Yield watching

The lifeblood of the economy and the investing world.

Interest rates are the lifeblood of the economy and investing world. These are the rates at which central banks decide they can lend money to the country’s financial institutions, which in turn influences corporate and retail credit rates and allows the multiplier effect to flourish.

Rates set the tone for not just how you consume or save but also how you invest. For individuals, they determine the opportunity costs or the minimum acceptable rate of return. A rate that at least ensures the purchasing power of your capital is intact.

For businesses, they are a key determinant in the ‘cost of capital’. A basic rule of thumb for economic value creation of any business is generating returns on investments higher than the cost of capital. After all, economic value creation is what enables it to grow and meet the needs of all its stakeholders.

Its fair to say that rates (and changes in them) touch almost every facet of the economy (the real world) and the investing world (the markets). The U.S treasury bonds and notes, also called the 10-yr treasury, 30-yr treasury etc. are viewed as one of the most liquid and safest assets and looked at as proxies for risk-free rates in the market. The market prices of these bonds determine what yields they offer, a function of expected growth rate in the economy and of course expected inflation.

The rise in U.S yields in the last few weeks has made most investors quite uneasy. First, because the U.S treasuries and are held by all kinds of investors globally (for reasons we wouldn’t talk about here). If yields in the bonds in the world’s reserve currency change, the value of trillions of dollars of this debt fluctuates and that effect in turn reverberates in the markets all around the globe.

But why should you care?

Valuation re-ratings and a reset in expectations

The actual value of any asset we all know is what the buyer is willing to pay for it. Almost all the time, what you pay today in the markets is a multiple of what you expect to receive in the future. This ‘multiple’ could take myriad forms and is often used as a guide to get to that true value. The value in turn is affected by expected cash flows of the business, the changes in them and most importantly their timing (do they arrive tomorrow, at some time in the near future or are they far-off in the future).

To value those cash flows, you would normally apply a discount rate. This rate is made up of a risk-free rate plus a risk premium (a premium to compensate for the additional risk of that asset). So when you see yields (the risk-free rate proxies) rising, the most intuitive affect you could observe is the value of those cash flows (rates and present value move in opposite direction) decrease. Therefore, the ‘multiple’ you pay today effectively declines. That is the first order effect of rising yields on the value of your stocks.

Interest rates don’t start rising or falling in vacuum. They are driven by changes in the overall economic environment. Falling rates over the last decade signalled a low growth-low inflation environment. For a firm to get to that cash flow stage, it needs to invest in tangible and intangible assets for the growth of its business and the environment in which operates affects this without a doubt. Then, it needs to earn a return higher than its ‘cost of capital’ – what it pays to access the growth capital to create economic value. Not all firms can consistently earn a return (called the ROIIC) which is considerably higher than this cost. When the overall economic environment is sluggish, firms in relatively less capital-intensive sectors (like tech) earn a return much higher than their cost of capital, create more value and therefore are worth much more (with higher ‘multiples’) than the rest of the market. But the same long-duration firms (that invest a lot today for a higher return in the future) are highly sensitive to changes in rates due to:

The path they take to get to cash flows (the variability in ROIIC), which is what sets expectations for the future when they get there.

The timing of their cash flows, cash flows tomorrow, in the near-future or far-off in the future.

The increase in the risk-free rates signals a change in environment which sets new ROIIC expectations, thus decreasing the ‘multiple’ you pay for high growth names. This could be the second-order effect of increase in yields.

To summarise, an increase in yields directly affects the discount rates (via risk-free rates) which changes the value of expected cash flows (first order), and the expectations of the ability of a firm to earn a higher ROIIC (second-order).

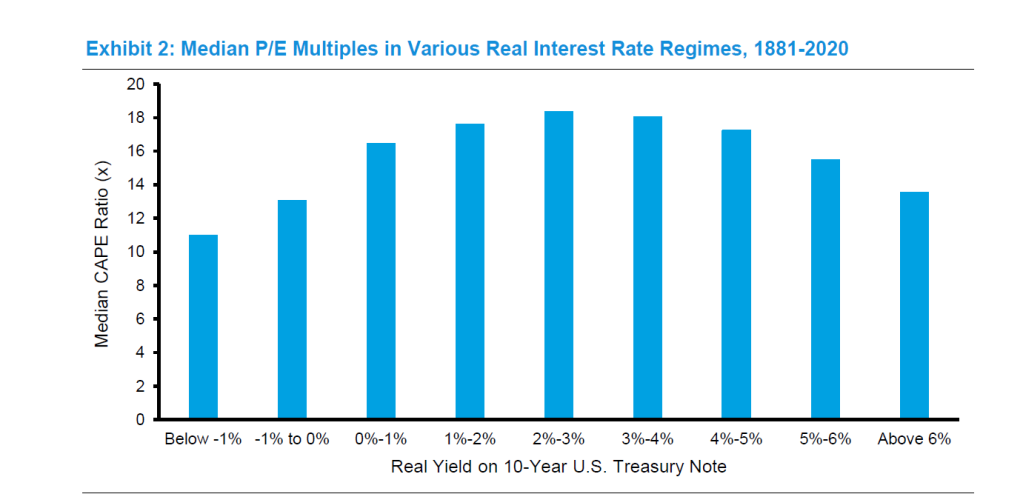

The chart below compares the median cyclically adjusted PE multiple with different interest rate regimes -

Are higher yields always that bad?

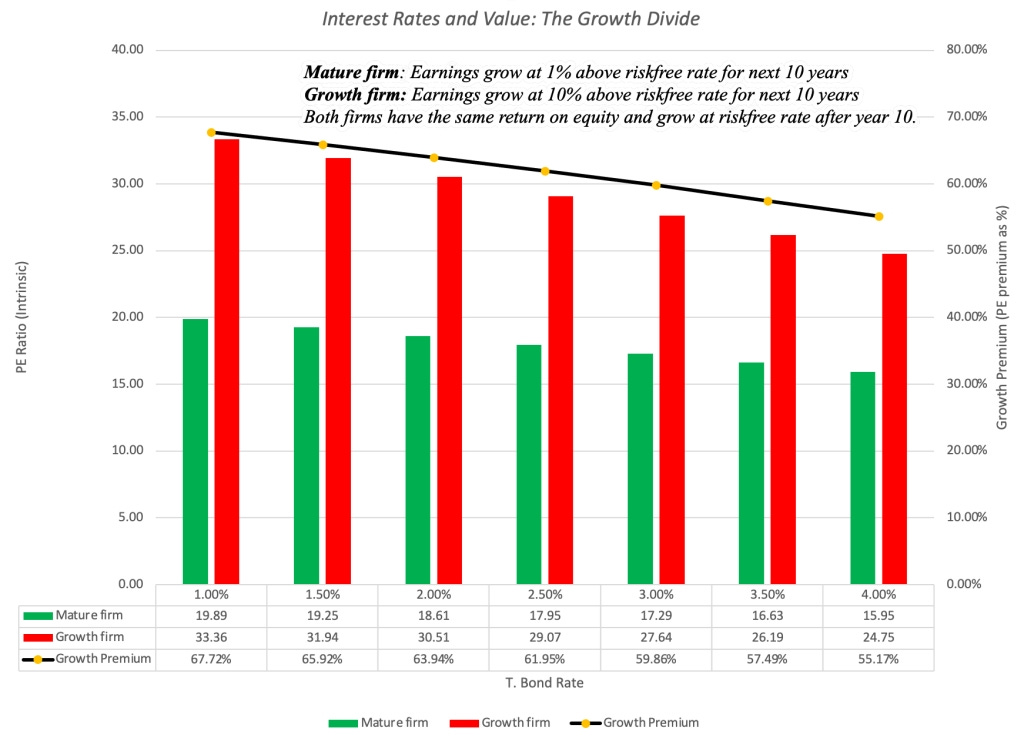

Aswath Damodaran put out a great blog post recently on the topic. When you look at rising rates, you ought to figure out what is actually driving those interest rates – Is it real economic growth and or is it expectation of price increases aka inflation. What happens to a stock depends on how each one of these factors affects that firm.

Higher growth translates to higher consumer and business spending and higher revenues. With pricing power, a firm can charge you more which translates into higher margins and higher cash flows.

On the other hand, higher inflation leads to higher revenues, but margins are hit if there is no pricing power as costs rise. This could have a negative affect on the cash flows you’re trying to value.

In an inflationary environment, most young firms (with most of their assets as growth assets) see their reinvestment efficiencies decrease (what we touched upon above) which reduces the ‘Growth premium’ you are willing to pay for these names.

Broader market rallies, cyclicals leading and tech underperforming are a feature of the environment we find ourselves in at the moment. The multiples might have changed since the start of the year, but the first-principles are still the same. When costs of capital are rising for the everyone, firms with the most efficient capital allocators focussed on reinvesting in the business to innovate and create a competitive advantage around it are likely come out of this environment as winners.

Until next time,

The Atomic Investor