these earnings streams has significantly changed too, with multiple compression leading the large drawdowns in stock prices. Some of it might be related to a spike in real rates (nominal bond rates minus inflation, meaning higher equity risk premiums) while the rest looks like a hard reset in expectations.

The game of "Growth At Any Cost" seems to be changing into a game of "Cash Flow and Profitability". A common theme emerged during the recent earnings results where reining in free uncontrolled spending was cheered for and the excesses of the past, where money (that cost literally nothing) was ploughed in to chase the next big thing was punished really, really bad.

Cash burning money losing names have been slaughtered in this drawdown so bad that most of them are more than 70% from their all time highs.

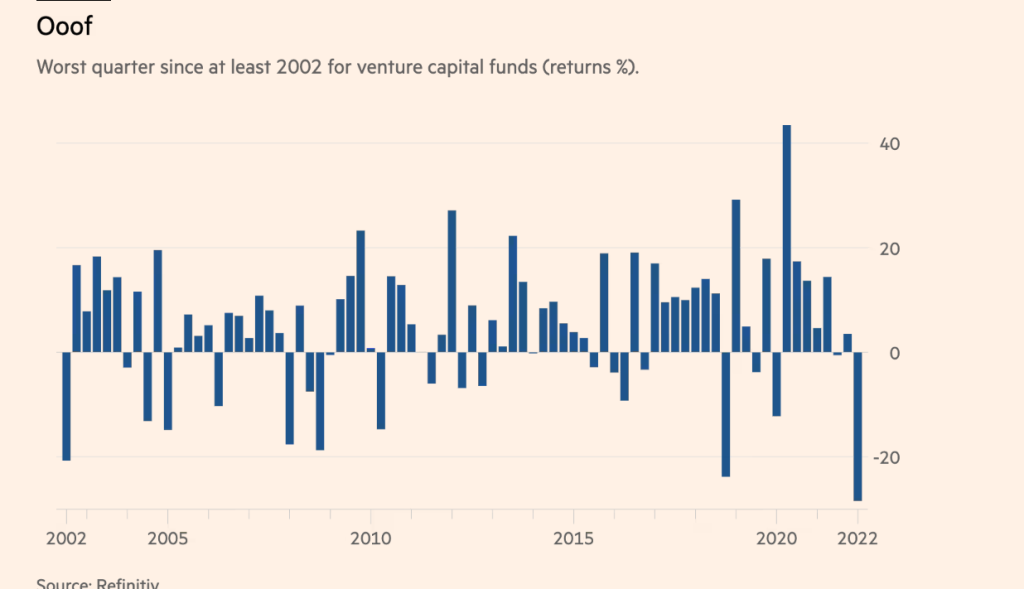

Hedge funds (some only having hedges in the name) have been caught wrong footed too. Tiger Global, one of the largest hedge funds in the world, lost $17bn in this washout, erasing more than 60% of its overall gains since 2001. VC funds registered a -25% return (the worst quarter since 2002) as valuations for high growth tumbled across the board.

And what about our favourite inflation hedge - Crypto? Catastrophy.

This looks like the end of free money putting the stops on what seemed to work for so long. Talking to people (or looking at their Twitter/Commonstock feeds) gives you sense of the hard time a lot of us are having, finding the right answers in these markets. We all learnt to play just one game, the rules of which seem to have changed.

No more just ‘exciting and disruptive’ business models, sales multiples, high cash burn and growth at any cost. Valuations are reverting to earth after a trip to the moon. The focus is back on cash flow generation and a control over costs. Nature is healing, as they say.

Morgan Housel, one of my favourite finance writers, once defined valuations as “A number from today multiplied with a story from the future”. Using the same definition, its fair to say that the numbers for a lot of stocks might have changed less, but the story, a lot lot more.

Can we learn to play a different game? Adapt the way we think about investing and the world to this new environment?

Range is key

I have this long held belief that experiences, in general, are additive. There are valuable lessons in both wins and losses, if you know how to look for them. Investing experiences are somewhat similar too. Every win is a chance to refine what worked and every correction or a loss is an opportunity to know what you do not know and understand what does and does not work for you in the long-run.

This bear market took me back to this piece I published here a while ago. This generation has created an incredible amount of wealth in the markets learning and playing a game that worked wonders until now. But if you are great at just one game and ignore the rest, you put yourself at risk of not being able to play when it stops working. There’s a high likelihood of getting a blank expression if you ask around about an energy company, a manufacturing company, a commodities market or a real estate business (sectors likely to perform better in this environment)

History tells you how the best investors, operators in any field performed at the highest level for a really long time. They built range and learnt about multiple disciplines at a first principles level. They avoided depending on the success of just one game and building their whole identity out of it.

We might as well be ‘good at a few games’ in both life and investing, not just ‘great at one game’. If you want to keep playing, building and using Range is key.

Until next time,

The Atomic Investor