The year of narrative violations

Narratives are a strong force in the markets…but some of them got violated this year.

The new year starting off on a weekend is a perfect chance for those Year-in reviews about the markets, and other stuff. I’m sure you’re already seeing a bunch of those from the 28 newsletters and blogs you follow, so I’ll try to keep it short and interesting.

If it feels like a lot happened this year in the markets, it did. The newsflow was strong, with inflation making the headlines numerous times. Some 2020 themes continued well into this year, like supply chain disruptions, chip shortages, China and of course our dear friend Covid-19 and its related disruptions.

Could it be the case that it felt like it was a highly eventful year in the markets because of the increasing time we are spending online? Jumping from Twitter to TikTok to Instagram, back to LinkedIn, then to Netflix, or Spotify or Youtube. Throw in a few more socials (Discord, Reddit, Snap, Twitch etc.) and we’re already drowning in a never ending stream of bits and bytes (more like gigas). Don't forget those op eds from all the 'experts', the glorified negative news, clickbaity pieces and a garnish of some useful and informational stuff. But this rabbit hole is a topic for another post maybe.

As I have said plenty of times here, a part of the markets (a considerable one) is driven by narratives and stories. One of the most interesting highlights of the year, in my opinion, was a number of Narrative Violations. They went against conventional wisdom and popular stories and beliefs that took over off in 2020, driving certain areas of the markets, and importantly, certain flows.

A violation in a long-held belief tests the best of the best, and forces them to reconsider their assumptions, get back to the drawing board and at times admit defeat. This by any means is not saying that the prevailing stories and narratives are false. Some of these secular trends are well underway and maybe 2021 is an outlier year. But interesting to see this happening nevertheless.

Here are some charts of these narrative violations using popular ETFs, the products you can actually invest in, all you Atomic Investors 😃

Markets are in a bubble! Valuations are stretched!

This narrative was screaming its lungs out in 2020. How can the markets be at all time highs when the global economy is in its worst recessions ever? Well, the S&P made 70, SEVENTY all time highs in 2021. The market doesn’t look like its in a bubble, even though some parts of it might have been.

Real estate is dead!

Covid killed real estate they said. The cities are dead, everyone is moving out to the suburbs. Okay, but house prices in all major markets are on fire. Rents are rising and all kinds of real estate sectors have recovered pretty well.

Bonds are trash! Rates are rising!

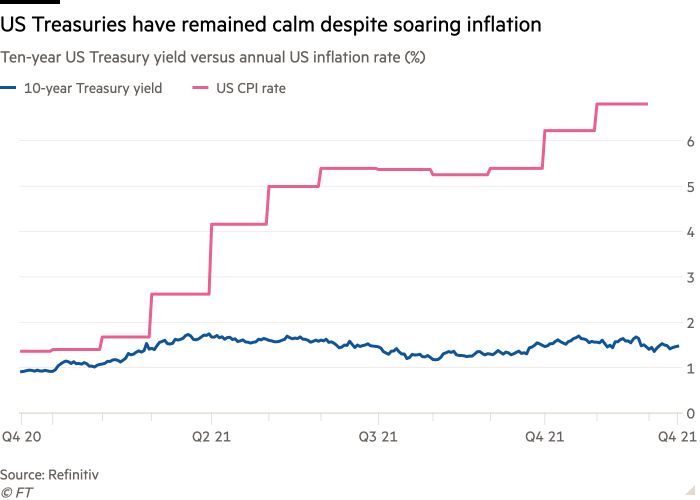

Its true fixed income is in a precarious situation. After the ultra low interest rates for the last two years, the economy is running hot and and a rising rate cycle is nigh. For bonds, this means an erosion in value (along with higher policy rates) as inflation moves higher. Bonds were down this year, still providing some cushion against the volatility. Inflation protected securities returned a decent 5+%. This was unarguably my favourite charts of the year.

Inflation is transitory!

This is officially a meme now. Inflation might normalise going into 2022 but it surely wasn’t as transitory as described. Commodities are up multi-fold, energy prices have sky-rocketed in many regions of the world, wages are on the way up (which is great), and inflation finally made a comeback.

Banks are old economy! FinTech is the new deal!

One of those secular trends that is well underway no doubt. Banks and financials have been in a downtrend for the better half of this decade. Fintech firms have raised gigantic sums in the private markets. Total value locked in DeFi is up by a LOT. Digital banking is the new deal. True. But here’s your chart for the year.

CLIMATE CHANGE! ESG! Sell your energy stocks!

We’re seeing a real shift towards environment friendly sources of energy. Increasing investments, activism and public policies are finally coming together for the better. True, that energy (like financials) has been the one of the worst performing sectors over the decade. But as crude and gas prices surged last year, the old energy stocks and ETFs had one of their best years in a long time. Quite the opposite for ESG labelled clean energy.

It should be noted that these market corrections in long-term trends are completely normal, and the supposed narrative violations could just last for one year.

But if you were putting your capital to use on the back of some these 2020 narratives, you were bound to be surprised. As the popular saying goes, in the markets you either can be rational or you can make money.

Make 2022 a good one in the markets and otherwise!

The Atomic Investor