The new growth engine

Does every company have a hidden ad business inside of it? Operators and investors are increasingly realising the potential of this new avenue of profitable growth.

A while ago I was served a message on Amazon Prime Video asking me to accept their cookie collection and data privacy terms, which made me suspect if they were about to do what I thought they were about to do.

Then a couple weeks ago my suspicions were confirmed. Prime Video would start serving me ads during movies and shows, with an add-on subscription for an ad-free experience.

This made me wonder about how we have come a long way from just a few years ago when TV was being unbundled into a low cost SVoD (Streaming Video on Demand) product, with a lure and promise of an ad free experience for content on-demand. But that was in the era of cheap capital I thought, where billions of dollars worth of content was being subsidised to focus on subscriber growth and getting to scale. In Its not tech anymore, its TV , I wrote about the unbundling to rebundling reversion as SVoD was just beginning to embrace the Ads model after years of vehemently denying the need for it.

That was almost like a test case of this new (but still very familiar) growth engine for all kinds of companies, the potential of which is still underappreciated till today even after delivering profitable growth for many a firms like Netflix, Amazon, Uber, Walmart and others. Even J.P Morgan has an ads business now. (Yes that J.P Morgan!).

Today operators and investors are increasingly becoming more accustomed to the idea of using this growth lever as certain changes in the market structure have opened up a new avenue for profitable growth.

First, lets take a step back to how we got here…

Monetization of our attention is one of the oldest business models out there. This market was dominated by newspapers and print media, radio, and cable television in the pre-internet era where companies were offered a space to publish ads (ad inventory) and a platform to reach potential customers. Market and consumer research firms (the Nielsen’s of the world) would help advertisers find the target customer and measure the effectiveness of their ad spend (attribution).

But it was like casting a wide net hoping to catch the right kind of fish. I would see car ads on TVs or magazines even if I was not interested in one, but someone else reading the magazine might be looking for something similar. Plus the car company wouldn’t be able to measure the return on this ad spend with much precision.

In the post internet digital advertising world, online platforms could now aggregate demand and expand the potential reach for an advertiser. Imagine millions of Google Search or Instagram users in a city as opposed to a few thousand newspaper or magazine copies in circulation. They could also collect user data and build a profile of their interests and desires, and then track their clicks and online behaviour to further enrich that data.

For ad buyers, this was great as they could show their ads to a more relevant set of target customers. If I searched for car auto dealerships near me, then went onto to check a specific model and make on a car website, I am likely to be interested in cars or I am looking at buying one. They could also measure how many impressions their ad had made, how many potential customers had clicked on it, and then bought their product. The full circle.

As our eyeballs shifted to online platforms from traditional media, the digital ads market exploded and overtook traditional ads by 2018, reaching more than $350bn in online ad spend in 2019 (double of that in 2015).

First came Google in the early 2000’s dominating Search, capturing more than 70% of that market. Then came an upstart Facebook gaining share of attention in the social media and mobile world of early 2010’s, and together with Instagram took over the display ads market.

For platforms, user experience is paramount to show the user what they are really looking for or what is interesting for them to keep them powered on. The more engaged they are, the higher the ad “impressions” and higher the likelihood of them clicking it. For the other side of the transaction, the platforms need to be better at targeting the right customers with the right ads to provide the maximum value to their ad buyers.

Thus the importance of user data continued to increase over the years. Both data from time spent on own platforms (first party data) and from time spent on other sites and apps (third party) became increasingly valuable, especially the latter which would help ad platforms make the targeting models more deterministic. The user is a person who likes dogs, a result of a combination of first party and a variety of third party data points. A big difference from the user is likely to be someone who likes dogs - a probabilistic model.

Google and Meta were able to control most of this market with their ability to have multiple properties (websites, apps etc.) with a growing user base and increasing time spent on them (share of eyeballs), combined with integrating first and third party data across platforms and apps to have the best in class targeting. Remember that instance when you were discussing a trip with your friend and you start seeing ads from Booking.com right after?

The ATT drama

In 2021, Apple played a masterstroke when it introduced ATT (App Tracking Transparency) in the name of user privacy, which was essentially a way to kneecap its biggest rivals in tech and shift demand towards its own newly launched iOS ad inventory.

With ATT, iOS users could now opt out of personalized ads on their devices. Then apps on iOS devices had to prompt users to “opt-in” again separately to allow tracking of user data (interests, demographics, in-app behaviour).

This critical third party in-app data was used by ad platforms for attribution, personalization and better targeting before. The supply of it was now basically cut off on one of the largest install bases in the world (2.2 billion devices according to some reports).

Advertisers could not just rely on Meta and Google anymore as they saw their ad performance declining. Targeting models suddenly became probabilistic, which meant more R&D investments from the platforms to improve their predictive algorithms (more on it in Its an imperative not an option).

First party data increasingly gained prominence as a result, as advertisers started to move towards other mediums such as email, gaming consoles, connected TV, streaming, and other two sides platforms. This redistribution of ad budgets has shifted the market structure by giving first party data owners an added advantage.

But data is not the “new oil” as it is repeatedly mentioned. It is the “sand” and you need to aggregate it in millions in a meaningful way to get any value out of it. Some companies have realised this and have started to build their own ads businesses to achieve different types of goals.

It’s understandable that any company with sufficient size and scale of data would want to build an ad network. Ad networks are highly profitable, generally running on very thick gross margins and mostly monetizing content and product surface area that already exists. So as the norms for data collection and aggregation change, favoring first-party contexts, the companies that can package together their first-party customer data to attract advertising revenue will do just that. - Eric Seufert, Mobile Tech analyst

Amazon: Capitalizing on the power of The Everything Store

Amazon, the modern day everything store is now one of the highest traffic websites in the world. A proper two sided marketplace connecting buyers with sellers with hundreds of thousands of SKUs across every category. And it has very relevant first party data. You search for what you really want or are looking for. You click on recommended products that might be interesting for you building a nice profile of what your interests are like.

Just as Google offers paid placement for web pages and links, Amazon started offering ad inventory and paid placement using this first party data to sellers who want to place their products on top when you search for something, and target relevant users with their product pages.

Amazon ads started attracting billions of dollars in ad revenue as “retail media” gained traction, and is are now bigger than the entire newspaper ads combined.

A $50bn business with AWS like margins (as opposed to low single digit retail margins) - something that is not usually discussed when talking about the company. A perfect example of monetizing first party data at scale for higher profitability and growth in cash flows.

As annoying it is for a user to now pay for ad-free viewing, it makes total sense for them to repeat this with Prime Video with more than 150mn users and over 100mn Fire TV devices (on top of Twitch, the game streaming site with 35mn users).

Netflix: Reaccelerating growth

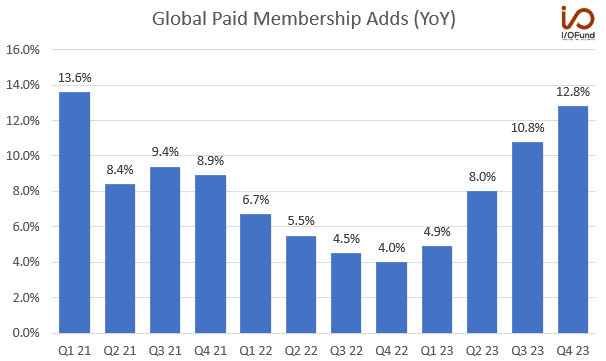

Netflix was firmly in the no ads camp for very long until its user growth started stalling in key markets. Then it finally launched a cheaper ad-supported plan in 2022 to gain back its user growth, also allowing it to expand into new markets and customers (at this lower price point).

"Our ads membership grew 65% quarter on quarter (after rising nearly 70% sequentially in each of Q3’23 and Q4’23) with over 40% of all signups in our ads markets coming from our ads plan” - Netflix 2024 Q1 earnings

Netflix will now stop reporting subscribers numbers (the key metric the market tracks), and will start reporting user engagement instead. Goes to show it is not only important how many users you have, but in the attention economy it is key to measure how engaged they are.

Uber: The path to profitability

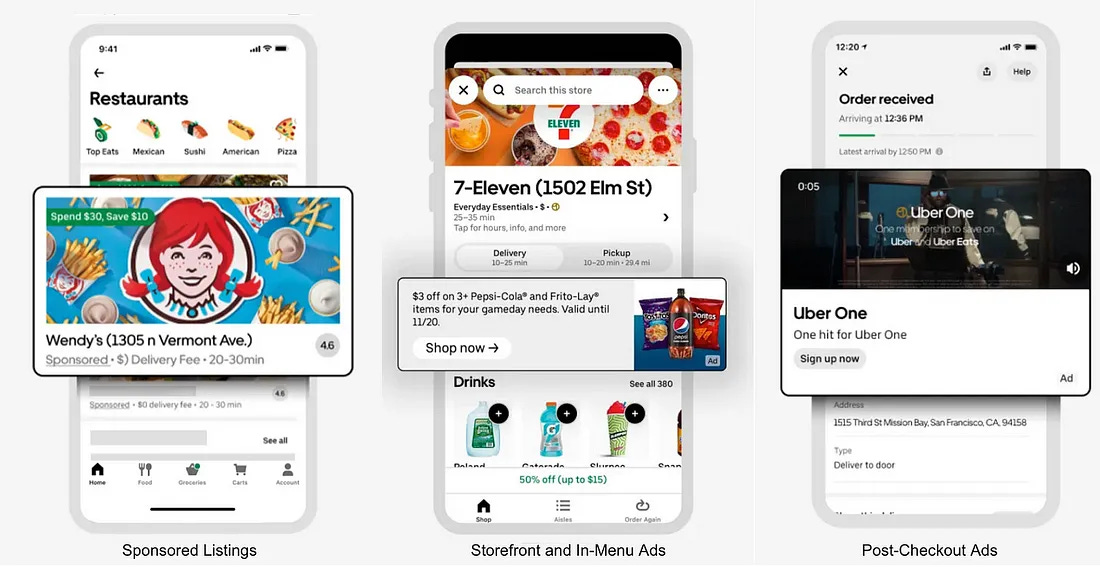

Uber, the ride sharing leader started offering ads on its app properties (sponsored listings, in menu ads, journey video ads, cartop ads) to small and large enterprises in 2019. Ad revenues have grown from $140mn in 2021 to $650mn in 2023 with expected ad revenue of $1bn in 2024.

The high margin ads business (already ~15% of annual cash flow) contributed meaningfully towards it finally delivering operating profits and free cash flows after years of struggling to get there.

“On average, it’s about two minutes that the consumer has the app open. So, it’s 100% share of voice in those two minutes, which is so much more than an advertiser sees on a social platform. And therefore, the engagement rates are super high, north of 3%. So, it’s really powerful – especially based on the data that we have about the consumers and how we can combine Rider and Eats data to really make ads relevant.” - Uber Advertising GM

Every company has a hidden ads business now?

Other large brands like Walmart (with $3.4bn in ad revenues) and ABInBev are using first party data across their brands and platforms to offer customer preferences and consumption behaviour data to their advertisers.

JP Morgan, with the first party spending data it has on its 80mn customers is now building an ads business to offer ad inventory on its banking apps and websites.

So every company with some share of eyeballs and valuable first party data has a hidden ads business now? Most of them think it is the case and we’re increasingly seeing more success stories of this growth avenue.

A strategic move by one large player and the increasing relevance of first party data shifted playing field from a two player dominance, and has reduced barriers to entry into the ads market. AI tools are reducing them even further by making ad targeting more effective, autogenerating ad campaigns and improving attribution models.

Companies are starting to realise the potential of the new growth engine. Investors should not sleep on it either with opportunities around harnessing first party data lurking around the corner.

Until next time,

The Atomic Investor

Its quite annoying to see ads pop up after every episode now!!

Your blogs r eagerly awaited @ atomic investor# storehouse of ideas ✌️