The other side of the coin

In this hyperconnected society where every debate gets polarised, we forget about the other side of the coin and that there can be a lot of grey in this world.

It amazes me to see the strides we’ve made in enabling ideas and opinions to propagate through society. They travel at lightning speed via clicks, blogs, tweets, reels, tiktoks and podcasts which allows us to get exposed to thousands of them every day, absorb what resonates with us and be a part of the ongoing debate.

But it also worries me that they come at us thick and fast, and our minds pick the path of least resistance to make sense of it all. We side with opinions and facts that support our existing beliefs. We follow and support personalities whose stories and thoughts we like, and mute and block whose opinions go against what we believe in.

Our beliefs are a means to identifying with our own self, and anything that goes against our beliefs is going against who we are. As a result, our minds very naturally predispose us to resist opposing beliefs, and we fail to realise that there could be two sides to an argument, coexisting with one another.

In this hyperconnected society where every debate gets polarised, presenting things in black and white, we forget about the other side of the coin and that there can be a lot of grey in this world.

Here are a few instances where I’ve noticed the other side of the coin being ignored or not talked about enough.

The low interest rate environment and loose monetary policy argument

We saw global central banks hiking interest rates at the fastest pace ever in this cycle to get inflation under control, thus putting an end to the cheap/free money environment that prevailed over the last decade.

Today, we see the investment community arguing that this atrocity of low rates should have ended earlier as it pushed asset prices up for too long and was only beneficial for an asset owner, doing little for the rest. They also argue that it enabled excessive risk-taking by both individuals and institutions, inflating and creating asset price bubbles across the investment universe. Never again, they say.

The argument did have substance as we now can see. With the power of hindsight, we have instances of all of the above and can corroborate it with examples of the excesses and overvalued asset prices, the tech/crypto bubble, over-leveraged businesses, risk-taking in speculative assets et all.

But…

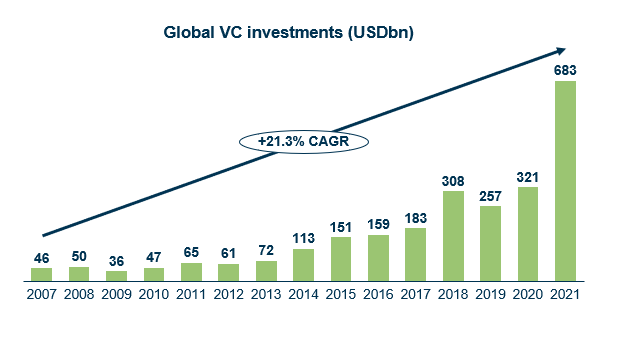

This secular decline in interest rates and a low inflation low growth environment pushed the marginal investor (and their dollars) further along the risk curve, increasingly towards young and high-growth tech businesses, worrying less about cash flows being far off into the future.

The substantial decline in the cost of capital for young businesses trying to disrupt legacy models allowed them to fund their ideas for a long enough period of time, helping them build applications and platforms that are now indispensable for both consumers and businesses.

Think about the apps and products we use today under the Social media, Streaming, Transport, Delivery, Payments, Cloud categories. Almost all of them were developed or gained traction during the low-interest rate and easy money period of the last decade.

The era of abundance changed consumer behaviour in ways where there is no going back. It lowered the cost of innovation substantially making convenience a commodity, something we do not even pay much attention to anymore.

For shareholders and investors, a swath of wealth was created and destroyed during the cycle (as always) but the other side of the easy money coin is not given enough credit today for bringing about a step change in technological progress and innovation.

The inflation debate

Inflation and the rising cost of living have been in the spotlight for almost a year now. The energy crisis made things worse as food and fuel prices both went up considerably. As demand shifted from goods to services after the reopening of the economy, a tight labour market made sure that wages went up too. A stronger demand and a tighter labour and goods supply was a double whammy for price inflation, and the combination of wage-price increases spooked central banks enough. Now, they’re scrambling to tame it before it gets out of control.

The market wants them to do whatever it takes to get us back to long-term inflation targets. The ills and perils of inflationary pressures are being discussed everywhere, from businesses (in the form of rising costs and slowing demand) to institutions (to not being able to get it under control and push the economy into recession), the consumer (rising costs burning a gaping hole in their budgets, the cost of living crisis) and investors (rising interest rates and monetary tightening leading to lower asset prices). The arguments have substance as accelerating and persistent inflation leads to destruction in both wealth and economic growth.

But…

Due to the structural changes in the labour market and a shortage of workers, nominal earnings for the lowest-income workers grew fastest in decades from 2021 until the first half of 2022. More importantly, the lowest-income earners saw the fastest real wage growth in almost four decades.

For the first time in decades, wage inequality is falling. Real wages are rising among young, low-skilled workers and workers at the bottom of the wage distribution.

Princeton University research on wage growth post Covid-19

Although inflation was not the trigger for this wage growth (it was competition for workers in the strong reopening economy and overall labour market tightness), it has surely been a driver for it and allowed it to persist for longer than it would have without it. The gap still remains between average wage growth between low and high-income earners, but the inflationary period has helped tip the balance on the side of the worker, even if albeit slightly.

If a controlled inflation helps reduce wage growth inequality and in turn does a world of good for the workers at the bottom rungs of the income ladder, it might not be as bad after all. The side of the inflation coin that no one talks about enough.

The bear-market

2022 has been one of the worst years for the markets…ever. It experienced massive drawdowns across asset classes and sectors within them.

It was the third worst year for a 60/40 (Equities/bonds) portfolio.

We moved from a bull market on fumes to a bear market with a tough economic environment and uncertainties galore. More than $30 trillion of paper wealth was destroyed during the year. Quite naturally, investors are fuming. The economy is heading into a recession, they say. They’re blaming it on the central banks for doing too little too late.

Things are not any better in the private markets either. Late-stage VC funding is bone dry. The IPO market is literally shut. Startups that got used to cash gushing in every year or so are having a hard time to pull through and work their way to this new ‘path to profitability’. For PEs, a lack of cheap financing options has stopped the LBO train in its tracks. It's gotten much harder to buy at high multiples and sell at higher.

But…

For public market investors, the recent drawdowns in both stocks and bonds have pushed up expected returns considerably. Falling valuations and prices now allow them to buy stocks at much cheaper prices, enhancing their long-term returns.

The new environment, though it sounds counterintuitive, is a godsend for investors who are just starting off on their investing journey and are in the early innings of building their wealth. If you have a 10-year horizon, you are now getting 4%+ for almost zero risk (via U.S treasuries), with highly rated corporate bonds yielding close to 6% in some cases. In other developed markets, you can finally earn a risk-free return greater than 2% in more than a decade.

For the private market and young businesses, the turning of the cycle is finally pushing them to get back to creating real value for customers and investors. They have to get back to building products that make economic and commercial sense. The last decade was too easy as funding and financing came easy, and growth was thought to have a long runway. Ample exit opportunities for everyone involved allowed short-terminism to creep in.

The environment anchored founder and investor behaviour to growth without much consideration as to whether it creates or destroys long-term value. Investors and founders got complacent as we went from one hype cycle to the next one.

Now they are forced to go back to the drawing board and rethink their business models and investment strategies to adapt to a more “normal” business and funding environment. The private markets are facing significant short-term volatility but it might go a long way to better long-term prospects taking out the excesses and complacency that built up in the system over the last decade.

If there was a bright side to the current bear-market in both public and private markets, this would be the one for me. The other side of this coin has very low visibility out there.

The ability to side with or hold two different arguments on opposing sides of the aisle is not easy, as one of those is likely to go against what we believe in or more importantly, what we want to believe in.

But the other side of the coin, the side which is usually overlooked, can not only inform us of our behavioral biases and help us learn a lot more, but it could also aid better decision making and help us reach more logical conclusions in business, investing, personal finance and life.

Before we jump towards consensus and popular opinion, we might as well spend a tad bit longer to consider heeding the other side.

Until next time,

The Atomic Investor