The changing fabric of Football

Instances of fines and other restrictions at football clubs continue to increase as a wave of foreign and institutional capital floods the sport. The fabric of Football is rapidly changing.

I easily have more than a thousand conversations on football and everything around it every week, and one of those stuck with me lately. Someone told me they’ve lost most of their interest in the game as they do not recognise the sport any more. There are too many decisions being taken by people not involved in the game that have a sizeable impact on clubs and the game, have little consideration for fans and and are mostly unrelated to football related outcomes.

They were obviously pointing out to the rapid commercialisation of football and football assets over the last decade and the ever increasing interest these assets are attracting from investors. While there has always been a billionaire fan trying to get their hands on their favourite club’s ownership, the profile of club owners is changing as we see institutional capital and sovereign wealth getting involved, bringing a whole host of changes to the clubs’ and the respective leagues’ inner workings.

I get it. It is not easy as a fan to digest so much going on in the shadows. Imagine being an Everton or a Nottingham Forest supporter and seeing your club taken 5-10 points off them because of breaching financial sustainability rules, putting them close to or straight into the relegation zone. None of this for their performance on the pitch, but troubles off it. I’d be fuming as well.

Even the largest clubs in the world like Football Club Barcelona , Manchester United and Juventus are not pristine as they seem and have faced a multitude of problems recently, stemming from bad financial and operational decisions taken off the pitch. The latest victim of that is Reading FC (one of the oldest clubs in English football) which was docked 18 points, relegated to the third tier and is in a sorry state due to overspending under the current ownership.

We’re increasingly reading these tales of fines, restrictions and other similar impositions at football clubs, both big and small. Football leagues and associations are now suddenly having to clamp down hard on unsustainable operating and financial models at clubs as a wave of foreign and institutional money floods the sport.

The fabric of football, like it or not, is rapidly changing as we try to get our heads around on what it means to run a modern day football club.

A new era of excesses

Football entered a new era when the broadcasting rights market started warming up to European football and Sky signed a landmark GBP 300mn deal with the newly formed Premier League in the UK in 1992.

Premier League 1992 launch video. A whole new ball game.

Spreading of the sport globally got hundreds of millions of fans onboard and allowed the top leagues and its member clubs to get bigger and richer by attracting commercial deals, sponsors and other growth avenues.

The best players now could be attracted to join the biggest and the most successful clubs, which further fuelled the growth in global fanbases. The pace of this ascent was astronomical. In 1992, the combined revenues of the English First Division clubs (the Premier League) were GBP 170mn. In 2014, roughly two decades later it had surpassed GBP 3bn, growing 18x in that period.

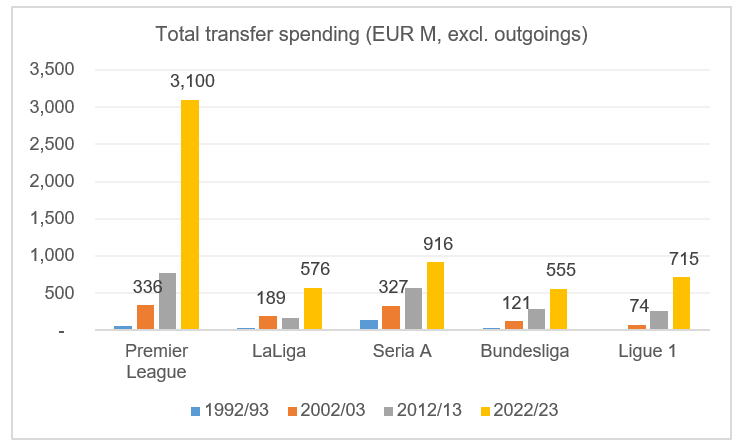

The amount of money clubs spent on building their squads ballooned as well as a result. The top 5 European leagues spent EUR 280mn combined in the 1992/93 season, more than EUR 1bn 10 years later and a mammoth EUR 5.8bn in 2022/23.

The last decade has seen an acceleration in the trend and pushed this market into extravagance and excess.

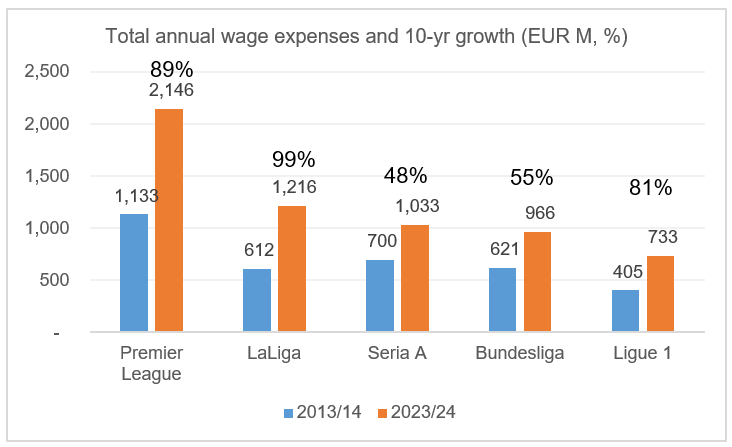

Transfers might not impact the club in one particular year as the costs are spread (amortised) over the length of the contract. Player salaries, however, are real annual expenses that have a direct impact on the financial health of the club. Here too, the trends are just preposterous. Total salary expenses in the top 5 leagues almost doubled across the board and average salaries more than doubled in the last 10 years (2013/14 - 2023/24). It was a very different kind of wage inflation in football.

Another insightful chart from Arctos which shows that wage growth in the top 5 leagues has outpaced revenue growth considerably over the last decade. Business 101 says this might be unsustainable.

Throwing money at success, and now at survival

As new money led by a different league of investors has started pouring into football, the game has seen some structural changes. Success on the pitch is increasingly being defined by the ability to bring in commercial success.

The three relegated clubs (in 2021/22), Norwich (£118m), Watford (£87m) and Burnley (£92m), were also all among the six lowest spenders with each spending significantly less than the league average of £182m - Spencer Stuart, Moving the Goalposts

Players are also being lured by paying them ridiculous sums of money and signing other off the balance sheet deals.

One could argue that in the modern day there are more way to monetise these footballing assets (merchandising, sponsorships etc.), so investors can afford to pay these amounts. But with that the delicate balance between the commercial and footballing side of the game is tilting increasingly towards the former as the latter takes the backseat for a number of new club owners.

After all, the richest clubs get the best players, have the best academies and can afford to provide the best environment for talent and youth to develop - all of which are important ingredients of success on and off the pitch.

To stay competitive, unfettered spending beyond the clubs’ means is now becoming commonplace even amongst smaller clubs. It is a complex situation where on field success is closely tied to business success and vice versa, putting a massive strain on the financial and operational health of those clubs.

Most new investors come in with a big equity cheque or take on large amounts of debt to fund player transfers, stadium buildouts and other developments at the club to fuel revenue growth and ensure survival (on which most of the commercial success hinges), essentially spending more than they make in most cases. Chelsea FC for example, made GBP 534mn over last year and spent more than GBP 1.1bn led by the new ownership of Clearlake Capital and Todd Boehly.

Examples of Reading, Everton and Forest are other cases in point of this new investor playbook of spending for commercial success and footballing survival, where misaligned decisions taken in the boardroom stand to decide the fate of the club and its future.

Fans, as a result are increasingly becoming disillusioned by all of this happening, putting owners at the risk of losing the most important asset in football. Not the players but the fans that make football what it is (and also drive all of the commercial success which investors so eagerly look for).

Can the new regulations help?

UEFA and the domestic sporting leagues recently introduced new financial sustainability rules (Profit and Sustainability rules or PSR by the Premier League) to rein in uncontrolled spending by teams and force them to operate within their means.

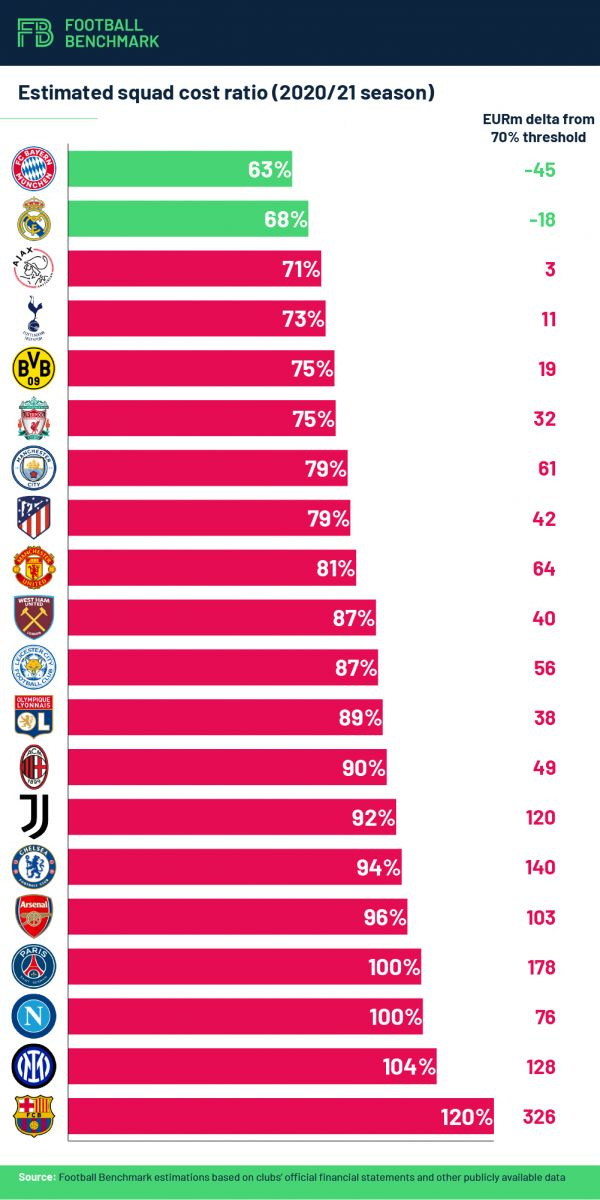

The new squad cost ratio restricts clubs to exceed their squad costs above 70% of revenues by 2025/26 season.

But there’s a laundry list of who’s who of clubs that currently do not comply with the 70% number.

The wages alone in the top 5 leagues have flirted close to the upper limit for squad costs and have even exceeded that in some countries over the years.

The situation is even dire at lower leagues where just the wages alone exceed the 70% number, and go above and beyond 100% of revenues.

Both UEFA and Premier League have put in additional rules in place regarding club profitability. Clubs cannot show a cumulative loss of more than GBP 105mn in the previous three reported financial years (the PSR) and only 15mn of that 105mn can be funded from the club’s own earnings. The rest of it (90mn) would need an equity injection by the ownership or new investors, implying that first you cannot continue spending more and report losses, and then if you do it will be funded by new equity capital, not the club’s existing balance sheet (which is likely to further increase the influx of new club owners with varied interests).

But the average club in the richest Premier League made a pre-tax loss of GBP 31mn over four seasons until 2021/22. Lower division clubs fare much worse with hugely negative operating cash flows.

Now a new independent football regulator will be formed in the UK with the powers to remove “unsuitable” club owners with the track record of financial mismanagement and no involvement of fans in key off field decisions. This might be a step in the right direction but it does not solve all of the problems.

Club ownership needs a new operating model

As the game, the product, the fans and regulations continue to evolve, clubs need a better operating model to thrive in the modern day. There are various examples today where new club owners are already implementing the following ideas.

Get the management structure right with competent people in the right roles:

A right management structure for the club is key for both the football and commercial side of the business. The appointments do not end at the head coach and the staff running the team. A club today needs competent leadership in charge of football operations with the knowledge of the modern game along with astute management and operational capabilities. The right board composition is also key to take objective strategic decisions aligned to the owner’s and the club’s plans.

Clean up broken finances:

New club owners need to clean up broken finances of their clubs first instead of doubling down on spending. Finding different balance sheet solutions involving the assets they own (club facilities, stadium, digital/media assets etc.) can unlock much needed capital that can be deployed elsewhere. A well defined transfer policy with rules around player wages could also allow them to bring down the squad costs. Operational sophistication is key to manage overall costs and expenditures and can go a long way to save up much needed cash for mid-sized and smaller clubs.

Create a vision aligned to the time horizon of the fans and your own thesis:

Owners need to define a clear vision for the club alongside their fans which is aligned to their own investment thesis. Football clubs do not need short term fixes and are rather long-term investments that take years to create value for all parties involved. A modern day fan desires instant results and therefore a plan that gets everyone on board is critical.

Formulate an optimal capital allocation strategy for your goals:

A top down capital allocation with a plan not for the next transfer window or financial year, but several down the line. Focus on not just getting the most commercially valuable players, but the ones that can add the value to the squad to get the desired footballing results. Then, a proper plan in place for off the pitch investments including club infrastructure, youth/talent academies, technology/R&D which can lower future capital expenditures and squad costs.

Make your fans an integral part of the governance structure:

Getting the fans involved in key club decisions is necessary as a highly engaged fan can not only lift the performance on the pitch but is also more commercially valuable. New governance models where the fans (or registered fan clubs) can have their say could be an interesting way for owners to stay accountable and stay on track on the long-term plan, and also keep the fans happy.

Football is rapidly changing and so is the business of it. As new owners and ownership models take helm at the centre stage, the need for operational excellence at football clubs is getting even stronger.

After two decades of unstoppable growth, Financial Sustainability, Integrity and Fan Engagement are the three pillars around which we are likely to see this space developing over the next decades.

After all, the beautiful game must stay beautiful.

Until next time,

The Atomic Investor

Excellent article. These Atomic posts on Football x Finance have become by go-to source on the topic.

true for every sport now when it comes to leagues. be it tennis or cricket!!