Written in the Cloud

We cannot get enough of the Cloud, and neither should we.

Behind every great business lies a great culture and the drive to constantly innovate and develop internal tools to spur growth. At times, these tools, that started off as ideas, turn into full blown businesses into themselves.

Some of these internal tools are spun off to become independent businesses, like MongoDB out of DoubleClick, Slack out of Glitch, Persona out of Square. A few of them are so great that they not just allow the parent company to reach escape velocity, but also end up creating substantial value around them.

The growth story of Amazon Web Services, the largest cloud infrastructure business in the world, offers nuggets of how a tool that was developed as an internal service to help Amazon.com manage ecommerce traffic, ended up not just transforming Amazon itself, but turned into the 'operating system of the internet'.

In short, AWS laid the groundwork for the services on top of which the rest of the world could build their applications and businesses.

“We realized we could contribute all of those key components of that internet operating system, and with that we went to pursue this much broader mission, which is AWS today, which is really to allow any organization or company or any developer to run their technology applications on top of our technology infrastructure platform.” - Andy Jassy, current Amazon.com CEO

Although AWS was launched in 2006, competitors took several years to respond. By the time the cloud infrastructure business gained traction, AWS had already captured a large chunk of the market. This kicked the entire market into high gear and saw tech giants like Microsoft, IBM, Google launch their own cloud businesses. Thus, AWS kickstarted a secular shift in technology and in turn, public and private financial markets.

The shift to cloud has transformed the entire tech stack in the last decade. Now, it is uprooting traditional business models in multiple industries which are now being redefined by young, cloud and software startups.

Bessemer Venture Partners, an early stage VC firm investing in cloud and digital infrastructure businesses came out with its annual 'The Cloud 100 Benchmarks' report last week.

BVP has kept a track of investments in Cloud and SaaS startups since 2016 (and made a lot of money for their LPs too by spotting the secular shift early, in the process) and this report shares some fascinating developments in this space using the 100 most valued private cloud companies in the world.

Here are some of the takeaways.

Bigger every year

The combined value of the companies in the list is up a staggering 94% from 2020 with the average value now at $5.2bn (without Stripe which is alone worth $95bn). The rate of change in valuations is much faster with the influx of high velocity VC capital. The Cloud business model has worked well in all environments due to its subscription based nature and allows it to sustain higher margins, the cash flow from which can be reinvested to fuel growth.

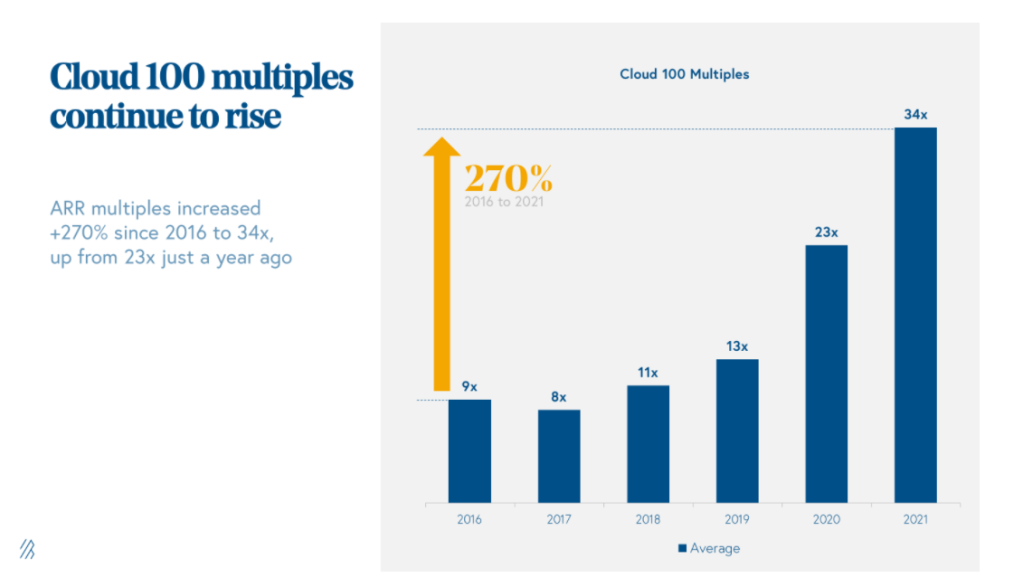

Multiple expansion on fleek

Average ARR (Annual recurring revenue) multiple has increased 270% since 2016 to 34x (it was 23x in 2020). Yes , the average growth rate is slightly higher but even if you adjust for growth rates, revenue multiples are much higher than 2016's. Investors are writing checks at higher prices to get exposure to this tech sector.

More volume, more value

The market witnessed more funding rounds and of larger size on average. Some say that investors are writing checks just to get introduced to a few people in the space. With the cost of money so low, and investors looking for alternative asset classes everywhere, the capital spigots seem to be running for...forever.

Fintech continues to lead the way

Fintech still leads the pack with 146% growth in aggregate value with Customer experience and marketing at second. Vertical SaaS also saw a pickup in growth rate, with literally every sector witnessing some level of growth.

Global expansion

The list got more global and now 30% of companies are from rest of the world (ex-North America). This is likely to keep increasing due to a variety of factors.

The top quartile cloud companies now have ample access to capital to fuel expansion. This in turn allows startups in other countries to use these SaaS and cloud tools, be digital first from the get go and grow faster than what we have seen previously. Investors too have diversified their regional exposure which gives non-U.S startups bigger funding base.

It is like a positive feedback loop - higher growth leading more capital flowing into the sector, leading to more companies being founded, more entrepreneurs exiting to start their own ventures, more successes leading to more startups entering top quartile. Not to forget, now a startup has access to much more tools to bootstrap its growth at all stages.

Unicorn for everyone

The existing cloud ecosystem is helping allowing emerging cloud startups to achieve much higher growth rates. Higher growth means milestones arrive much faster. One of the most watched milestone, the Unicorn status, has come much faster this year due to confluence of all the factors above. Every company in the list is now a Unicorn! A first in the list's short history.

Although these companies are going public much faster than before, Time to IPO could increase. Companies are likely to choose to stay private for longer if the VCs continue funding them at even higher valuations.

Cloud startups have created enormous value for private and public shareholders alike. To put it succintly, the decade in tech and public/private investing was defined by Cloud.

Are we likely to see more winners emerge from the space?

When every young startup is written in the Cloud, we are likely to see the list getting much bigger in value. Investors too are craving for more cloud and SaaS companies to come through, and when the supply fails to satiate demand, prices only go in one direction.

Hit the subscribe button at the bottom for more posts like these!

Have a great week.

The Atomic Investor