What mattered #7 - Dividends are forever

When dividend stocks shine brighter than the diamonds.

Welcome to another edition of What Mattered. A collection of stories and events grabbing eyeballs in the markets.

There was a time when investors cared about cash returns on equities. Dividends were like a filter to screen the stocks you wanted to invest in. A stable stream of dividends was considered a positive, as a company that had track record of regularly rewarding its shareholders was worthy of putting your money into. This was real cash flow with high level of certainty. The rest of the bunch were mostly out of the individual investor risk budgets.

As times changed, investment philosophies did too. Young investors today don't care about the likes of legends like Ben Graham and their dividend discount models. Growth investing, investing in young tech companies with no earnings (and no revenues at times, sadly) is the new game in town. For context, young, high growth companies would not pay a dividend and invest all their cash flows to sustain their growth rates.

The market’s perspective on these non-dividend paying stocks took a while to change. But it did. The late nineties and early 2000’s was it probably, when Venture capital took the markets by storm and investing in these companies became almost mainstream.

Dividend paying stocks were now associated with mature, low growth industries that have exhausted most levers for growth and have fewer attractive capital allocation opportunities left.

Fast forward to today, if you mention dividend yields to your next-door crypto bro, the likelihoods of being called a BOOMER are quite high, I must say.

Cyclical story takes hold

Last year was a tough one for dividend investors as most companies paused their payouts to shore up their cash reserves and guard the businesses in a highly uncertain environment (around 40 companies in the S&P 500 had suspended dividend payments last year). In this midst of an ongoing secular decline in flows towards mature dividend paying stocks, this was a big blow to most dividend funds and ETFs as they saw substantial outflows in capital.

As companies resumed dividend payments this year, the flows came roaring back culminating in a 4 percentage point outperformance for the Dividend Aristocrats index over the S&P 500 this year.

One of the biggest dividend focussed ETF – Vanguard High Dividend Yield (VYM) saw its AUM grow over 46% since October 2020.

And here’s three possible reasons why:

Value tailwinds

As capital moved from mature, stable and old economy stocks to the young, technology and the new economy names, the spread between the respective multiples grew wider. As a result, these high dividend yield stocks started entering in the ‘value’ bucket. (Although the methodologies behind constructing these factors might slightly differ, stocks cheaper on P/E or P/B basis are usually added to this category).

The underperformance of the value factor was like a double whammy. Now that ‘value’ factor is forging a comeback on the back of a cyclical upturn, and so are most of these stocks.

Scouring for yield

Income producing assets (like bonds) make up a big chunk of long term portfolios, both for individual investors and institutional clients (like endowments, pension funds). The secular downtrend in global interest rates doesn’t help if you’re owning assets that don’t produce income that is sufficiently above average inflation levels (real interest rates have been negative or close to zero in most developed markets in the world for some time now).

In addition, this part of the economic cycle bears high duration risk for fixed income assets (a rise in rates means prices for long duration assets fall much more than short duration assets).

The Bond proxies concept is gaining traction – stocks with a stable dividend income acting as a proxy for fixed income returns. Companies with a long track record of dividend increases could qualify as bond proxies, especially in sectors like consumer staples, healthcare and utilities. Sure, these would be more volatile than your treasuries but the risk-reward looks quite attractive given where the interest rates are at this point.

Inflation scare

Higher than expected CPI readings in across major economies have led to most market participants sounding the inflation alarm. Some investors too do not fully agree with the Fed's transitory inflation narrative, the fact that most price increases are short-term due to low 2020 base and supply constraints. They might already be putting their money to hedge inflation risk.

Stocks with low cash flow risk (REITs, Utilities) might offer some inflation protection, especially the ones that have a record of payouts higher than average inflation, thus offering a positive real-yield. Cyclical stocks with high dividend payouts look quite attractive for the same reasons.

Goes without saying, dividend ETFs could play an important role in long-term (and Atomic) portfolios in this environment. With a steady income stream and lower volatility, they fit right in.

And now for our ETFs of the week:

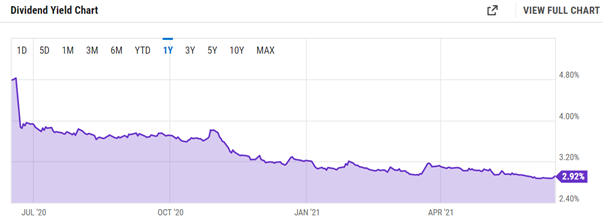

The biggest dividend ETF by AUM – VYM offers an average yield of 3% with a decent spread over treasuries, which has somewhat reduced as the price of the ETF has gone up recently.

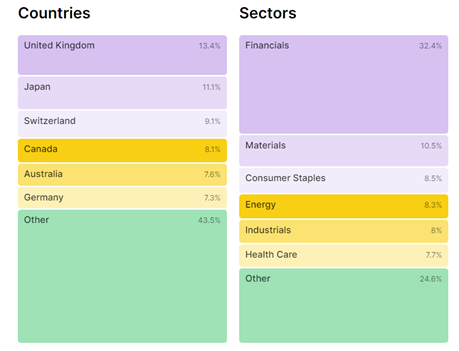

VYMI and VHYL are a couple of options that provide an exposure to international dividend paying stocks with an average yield of above 3.5%. With negative nominal rates in Europe and Japan, this could be an attractive alternative.

(Disclaimer: I may or may not be holding the securities mentioned in above. Nothing discussed here is investment advice, please DYOD)

Thank you for reading and keep ‘em yielding!

Until next time,

The Atomic Investor