Welcome back to What Mattered. A short read on key market events and stories driving the narratives around businesses and investing.

Yuval Noah Harari famously put in his most recent book 21 Lessons for the 21st Century,

“Humans think in stories rather than in facts, numbers, or equations, and the simpler the story, the better”.

The markets, which are a construct of the very same humans (and algos, created by the same humans) are driven by stories too at times. Last year was a tough year for us all. So many stories were floating around that it felt like everyone knew everything. Here’s another one that caught on – The companies that are better prepared to handle even bigger risks would endure this crisis better. This quickly escalated to ‘climate/environmental risk is the next big risk no one is prepared for, and companies with the best environmental credentials should be invested in.’ That simple, yes.

And now there are easy ways to do that, for not only institutional investors, but for retail (and atomic) investors as well.

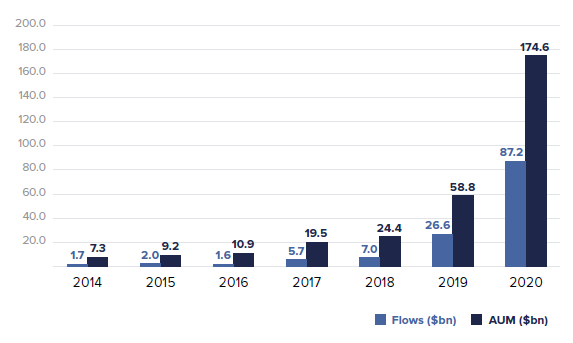

According to the Trackinsight, inflows for passive funds based on Environmental, Social and Governance principles, aka ESG, surpassed non-ESG funds for the first time ever in Europe in Q1 2021 with $25.8bn for the former vs $22.3bn for the latter. The flows, into ESG related products have been on a tear since last year with the assets now totalling $174bn, 10% of the total European ETF market.

In the U.S however, sustainable ETFs only accounted for 3.1% of the much bigger $248bn that flowed into ETFs in Q1. The story is starting to catch on no doubt.

The concept of ESG has been around for a while. But now it is becoming a part of boardroom conversations, shareholder meetings and investor conferences. Institutions want to do their part or show that their doing their part by investing in companies that are trying to make a difference and add value to the society. For companies, this is great news. ESG sells.

It also entails some virtue signalling, both on the institutional and the retail side. These investments look good to look at in your portfolio. They make you feel good. You’re playing your part in doing something for the environment. In fact, according to a survey conducted by Montfort Communications, 63% of 18-34 year olds surveyed would choose new fund manager based on their ESG approach, and 78% of respondents in this age group said ESG affects their investment choices.

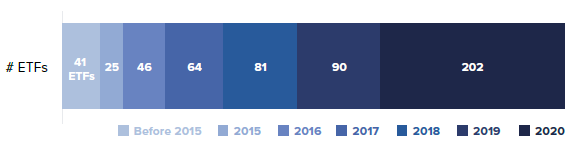

No wonder asset managers are feeling the FOMO with 88 sustainable ETF launches alone in 2020 (with over 200 in total), which was higher than the previous two years combined.

To give you some context, ESG funds, like any other ETF, track different indices. Index providers like MSCI, FTSE, S&P use their in-house methodology or external research and data from companies like Sustainalytics to score companies based on an explicit ESG criteria for the fund. Then, that ESG score decides how much weight would be allocated to the stock in the index and subsequently in the ETF portfolio.

The ESG space has gained some strong proponents, like the world’s largest sovereign wealth fund Government Pension Fund of Norway and Blackrock’s Larry Fink. But do we want to sound good or actually do some good?

But here are some questions that I do not have answers to yet:

Is there enough consensus on what ESG is, yet?

There are more than 400 (!) ESG indices out there. The problem? There’s little consensus on what companies qualify for inclusion in a category of indices and what score should it get. On average the ESG scores from major data providers only have a correlation of 0.46. Not only this makes harder for investors and allocators to find the right fund, it makes one wonder if there’s enough clarity in this space to pick the companies that are actually adding some value and therefore fit this bill.

Do you really care or are you only here to make money?

Are you investing because you really care about supporting businesses that can make a difference, or are you just here to make some money? Lets assume that companies that are conscious about ESG will do well. If that is the case and the market already knows it, then that information would already be reflected in the stock price. At the end of the day, that is what makes a company more valuable right? Its less risky than the ones who don’t care about the environment. But you cannot have your cake and eat it too. If you’re buying these companies at a premium, the premium itself should lower your expected returns. Are you ready to swallow that pill?

Would you accept missing out on what's working?

The ESG space is still evolving and a lot of it still depends on the ‘via negativa’ principle. The funds would just exclude ‘bad’ companies (via to their negative screens) and buy the rest. That works, until it doesn’t. A whole host of ESG screened funds excluded the oil and gas companies. And that (along with a massive exposure to tech stocks in general) helped them beat non-ESG benchmarks as investors shunned oil and gas companies last year. But what happens when Energy makes a comeback, like it did this year? Can we keep our hands off of companies that are poised to deliver stellar returns?

Are we ignoring businesses that are actually making it happen?

What if the companies that are doing better anyways can sell their ESG traits better? What if this is leading to their inclusion in ESG indices, and in turn leading to more flows and being rewarded with higher stock prices. Are we ignoring smaller companies that are actually doing good and just looking at big businesses that ‘sell’ it better?

A host of investment and asset management firms still see this as a business opportunity, something that gives them an opportunity to charge a few more basis points. Maybe we need more fundamentals driven research, along with more standardisation from regulators and ofcourse more disclosure rules around ESG data.

For anyone who sees this as an investment opportunity, you not only need to identify companies that are actually doing 'good', but incorporate this information in your thesis before the rest of the market. Or avoid companies with before major ESG risks before the market correctly prices those risks. Not easy at all.

So what it is going to be? Doing good or sounding good?

Until next time,

The Atomic Investor