Thinking about change

Thinking about long-term change is fraught with challenges. In business and investing, you are navigating change at every step along the way. Understanding it early in the cycle is therefore, key.

The human mind is brilliant at a lot of things. But it still has some common intellectual traps it tends to keep falling into. Some of them seem to revolve around thinking about long-term changes in a complex environment.

Take trying to forecast the impact of a disruptive technology on our economy or our lives, for example. A big change in the environment, in ‘evolution-speak’, forces economic agents (us) to adapt and find the best fitness function i.e the way we interact or perform certain activities impacted by these changes. The ones who can adapt better have higher chances of survival and winning, while the rest are left behind facing the downsides of being in an environment not ‘fit’ for them.

This forecasting exercise becomes a highly complex problem where a multitude of inter-related factors are at play. We’re not only dealing with the tangible, physical aspects of the change, but also with the changes in the existing social fabric induced by a big change and the subsequent interaction between the two of them.

Understanding what is likely to happen is hard. We try to create order from all the disorderly info we absorb to get us to a reasonably perfect answer. We might use a linear framework to understand the impact of the x variable (input) on the y variable (output). We could combine that with our heuristics, anecdotes, personal experience, history and other available evidence to form an opinion on the solution. Additionally, we might also try to find patterns in the similar sets of changes in the past to allow us to speculate how things might transpire in the future.

But big disruptive changes rarely follow a ruleset. There could be long phases of small incremental changes that go unnoticed, a string of negative surprises (things don’t go as they were supposed to) and then sudden step changes upwards. There might not be a fixed order of developments either. A lucky or an unlucky turn of events can reverse the course or slow down the pace of change (or even accelerate it).

In business and investing, you are navigating change at every step along the way. Understanding it and its potential impact early in the cycle is therefore, key.

Our deductive approach might still be helpful and work with decent success. But for a different perspective, a couple more frameworks or lenses might come in handy as alternative ways to understand big changes and how we might position ourselves to be fit for them.

The disruptive innovation lens - The Clayton Christensen model

The disruptive innovation theory was first developed by Clayton Christensen in 1995 (later updated multiple times), and has seen its acceptance and application in tech and finance grow ever since. Now, nearly every major and minor breakthrough is conflated with the concepts of being “disruptive” as in the original innovation theory.

The correct understanding and nuances of it is important as different types of disruptive changes require different approaches by investors and operators, and cannot be applied with a broad brush to everything.

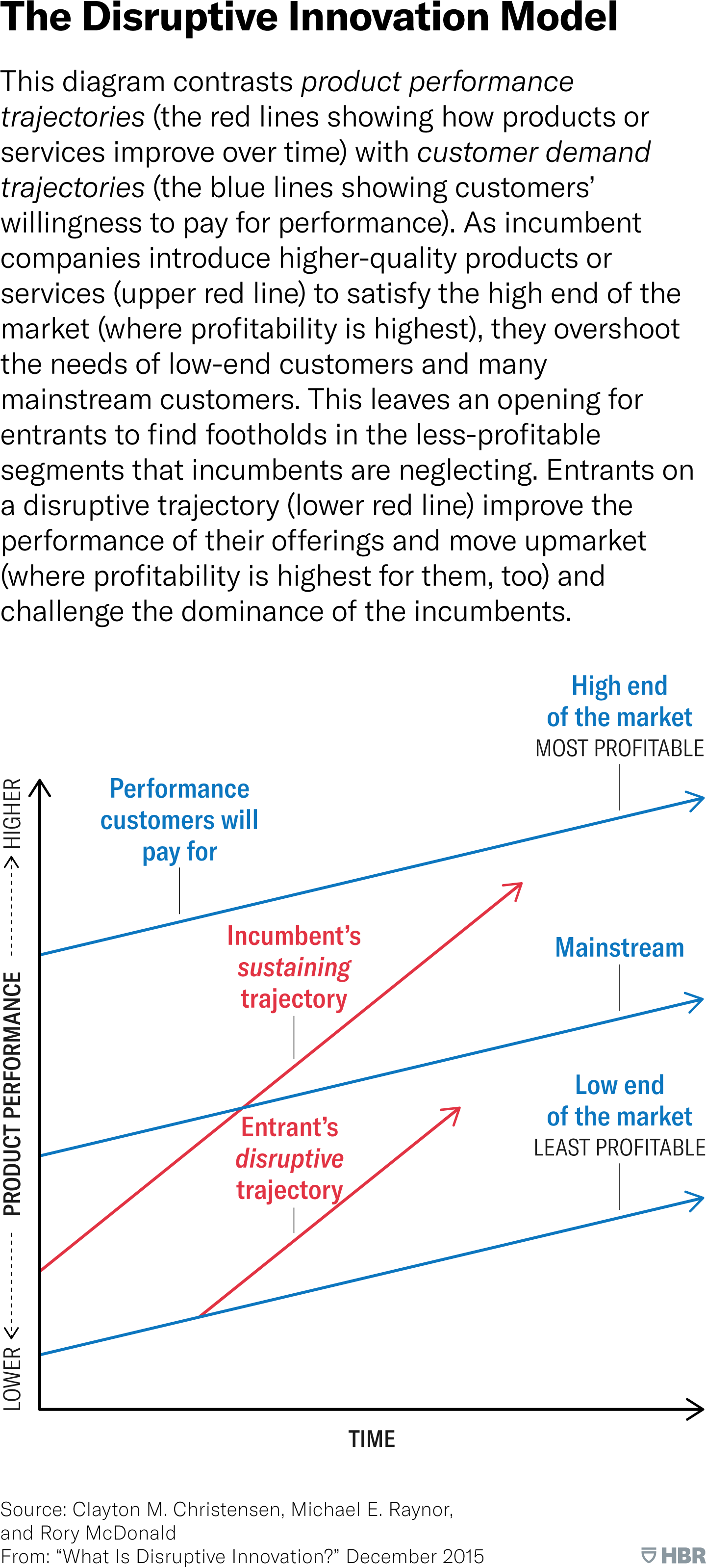

Disruptive innovation emerges from one of the two segments: unserved/underserved customers overlooked by incumbents or complete non-users. Disruptors will either start by capturing the low end of the market and move upwards where incumbents play, or create a new market for their product where none existed.

However, it is not just a point-in-time instance or a single product that is disruptive. It is the evolution of it through its development lifecycle.

Additionally, these innovations do not catch up with the mainstream consumers until they meet their quality standards and needs. Incumbents usually focus on sustaining what they have and add incremental improvements that make the current set of profitable customers happy.

Disruptors on the other hand focus on big ‘step changes’ and improve the product until is equal or better than the incumbent which is where they start gaining market share as consumers start switching.

Time to give this lens a test run.

The entire investor community today is trying to pick winners and losers in the disruptive change introduced by AI. Although it has been painted by a broad ‘disruptive technology’ brush already, AI and machine learning models have been around for decades.

If you go back in the AI timeline, you would notice sustaining, incremental improvements in models over years bringing in more precision, speed and capacity accuracy to computational problems. The developments over the last decade or so got us to the current state large language models (LLMs like GPT-3, LLama, Claude etc.) which are trained on billions of inputs and can accurately understand the nuances and complexities in human language to generate different forms of output. AI (Gen AI), the underlying enabling technology, would therefore be more of an incremental improvement (sustaining innovation) than being totally disruptive.

The products and innovations being built on top, however, have the ability to be truly disruptive. Entrants are currently competing in low value areas (simple consumer apps) as they reach the quality of the product and effectiveness of the use case to be adopted by the mainstream. Chat-GPT has shown some promise but the average search customer still ‘Googles’ things.

Incumbents like Google, Amazon, Microsoft and Meta are sustaining their business models by focusing on where the profitable customers are. But recognising the potential of AI they are using the enabling technology in house, or are partnering with the entrants to make their existing products and core business better for both consumers and high value enterprise customers.

Given low barriers to entry (with open source models) one can expect multiple entrants vying to build the next app or business model. However, the need for data troves to train the models and the sheer compute capacity means partnering with incumbents or well funded players with access to capital and resources increases their likelihood of success. According to the theory, sustaining innovation puts incumbents at an advantage most of the times, which is what we see playing out..so far.

Another interesting personal observation here. The arc of the development of a truly disruptive product also depends on the incremental improvements in the underlying enabling technology (the LLMs).

The framework does not give you the right answer straightaway but does help you build and inform your strategy, whether you are an operator or an investor, with a more informed perspective on changes driven by these innovations.

The Paradigm shift lens - Carlota Perez’s tech revolutions framework

Carlota Perez’s “Lifecycle of a technological revolution” is a widely used framework to analyse the development of an emerging technology and technology cycles. It was written in 2002 right after the dot-com bubble burst, and was validated and vindicated with the success of the internet paradigm in the decade that followed.

The theory views long-term shifts as new paradigms that have a lifecycle of half a century until they get exhausted, and further divides the trajectory into different phases (as in the image below).

Phase 1, where there is an explosion of new products and growth and innovation is expanded to different industries. (irruption)

Phase 2, where the technology flourishes along with new industries and infrastructures, and sees intensive investment and market growth. (frenzy)

Phase 3, where the technology starts to be fully deployed across the market potential. (synergy)

Phase 4, the paradigm reaches maturity, growth starts slowing with decreasing returns on invested capital. There is again a demand for new, better technologies and products forcing innovators to start tinkering again. (maturity)

How would you view the new tech paradigm kickstarted by the advent of the internet using this framework? The irruption would be the early days of the dot com era where the internet burst onto the scene, with companies building products and services around the enabling technology.

We have all lived or read about the frenzy phase, with the flood of capital and speculation into the space leading to one of the biggest tech bubbles in history.

The synergy phase came after the dot com bubble burst, when real internet enabled business models were deployed, the internet era companies took over the stage and created generational wealth for both investors and operators. This phase, and the innovations enabled by the foundational technology, also gave birth to other tech cycles which we now call the Mobile revolution, the Cloud era etc.

Finally, the internet is now a commodity and the market, mature.

Does AI seem to the be the next paradigm? If so then the launch of Chat GPT might have started the irruption phase (termed as the ‘big bang' moment needed for irruption). Given the hype around the space, we are quickly marching towards the frenzy phase.

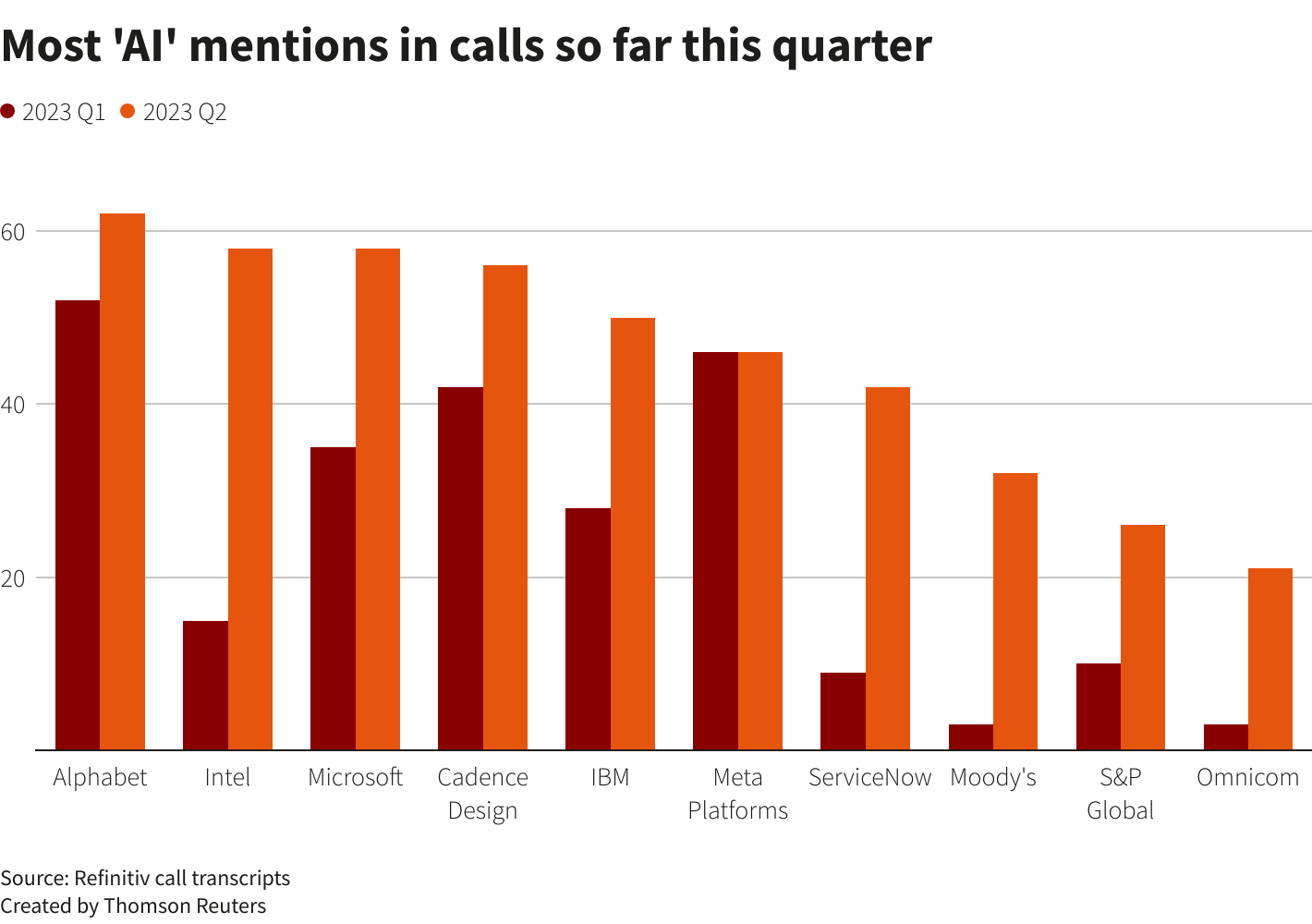

AI mentions on earnings calls are at all time highs.

VC money is being invested at stratospheric valuations.

Where would Big Tech (and the rest of the market) be if Gen AI was not in the picture?

A few other interesting highlights from the text to put the apparent big changes in this cycle into context:

Profound change: Long term changes driven by innovation are involve intense interaction between the economy and social institutions and profound changes in both. The changes occurring in the techno-economic sphere imply a huge social cost in loss of jobs and skills as well as in geographic displacement of activities.

Why change occurs in revolutions: The favourable conditions for the next revolution are created when the potential of the previous one approaches exhaustion. Once the valid trajectories for new products and processes as well as for their improvement are known, successive and successful innovations will follow. They will be compatible among themselves, they will interact smoothly, they will find the required supplies, qualified personnel and market channels and will encounter increasing social acceptance based on learning with the previous products.

The turning point: The frenzy stage leads to a bubble which when bursts acts as a turning point for the tech cycle, which creates an environment for the deployment phase.

Thinking about long term change is fraught with challenges as these cycles rarely play out like the last time. The changes in the environment and the interaction among its variables happens in real-time. Even if you could get the cycle right, you still cannot time the turn of a phase perfectly.

However, even though the nature of change might be different, some things like human behaviour stay mostly the same.

Until next time,

The Atomic Investor

Change is constant though

Very informative blog 👏

👏