What mattered #5 - Extraordinary

Every sliver of a positive surprise is resetting expectations of what lies ahead.

This is What mattered. A collection of stories and events driving the market narrative every week. I wonder how the relative strengths of positive and negative stories and newsflow has changed since the world started getting out of the valley of eternal dread in the lockdowns of 2020. Every sliver of a positive surprise is resetting expectations of what lies ahead. Vaccine rollouts, faster than expected economic recovery, labour shortages, earnings growth, record results, all of this is adding splashes of fuel to this boom what most people are already calling ‘The Roaring Twenties’ of this century.

However, the fundamental principles of monetary policy and macro economics suggest that given the current stance of major central banks all over the world and their willingness to let price increases tread beyond their long-term targets, the Roaring Twenties is bound to tag along inflationary pressures with it.

The U.S economic output is now only 0.9% below its pre-covid peak as consumer spending accelerated with the help of fiscal and monetary stimulus in the country. Although the Eurozone output is still 5.5% below peak levels, lower than expected contraction and record manufacturing output readings indicate the recovery has been better than initially expected. Surging demand on one hand and constrained supply on the other have led to modest price increases in input costs already, whereas talks of a ‘commodity supercycle’ have gathered steam with basic raw material costs soaring this year.

As they say, you cannot have your cake and eat it too. If your story or investment thesis features stronger recoveries and demand hitting its pre-covid levels very soon, you cannot ignore the possibility of a surprise CPI reading on the upside.

“It just won’t stop, people have money in their pocket and they’ll pay the higher prices.”

Warren Buffett on the red-hot U.S economy and inflation expectations

As the narrative of inflation takes a firmer hold, we are most likely to see some interesting movements across asset classes. History would also remind us of how central banks are usually behind the curve of getting inflation under control. If that’s the case this time around, then we might as well brace for some volatility in both equities and fixed income.

Now moving on to some extraordinary results from last week.

Big Tech gets (way) bigger

It was a long-awaited earnings week when the FAAMG group reported their Q1 2021 earnings. Everyone had an eye out for growth, sustained trends in the covid (and post-covid) world and ofcourse some commentary on their businesses. Unsurprisingly, the results were impressive to say the least.

The combined yearly revenues of Amazon, Apple, Google, Microsoft (the FAAMG) hit $1.2 TRILLION (!) this week, which is 25% higher than the numbers reported in Q1 2020. Growing at that rate from such an enormous base is just mind-boggling. For context, this is 5% of total U.S GDP.

Ad-spending is usually considered quite cyclical. But Facebook’s and Google’s advertising revenue growth has not only been resilient in this crisis, but has grown much faster than the years before. Almost half of total advertising market is now digital, with Google and Facebook dominating two-thirds and a third of those markets respectively. Some analysts referred to these businesses as almost recession resistant. Most advertising moved online during the pandemic as the number of eyeballs glued to the screens jumped substantially. With the world reopening again ad-dollars from the travel, hospitality, retail and entertainment sectors are adding the cyclical exposure to the advertising segments. Fascinating.

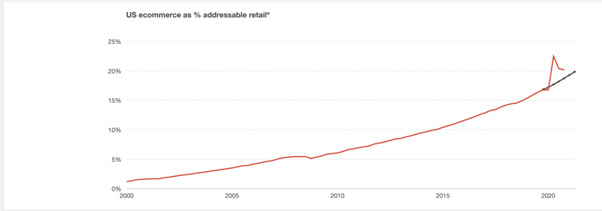

The ecommerce-to-compute giant, Amazon, saw a 44% YoY growth in revenues. Amazon has an exposure to both consumer and businesses with its marketplace and AWS (growing at 32% YoY). As Jeff Bezos likes to put it, looks like it is still DAY ONE for Amazon, which is going from strength to strength by setting high bars and beating them time and time again. Some secular trends are acting as tailwinds too.

Amazon has executed to near perfection and made sure it captures the growth in all the major markets. Oh and lest I forget, it also has a high growth ad business (marketplace ads paid for by the sellers) in there which has more than 20bn in revenues. Staggering.

Remember the days when Apple was valued as a hardware and electronics company? Me neither. Apple has seen its average P/E multiple go from ~10 to ~30 in the span of three years taking its market-cap to beyond $2 Trillion. To be fair to the company, the high growth, ARR friendly services division has delivered but this quarter felt like everyone bought replaced their phones, iPads and Macs all in one quarter. Hardware sales grew more than 70% YoY as demand for devices soared to cater to the work-from-home tasks.

This is Big Tech for a reason. While the pandemic was expected to help digital and technology companies, not a lot of people expected the biggest tech companies in the world beat expectations by that margin. So, is it that the companies have perfected the art of keeping competition at bay? Or are we so entrenched in their services and products that these are like the new digital staples? I think these are exceptionally run companies that have developed a wide, very wide moat around their businesses, thus becoming goliaths of their worlds. Then, these companies know how to keep innovating with best-in-class capital allocation records.

Some would cry foul and ask for regulatory assistance. I would say please innovate, don’t regulate. Let the size of the pie grow and fight for your share. There are some interesting stories developing in the Big Tech space, as they go head-to-head against each other, Facebook and Apple for example, over a rule the latter enforced in iPhone devices regarding tracking via ads, or Google, Amazon and Microsoft for the cloud services for Telecoms industry, or Google’s foray into ecommerce via Shopify and other partnerships.

Investors are quite happy, the stocks have done phenomenally well over the last year and have handsomely rewarded both shareholders and employees.

Now with Big Tech as the backdrop, our ETF of the week had to be none other than ETFS FANG+ ETF. The ETF is listed on the ASX (Australian Stock Exchange) and provides you with an equally weighted exposure to the NYSE FANG+ index. Here’s how the top holdings look like –

It has a large cap tilt built-in, and one must expect a greater volatility in a concentrated portfolio such as this one.

See you next week with more ideas and stuff that mattered. Take care.

The Atomic Investor