Upping the stakes

Private Equity is believed to be in for a rough ride. The post dives deeper into the key performance drivers of PE and how managers are likely to navigate the current environment

From $2 tn in 2010 to $11.7 tn in 2022 in assets under management in 12 years - a CAGR of almost 16%. Any asset class with those numbers would command extra attention. Even more so in the case of private markets, which with those numbers has attracted both believers and naysayers.

As allocations towards private markets have steadily gone up attracting capital away from other asset classes, market participants and investment managers have increasingly questioned the allure of Private Equity (the largest sub-segment of private markets) has had and continues to have amongst institutional investors. They’ve tried to deconstruct the drivers of PE performance and have argued that the industry might be in for a rough ride.

The gist of their argument goes something like this: lower rates kept costs of capital low and allowed PE funds to finance larger deals easily, increasingly higher valuations meant they could exit at expanded multiples, higher leverage was a lever to juice up the returns and performance, and a market awash with liquidity was strong tailwind for fundraising, M&A and tapping capital markets at their whim and at ultra low costs.

Now, the new regime has already pushed up financing costs by a significant amount making it harder for PE managers to find sustainable sources of financing. Lower valuations via falling multiples is putting a dent in fund performance for all the deals made at nosebleed multiples. Institutional allocators and LPs are already scaling back as they rebalance their portfolios in light of falling public market performance.

A recession or an economic slowdown might also hurt the fundamental performance of PE portfolio companies and slow down earnings or cash flow growth, making it harder to deal with the high levels of debt on the balance sheets. The tailwinds have reversed course and are now turning into headwinds for PE.

There is little doubt that all of the aforementioned drivers have been instrumental in helping PE become a mature asset class from a niche segment of the market a couple of decades ago. But digging a little deeper into the performance drivers would be useful to understand where Private Equity could be headed in this new cycle.

The three legged PE stool

PE performance, broadly speaking, can be seen as a three legged stool, with leverage, multiple expansion and fundamental PortCo earnings growth making up three main contributors of long-term performance.

Leverage:

Weighted average debt levels for PE deals have risen from around 5x EBITDA in 2012 to roughly 7x in 2020-22 driven by ultra low interest rates and an increase in the number of sources for leveraged loans (i.e the emergence of private credit funds).

However, leverage has only contributed to 25% of PE returns during the decade, as compared to 50-75% in the periods prior. It is a valuable lever for PE performance but its overall weight in PE performance attribution has decreased. In the current rate and financing environment, you could expect that to go down ever further.

Multiple expansion:

PE returns are highly sensitive to entry and exit multiples. The last decade saw a flood of capital moving into the asset class chasing the same number of deals. That, combined with low discount rates pushed both entry and exit multiples up, which contributed to 28% of PE returns over the last decade. Average entry multiples went from 9x EBITDA to 12x for LBOs.

Multiples could already be on their way down as public markets come off from their highs and higher discount rates puts additional pressure on deal multiples.

Fundamentals and earnings growth:

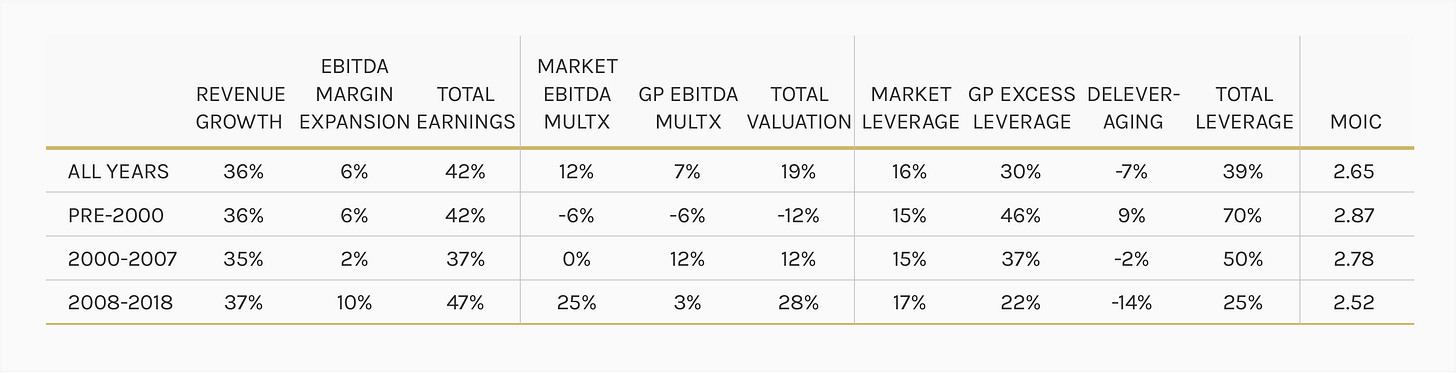

Fundamentals and earnings growth has been the most important performance driver for PE, contrary to popular opinion. Post GFC, revenue growth and margin expansion contributed to 37% and 10% respectively to PE returns for a total of 47% contribution from fundamental improvements.

There are a number of ways GPs fuel growth and create value for the PortCo (and in-turn their LPs), and some of those over the short term might include business model transformation to unlock stronger revenue growth, digitalisation, cost reduction strategies, unlocking operational efficiencies and operating model transformation, M&A, divestments and carve-outs to realise value and capture synergies and so on.

Here’s how performance attribution has looked like over the last three periods.

The importance of earnings and revenue growth is likely to go further up as the other two levers come under pressure. LBO loan market is down sharply as banks pull back whereas multiples are contracting due to falling public market equivalents and a tough dealmaking environment. PE managers, therefore, are bound to lean into the third lever a lot more and find ways to enhance top-line growth and bottom line expansion.

Upping the stakes

A tighter credit market makes it harder to get deals over the line. To snap up good businesses at bargain prices and put the money to work, PEs have upped the stakes and have recently been writing larger than usual equity cheques. While usually at 20-30% of the total Enterprise value, some of the recent large LBOs have had equity components at more than 50% of EV. The likes of Cvent by Blackstone, Qualtrics by Silverlake and Univar by Apollo were bought at above $5bn in EV with much larger equity cheques than usual (Silverlake and co-investors put up $10bn in equity for Qualtrics for an EV of $12bn).

A large equity component makes it much harder for managers to reach the typical 20-25% IRRs they would normally target. The classic LBO playbook has involved using stable/growing cash flows to pay down the debt, and using bolt-on acquisitions to grow EBITDA faster inorganically to get to a levered 20% return with a quick turnaround.

Now either the managers would have to put up with lower returns (due to lower leverage and dealmaking) following the old playbook, or they would have to invest in the business via high ROIC (Return on invested capital) projects to improve revenue and margin prospects for the long-term.

In an environment where cost of capital has risen and continues to rise, lower returns are like a bitter pill managers wouldn’t want to swallow. The latter is where Private Equity is likely headed going forward. Operating partners, business strategists and growth managers would be back in focus as dealmakers take a breather. Experienced fund managers are already taking larger share of LP commitments, and might continue to do so given their scale advantages and the track record of performing over multiple cycles.

Private Equity, like the public markets, faces headwinds that would slow it down in its tracks but a different kind of playbook could be massively valuable for it to navigate the current cycle well.

Until next time,

The Atomic Investor

Conduit of ideas flowing out every week @ atomic investor # private equity 👊