The end of the tunnel

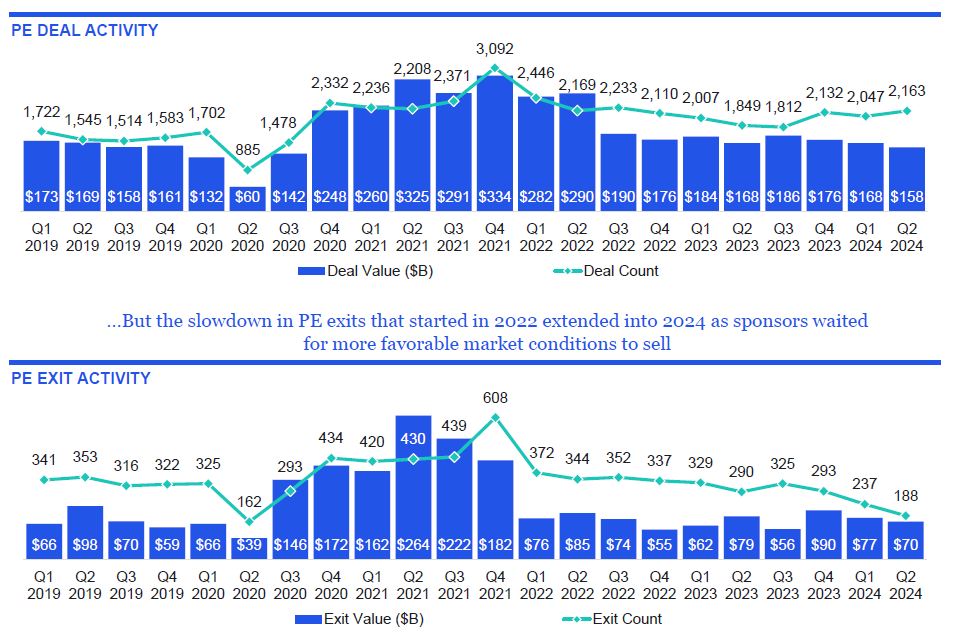

Private Equity has had a tough 24 months or so with the macro backdrop taking away some key growth levers. Things seem to be picking up but some unresolved issues remain.

Private Equity has gone through a painful couple of years. The prevailing interest rate environment where financing costs were highest since the early 2000s took away many tailwinds that benefitted the industry.

Deal leverage had to come down significantly with a big disconnect between buyers who wanted to buy low and sellers who were used to selling high (or had bought high and wanted to sell higher). Multiple expansion turned into multiple compression. A challenging macro environment meant both investments and exits almost came down to a halt, breaking the PE flywheel in its tracks. Some might even call it a necessary evil needed to eke out the excesses the industry got accustomed to in the ZIRP era.

The mega-cap PE managers recently reported their Q2 earnings which is always a useful pulse-check of the industry. Roughly 2.5 years into the correction, things have started to look a wee bit better.

And I would say by virtue and I said it last quarter, sort of my briefcase indicator continues to be getting full and indicates that there should be increasing solid levels of transaction activity. - Jon Gray of Blackstone during Q2 24 earnings call

The macro backdrop is much more benign than it was a even six months ago. Interest rates are on the way down. Dealmaking looks like it is finally bottoming, albeit with a different (and hopefully better) playbook. Some optimism seems to be creeping back in.

This is no roaring recovery, it is a slow and steady grind to the end of a long tunnel.

The chart makes it pretty clear where the problem still lies though.

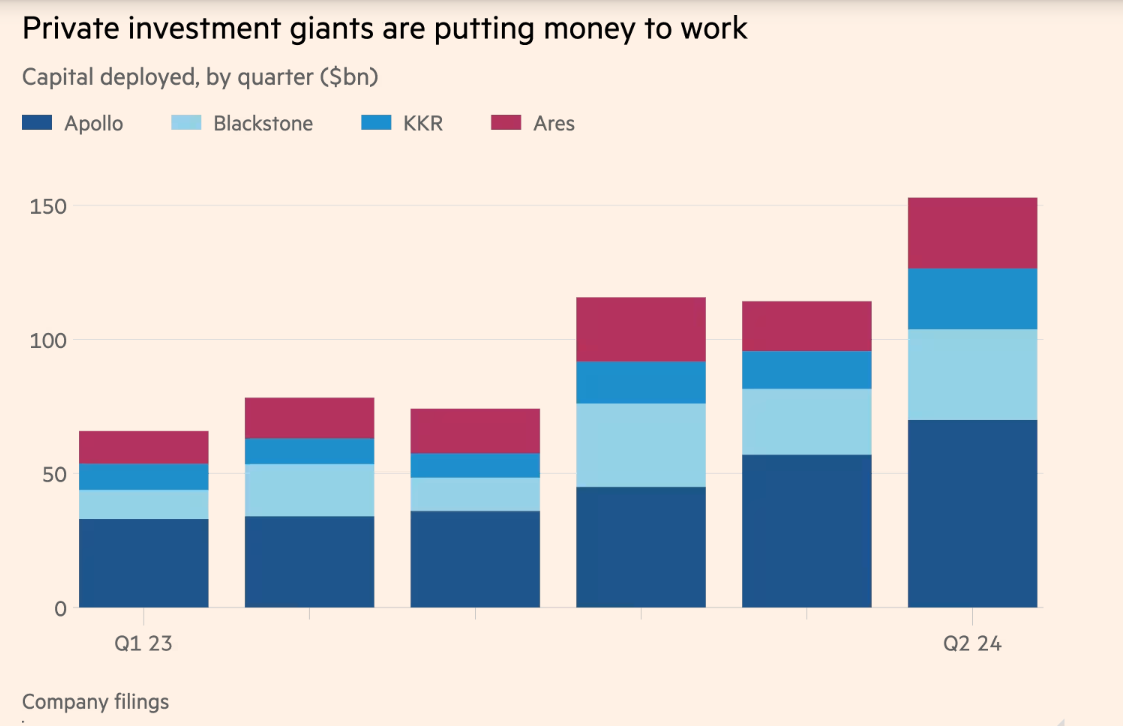

Deployments are picking up the slack

It was a great quarter for deployments and putting that perennially dry powder to use. The top 5 managers alone deployed more than $180bn across all strategies/asset classes, with private credit continuing to take a major share in literally everything from deployments, to fundraising and returns.

As a result of our convictions, we decided to adopt a more aggressive approach to new investments. I'm pleased to report that in the second quarter, we deployed $34 billion, the highest level in 2 years, and nearly $90 billion in the last 3 quarters since the 10-year treasury yield peaked - Blackstone Q2 24 earnings

Turning to capital invested. We deployed $23 billion of capital in Q2. For the first half of 2024, we have now deployed $37 billion, which is almost double the first half of 2023. Real estate, in particular, had a strong deployment quarter across equity and credit. - KKR Q2 24 earnings

Private Equity deployment was strong although still lower on a TTM basis, while Private Credit grew 37% YoY, led by both organic originations and via credit GPs acquired over the last few years

Another major area of growth for Brookfield has been our credit business, which has grown to over $300 billion of assets. The growth of our credit business has been the biggest driver in our revenue growth over the past 12 months, with second quarter credit revenues up 19%. - Brookfield Asset Management Q2 24 earnings

Mega-cap PE has always been quick to adapt to market conditions. They are now leaning into the hottest sectors like AI. GPs are deploying across the capital stack and strategies to make the most of these opportunities - from lending billions to AI Cloud providers like Coreweave, building AI datacenters with their portcos, or even signing renewable PPAs with large hyperscalers for their datacenters.

If we think about our data center investment activity,…it's been one of the core investment themes for several years.…And that's not just in datacenter, it's also in power generation, transmission, renewables, technology, and then also Capital Markets plays a piece in this as well, as you heard from the CyrusOne example….we have 4 independent data infrastructure platforms, 1 in the U.S., 1 in Europe, 2 in Asia Pacific. - KKR Q2 24 earnings

Our portfolio today consists of $55 billion of data centers, including facilities under construction, along with over $70 billion in prospective pipeline development…Through QTS and our other holdings, we have a robust ongoing dialogue with the world's largest data center customers. We're also providing equity and debt capital to other AI-related companies. - BX Q2 24 earnings

Our Microsoft agreement is a good example of our value to customers. This groundbreaking agreement is almost 8 times larger than the largest single corporate PPA ever signed. Being at the intersection of AI growth and renewable energy development, positions Brookfield uniquely to capitalize on these trends. We can provide our clients with scalable, integrated solutions that meet their needs, both for advanced data centers and sustainable energy sources. - BAM Q2 24 earnings

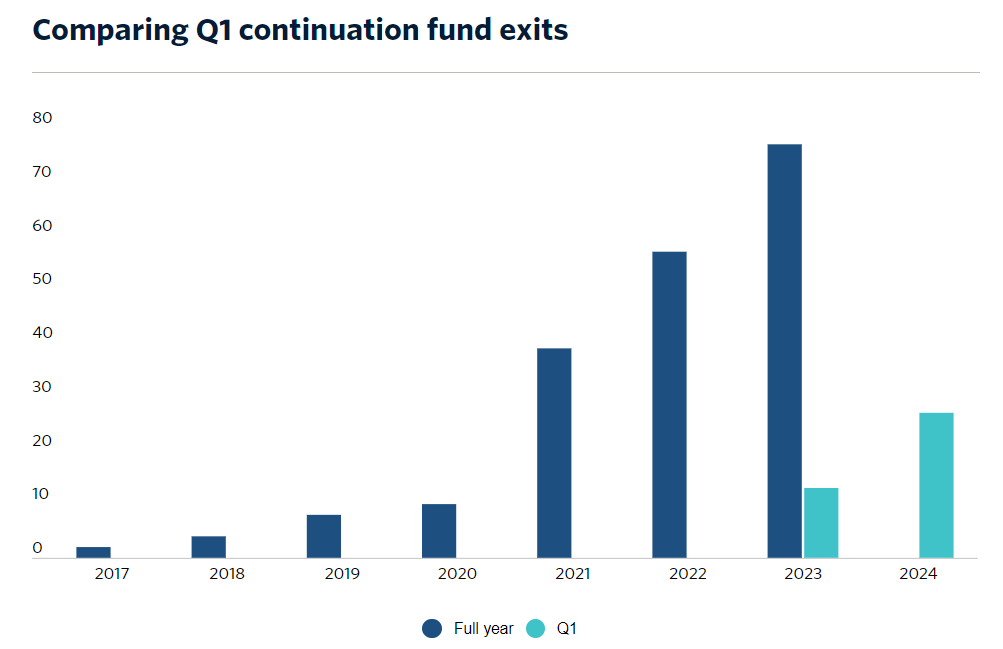

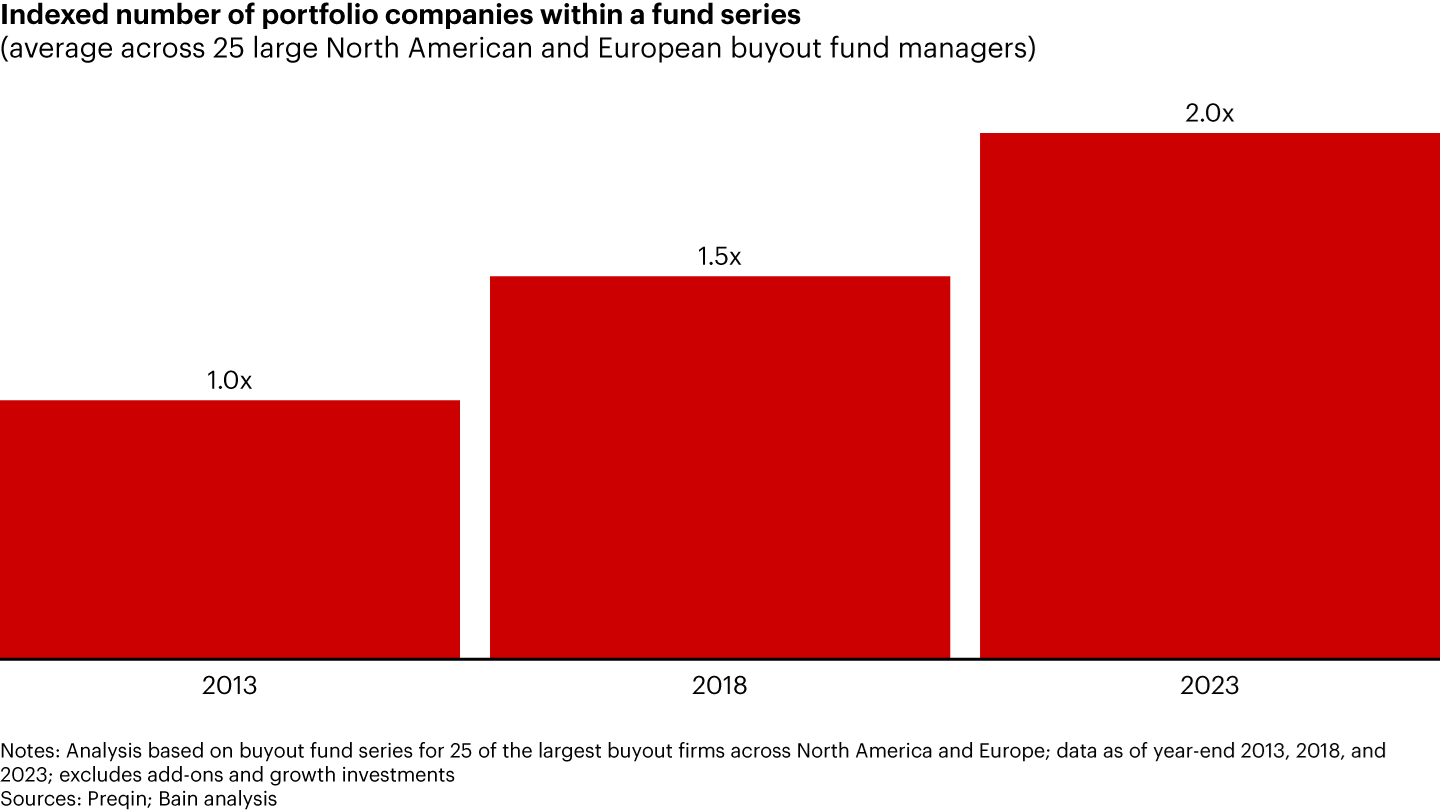

Exits are still far from their very best

PE owned assets are ageing as hold times continue to creep up. While deployments now seem to be picking up, exits are still flat (at a deal count level, but with some growth at deal value level).

This has created an imbalance of sorts where PEs keep raising (and now increasingly deploying) on one hand with long held assets on the other, not converting the paper wealth into actual returns for their LPs.

Partial exits via continuation funds have picked up pace, where PEs move the asset to a new fund using the new LPs’ cash to pay out the investors in the previous fund (some would even say it is very Madoff-esque..).

Secondaries is another area that has gone through the roof as both LPs and GPs sell stakes in funds to monetize the NAVs and get some much needed liquidity.

And so that's why secondary's business continues to grow. And our business, which we started with 10 years ago at $10 billion has grown eightfold, and so there's a need for liquidity. And even today, if you look at the volume of secondaries at trade, it's 1% to 2% of the underlying NAV in funds, which is very low for most asset classes in terms of liquidity. - BX on their secondaries business

Mega-cap managers are however optimistic of realizations picking up, and now that the Fed has finally signalled a rate cut, the exit logjam might finally start to clear as M&A and IPOs slowly open up again for business. But it still might not be an “opening up the floodgates moment”.

The main message we shared with our investors is that we are seeing significantly greater market activity since the beginning of the year. The macro inflation and rates backdrop has improved, markets are open, and the deal market is back. To give you a sense, globally, year-to-date, leveraged credit issuance is up over 100%, IPOs are up nearly 50%, and announced M&A is up approximately 25%. - KKR Q2 24 earnings

The way we would describe the current environment, with rates stabilizing even now declining and liquidity improving, is we're just seeing that bid-ask close and that's going to lead to more transaction activity. We certainly wouldn't suggest at this point that we're seeing overly aggressive or irrational bidding behavior. - BAM Q2 24 earnings

But mega-cap PE continues to grow

After a muted or no growth in distributable earnings last year (fee related earnings plus net realizations, a proxy for cash flow), the key PE metric is expected to return to growth in 2024.

Credit focused managers like Apollo and Ares, already having a stellar 2023, are expected to continue growing.

Other avenues like Secondaries has been a highlight for the industry, which does well in environments like these. Only 1-2% of global PE NAV is traded in secondaries, and GPs expect it to increase to 3-4% unlocking billions in secondaries opportunities. Secondaries or private solutions focused managers like StepStone or Hamilton Lane are expected to grow quite handsomely.

Private Wealth channel is still allocating to Alternatives as mega-cap PE launches more dedicated semi-liquid products and expands distribution channels and networks.

Our commitment to the $85 trillion private wealth market is stronger than ever. Multiple other areas of the firm are showing strong momentum today. - BX Q2 24 earnings

Retail PE products are still largely untapped, but there are some movements on that front. KKR for example has partnered with Capital group to launch a series of hybrid (public and private) products for the mass market beyond the accredited investor base.

The industry has come through a full market cycle in less than 4 years - of zero rates to inflation led rate hikes and peak interest rate in decades, to now the beginning of a rate cutting cycle. LP allocations have little room to expand beyond where they are, but other areas in Credit, Infra and mass market PE/private wealth might continue to unlock opportunities further.

Q3 should make it clearer whether they had finally reached the end of the tunnel.

Until next time,

The Atomic Investor