What mattered #1

The first of weekly/monthly market updates.

Welcome to What mattered. This is the first of my weekly posts I intend to publish. What mattered would be a collection of most important market developments of the week all around the world, and why it matters if you’re invested in these global markets.

Almost a year has gone by when we saw the one of the biggest one day drops ever (atleast in my living history) in March, when the fear of the pandemic and the lockdown took over. As Micheal Batnick pointed out in his latest post, 46% of the stocks made their 52-week bottom. Oof. A lot has transpired since then and I feel there is a need to set some context here.

The S&P 500 is up more than 78% (!!) from its March 2020 low, while the UK large cap FTSE 100 index has rallied 36% in the same time frame. The European counterparts haven’t fared bad either, with the Stoxx 600 index registering almost 54% gains since a year ago. You cannot complain can you, if you stayed put or just bought the gigantic dip. Here’s how the corresponding ETF’s have fared.

The APAC markets have been on a tear as well with China, India, Taiwan, South Korea, Japan and Australia all performing exceptionally well. Emerging markets tend to outperform when the economy’s coming out of a trough having higher exposure to commodities and manufacturing whereas developed Asian markets (Japan, SK and Australia) rallied on the back of domestic and international demand.

South Korea, Taiwan, Australia, India all posting 80+% gains in a year, quite phenomenal indeed.

A lot of it could be explained by rock-bottom rates and unprecedented levels of fiscal and monetary stimulus by central banks and governments globally. This tends to drive flows into riskier assets (lower opportunity costs, money costs nothing) and we all witnessed an astronomical rally in tech stocks as the world fell in love with anything tech or SaaS.

The above chart has only a subset of tech stocks but it’s a functional proxy I believe. Regional tech indices and tech ETFs performed differently due to different composition and exposure (a post for another time).

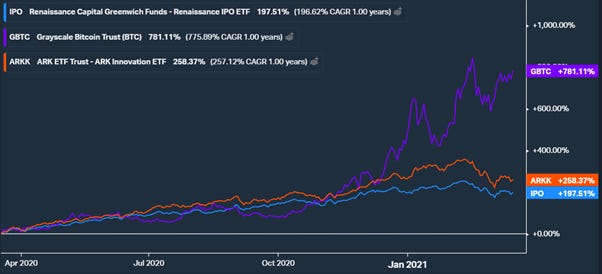

‘Speculation was rife’ would be a euphemism. Here’s another chart,

Who am I to complain, the Bitcoin trust, Cathie Wood's ARKK and the IPO ETF both have been on a wild ride since a year too.

Low rates and stimulus are nirvana for these riskier names as every single one of us wanted to have piece of them. It never felt that easy to make money in the markets.. Until a few weeks ago.

Promises of keeping rates low ‘for years’ by the issuer of the global reserve currency let inflation fears creep in pushing up long term yields to 16-month highs (which takes us to pre-covid levels). And higher rates are like kryptonite for the same high flying assets (think of them as long duration assets) as almost all of their cash flows are supposed to arrive in the distant future (if there would be any). As a result, the present value of these cash flows is slashed significantly.

The yields in U.S treasuries has been the biggest mover of them all with the markets baking in not just inflation but higher growth expectations. The Gilts (UK 10Y) and German 10Y (a proxy for Euro yields) have only moved slightly higher due to different recovery paths their economies are on with their own sets of issues (Brexit and the promise of bond buying by the ECB, Mario Draghi back in the scene). If you’re invested at the higher end of the curve, then buckle up for some drawdowns and volatility.

These are the long-term bond ETFs for the three regions. Long-term bonds in this environment are in a tough spot clearly.

Jesse Livermore’s upside down markets was an incredible piece on the bizarre market behavior when the real economy was in one of the deepest recessions. Investors voiced their concerns about the disconnect between the two. How can the markets hit all-time highs in a pandemic?!!

Now investors are concerned that the economy would do too well too soon. Funny as it sounds but that’s what the bond markets and the shift to reopening and cyclical plays tells you.

The unloved and ignored sectors both in Europe and the U.S, financials and energy have knocked it out of the park since the start of the year. The just happened to be the cheapest (by valuation metrics) sectors as well so value has a huge leg-up vs growth this time around.

Just another ‘reopening play’ chart YTD: Hell yeah we all want to travel so bad. Some of these stocks made their 52-week highs, some even higher than their pre-covid levels. Wow.

So here we are in March 2021, a year later. So much has happened its hard to keep track of all of it.

So many questions to ponder upon – Will there be inflation? What would the CB’s do? Does tech underperform from here on? Earnings? Valuations? Hold cash? Buy?

There is no right answer I think. As Howard Marks usually puts it, you can never 'predict', but always 'prepare'. The economies all over the world are recovering, which is great to see. The sectors that were hit the hardest are poised to get back. Simply put, expected returns are a function of price you pay. For assets that have already done so well recently returns are likely to be lower, given the macro situation. Does it mean you go all in on recovery stocks? Probably not.

If you’re invested, staying diversified is probably the right way to go. If you had been positioned towards money-losing, quasi-speculative, high growth assets, now might be the right time to rebalance. Returns on cash on bonds look quite unattractive going forward whereas equities and real-estate (with stable real-cash flow yields) are likely to do well. Lets see how this cycle unfolds...

See you next week with What mattered #2 where we look at a lot more!

I would be ending What mattered each week with interesting funds or ETFs I come across. I am a big fan of passive products that give you an exposure to sectors, regions or asset classes of your choice. Not expensive, easy to buy and sell and highly transparent which makes them suitable for Atomic Investors all around the world.

ETF of the week – The Roundhill MVP ETF (NYSE: $MVP)

This one’s for investors who want exposure to the world of professional sports. I love the look of it as a I'm huge sports fan myself.

Here’s how the top holdings look like:

Thematic ETFs are incredibly useful if you’re looking very specific exposure or want to invest in a ‘theme’ or an idea.

The world of sports was hit pretty hard without ticketing revenues but the ones that have managed to survive could be interesting short-term or long-term plays.

See you next week!

The Atomic Investor