What mattered #2: Reversal

A reversal of a long-standing trend.

(Disclaimer: None of this is investment advice. Please conduct your own research. I may or may not be holding positions in the securities/products discussed)

Welcome to this week’s edition of What mattered where look at some interesting developments in global financial markets and try to figure out why it really matters.

In the previous edition, I briefly touched upon how higher yields across the developed markets have taken away the punchbowl from the high-flying growth stocks. We take a closer look at some relative performances since the start of the year.

The S&P 500 has had a volatile start to the year driven by rotation trades and covid-19 related news flow. It is still up 5.6% YTD and +0.84% this week. Meanwhile vaccine distribution issues and another round of lockdowns has not stopped the broader European markets – Stoxx 600 is up 6.2% YTD and 1% this week. The UK large cap index has underperformed (even with relatively higher exposure to cyclical stocks) with 3.86% YTD returns.

These are how the corresponding ETFs have performed:

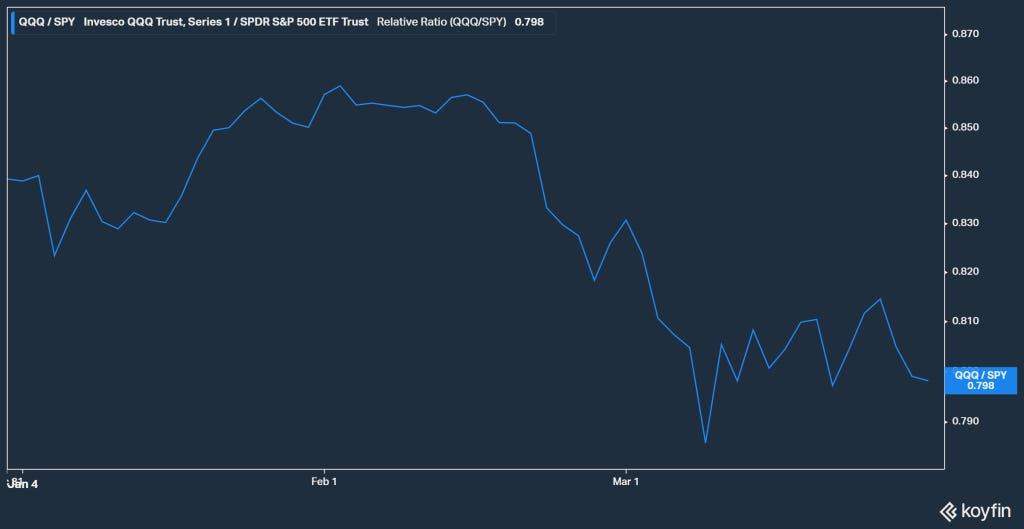

But what has caught my eye over the last few weeks is the tech selloff across the board. The year kicked off a massive rotation trade which directed flows out of tech while the broader markets have rallied ( I use relative strength (QQQ/SPY) to look at that:

The broader tech indices have underperformed in the U.S whereas in Europe the tech trade is still going strong. You could call this a ‘reopening trade’ in the U.S where the pandemic winners start underperforming as things go back to normal. For Europe, the Stoxx 600 technology ETF (EXV3) has a enormous exposure to semiconductor companies and given what’s going on in the semis industry, the outperformance of European tech could continue.

Broad based rallies are also a leading indicator of pickup in overall economic growth when the small-mid caps (sectors with usually weaker balance sheets and more exposure to economic sensitivity) start outperforming the larger companies.

The Russel 2000 U.S small cap ETF ($IWM) was up as much as 18% YTD until a week ago when it hit a wall and fell 5-6%. European and British small caps have outperformed their respective broader markets as well YTD.

With all global markets showing signs of a broad recovery, a valuation re-rating in the technology stocks is likely. Picking secular winners seemed easy in the last 12 months. Now, not so much.

Things might start to get even more interesting as we approach the Q1 earnings season.

In other news, AUM for thematic ETFs reached another record high as investors poured almost $42bn (!!) in the first two months of the year with the overall AUM ballooning to $394bn. Thematic ETFs give you an exposure to niche sectors (like $MVP in last weeks edition) and have gained a lot of popularity among young retail investors. Although they serve very specific tastes, they have been shown to be highly volatile in the past. ARKK has remained the most popular thematic ETF, according to the FT article even after the bloodbath seen in its flows last month.

The ETF space has been red-hot for quite some time now with the biggest companies slashing management fees to the bone. Blackrock (i-Shares) cut between 17-24 bp in its style ETFs this week signalling to the rest of the industry that’s revenues don’t matter that much as long as you can have a bigger slice of the pie. Style ETFs allow you to adjust your portfolio by adding more growth, value or quality factors or get an additional exposure to size factors.

The BlackRock iShares MorningStar US Equity style box ETF will now cost you between 3 and 6 basis points. WOW.

That brings us to our ETF of the week! This time we have $SRVR – Pacer Benchmark Data and infrastructure Real Estate SCTR ETF. The ETF invests in data centres, mobile towers and critical infrastructure Real estate investment Trusts (REITS) or securities around the world. REITs like these could act as a ballast in your Atomic portfolio with decent yields (the management has to pay-out 90-95% of the net-income by design) and a likelihood of price appreciation. Here’s how the top holdings look like:

This is our critical infrastructure of the 21st century as our data consumption touches new highs and our technologies move towards the cloud. I do not think the demand for computing, storage or bandwidth is slowing down anytime soon. This could be an interesting way to play that trend.

See you next week with more stuff that mattered.

The Atomic Investor