The Robinhoods of Europe

Retail investing in Europe is just getting started. And There is a successful playbook out there to be emulate.

“What is the S&P 500?” That’s the name of one of the most visited pages of the now infamous U.S technology broker Robinhood.

The app that disrupted the investing and trading ecosystem in the U.S, has made quite a few headlines over recent weeks. From getting embroiled in the GameStop saga to facing public and government backlash over its comments and activities, its fair to say it has had a tough time. But 2020 was still a stellar year for the company as trading volumes surged on the back of our speculating frenzy whilst bored and stuck in our homes.

These trends captivated the young investor cohort in other countries too. A trading platform in India reported that 15% of all trades on a particular day were in $GME. While Robinhood shelved its plan to expand outside the U.S and enter UK and Europe in 2020, the Robinhoods of Europe witnessed similar growth in both users and volumes. Here’s a brief on a few of these upstarts.

Trade republic: Setup in 2015 in Germany, the app boasts 600k users with flat fee, mobile first trading plans. It also offers savings plans with no negative rates. The company expanded to Austria and France recently, which have primarily been dominated by banks and traditional brokerage firms.

Scalable capital: This is more like a robo-adviser, taking over portfolio management and allocation for investors. It has garnered over USD2bn in assets and it also operates in Germany, Austria and the UK. The company offers a subscription like service – EUR3/month to manage investments and had around 80,000 customers including a B2B offering for banks who want to sell a robo-adviser service to their customers.

Free Trade UK: The UK based app has amassed 400k customers and saw rapid growth in 2020 like the rest of its peers. It offers commission free trading, including a freemium pricing model, charging a monthly subscription for SIPP and ISA plans. The company also offers fractional shares (very popular in the U.S) and has built their own technology (brokerage service for order execution). Their 10GBP/month includes everything and savings products.

Bux: This one in the Netherlands calls itself the largest neo-broker in Europe. It gained 400k users last year which now totals 2.6million, not a tiny number by any means. It has a zero-commission product that bundles orders together for best execution price with end of day order completion. For instant execution (market orders) it charges a flat fee of one euro. It has expanded to 9 countries in Europe and also has a social-app element to it – it allows users to connect with fellow traders along with demo accounts for digital currency to get new investors started without any real investments.

Nextmarkets: Another neo-broker from Germany that has established a presence in 9 European countries. It reported 1.2mn trades in 2020 and also offers commission free trading along with educational content for young investors, recommendations based on preferred investing principles. It charges them for wealth management products and leveraged products.

At a first glance, the European tech driven investing landscape looks like its dwarfed by Robinhood. But you’ll notice these apps in Europe lie somewhere in the middle of the spectrum between traditional brokers and banks (commission based, legacy platforms) and gamified investing and trading apps like Robinhood. They’ve tried to differentiate themselves from both Robinhood and each other by adding educational content, converging their platforms with social networks and advocating safer investments and savings plans with some interesting pricing models.

I see the common European market both as a challenge (different cultures, adoption rates, awareness) and an opportunity (underpenetrated tech markets, common laws and regulation) but these Robinhoods might be swimming against the tide here. Here’s why.

First, the Payment-for-order-flow issue is still contentious and is treated differently in different countries. The german regulator allows brokers to accept payments from market makers whereas this practice is not allowed in the UK. If push comes to the shove, unanimous ban on payment for order flow could put a chunk of their business into trouble.

Then, the problem of getting people to invest in the stock markets. Take Germany for example, the biggest economy in Europe. According to Christian Bortenlänger, Managing Director of Deutsches Aktieninstitut, the number of stock savers in Germany skyrocketed by 2.7 million last year. That brings the total to 12.4 million, which is 17.5% of the population aged 14 and over. But the number is still a far cry from other developed nations like the U.S where 55% of the population has invested atleast once. The UK has a much higher percentage at 33% of the population too. While 2020 was a breakthrough year for a lot of these apps, whether this would be looked back upon as an inflection point is hard to foresee.

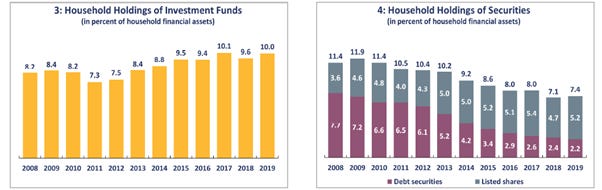

The Household Capital Markets Report by EFAMA published last year mentions the fact that a majority of European households do not participate in the markets at all still holds true. Most people in the 25 EU countries were found to be risk-averse and prefer saving via bank deposits and insurance products and annuities. With interest rates where they are in Europe, god save those souls and their savings!

The EU average has not improved much since the twin crises in 2008 and 2011 and in fact worsened for security holdings.

While tax benefits for pension and insurance products might explain some preference of these products, the demographic challenge, which the Financial Times called ‘a ticking time bomb’ is the big white elephant that no one talks about. That might also explain that level of exposure to pension funds across the region.

Europe witnessed record low fertility rates in 2020, with countries like France, Germany, Spain and Italy experiencing a sharp drop in their birth rates. While Europe has had lower fertility rates than the rest of the world for some time now, the pandemic accelerated this trend too, like many others.

Lower birth rates now means lower working age population in the future, which in turn means lower economic output and savings. And this feeds back into the ‘getting people to invest’ problem as the TAM shrinks decade after decade. Add the additional pension burdens to the pile of problems and you get an insurmountable challenge right there if you are a neo-broker/investing platform.

Technology has proven to be a great beneficiary for retail investors, helping them in product discovery and allowing first-time investors to get easy and affordable access to the markets. The growth runway for the European apps has got some miles left still as they expand across the region. Financial education could be the way they attract not just the young but people from middle-aged and the retired age group while regulation irons out some of the contentious deficiencies in the system.

Evens stevens for challenges and opportunities, for now.

Happy investing,

The Atomic Investor