Reality check

It did not take long for the markets to get a reality check this year.

Last year was one of worst years for the markets. Global stock markets shed more than $25tn, while global bonds ended the year down 31% making it a brutal year for everyone involved. Primarily, this was initiated by central banks hiking rates all over the world. Inflation had to be brought back under control by slowing down the wage-spending spiral, drawing liquidity out of the system and tightening financial conditions for both businesses and consumers.

Most importantly, the markets were responding to the uncertain path of inflation that lay ahead. It was tough to tell if higher rates will have the intended impact and by when. Given how much markets hate uncertainty, they were begging for some signal to get a handle of what the outcome might be.

The “soft landing” narrative, that higher rates would get inflation right back under control without pushing the economy into the recession, slowly became consensus as energy prices fell sharply from their highs from last year. CPI readings came in lower than expected for a couple of months, consumer spending showed signs of weakness and unemployment was still low.

Even the number of companies mentioning inflation in their earnings calls peaked last quarter.

The sentiment seemed to be changing fast. The signal that markets were dearly waiting for led to a strong rally in both U.S and European stocks, with the latter outperforming on the back of better economic data and a higher exposure to cyclical industries.

How easily we believe in something that we wish to be true. This week, the markets were handed a reality check via the latest set of economic data in both the U.S and the EU.

In the U.S, labour costs ticked up, consumer spending was resiliant, hiring was still strong. This shot up inflation expectations once more, leading to higher treasury yields in the wake of more rate hikes needed by the Federal Reserve to get it back under control.

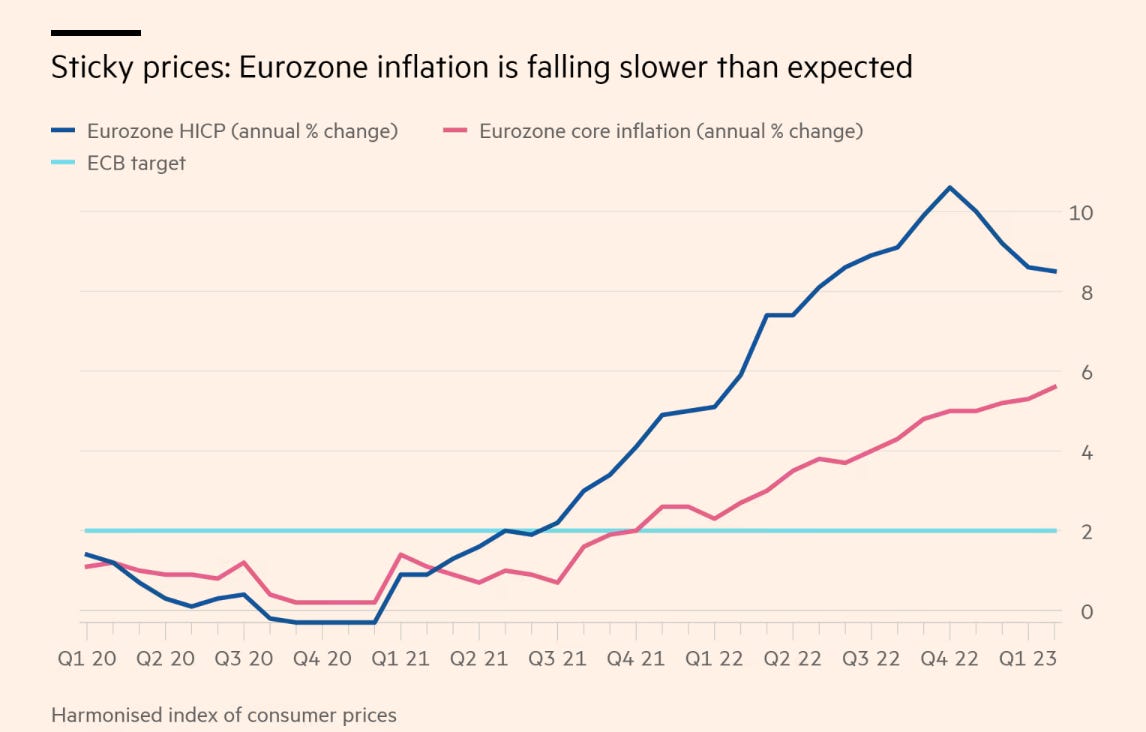

In the EU, unemployment was close to all time lows, and higher food priced offset the decline in inflation due to falling energy prices. Core inflation still seems to be going up and is way above European Central Banks’ target levels.

The reality check is bound to crush the soft landing hopes and bring a new narrative into the picture. Inflation might be staying higher for longer after all, leaving interest rates close to where they are for longer as well.

From a recession, “soft landing”, “no landing” (continued economic growth) to “higher for longer”. Narratives take their time becoming consensus. But when they change, they change rapidly.

The reality check has raised a bunch of heavyweight questions that are still unanswered. All centered around higher opportunity costs due to risk free rates more than 3% in the EU and above 4% in the U.S.

How do the markets contend to higher rates for longer? How will stocks be valued in a scenario where discount rates for the safest bets will be close to 10%?

How do businesses cope up with borrowing costs they have not seen in decades?

How do consumers face increasing rates amidst steady increase in prices? Do they slow down their spending to pay increasing debt and mortgage costs?

Can startups and young business access capital at terms which would not put their survival in jeopardy? Can VCs and PEs raise enough funds and finance deals under market conditions not seen in a lifetime?

Finally, is a global recession back in the picture?

We might never get a definitive answer, but we will have enough to pile onto a new narrative and start this game all over again.

Until next time,

The Atomic Investor

Short & crisp# flavour of season 👊