Big tech's balancing act will soon be over

The largest tech companies have continued to get fitter and have optimised spend to prioritise cash flows. Investors love to see this, but the balancing act might soon be over.

Big Tech earnings are almost always highly awaited. Even more so when those stocks have been pulling all of their weight in the market, and then some. New monikers keep coming around every now and then too to keep things interesting. “The Magnificent 7” or Apple, Microsoft, Amazon, Google, Meta, Nvidia and Tesla have added roughly $4tn in combined market cap this year.

Some of it is driven by a change in narrative around how they operate and a lot of it is the exuberance around AI. As I opined in Big tech passes the first test , these companies were put to a test by the markets if they can find more sustainable ways of growth and prioritise projects with a clear path to profitability. And that the new tech epoch of AI, being as capital intensive as we are all discovering it could be, would be the next big test for them.

This quarter was another glimpse into this balancing act of maintaining the cost discipline (that the markets handsomely rewarded them for) vs investing in AI.

Cash flow remains an undisputed king

Cost controls and prioritising cash flow was a recurring theme this quarter. These companies cut employee headcount or kept it flat to manage their opex growth. Some of them also slowed down on expansive capex projects. (Note the trend in TTM capex spend in the chart below)

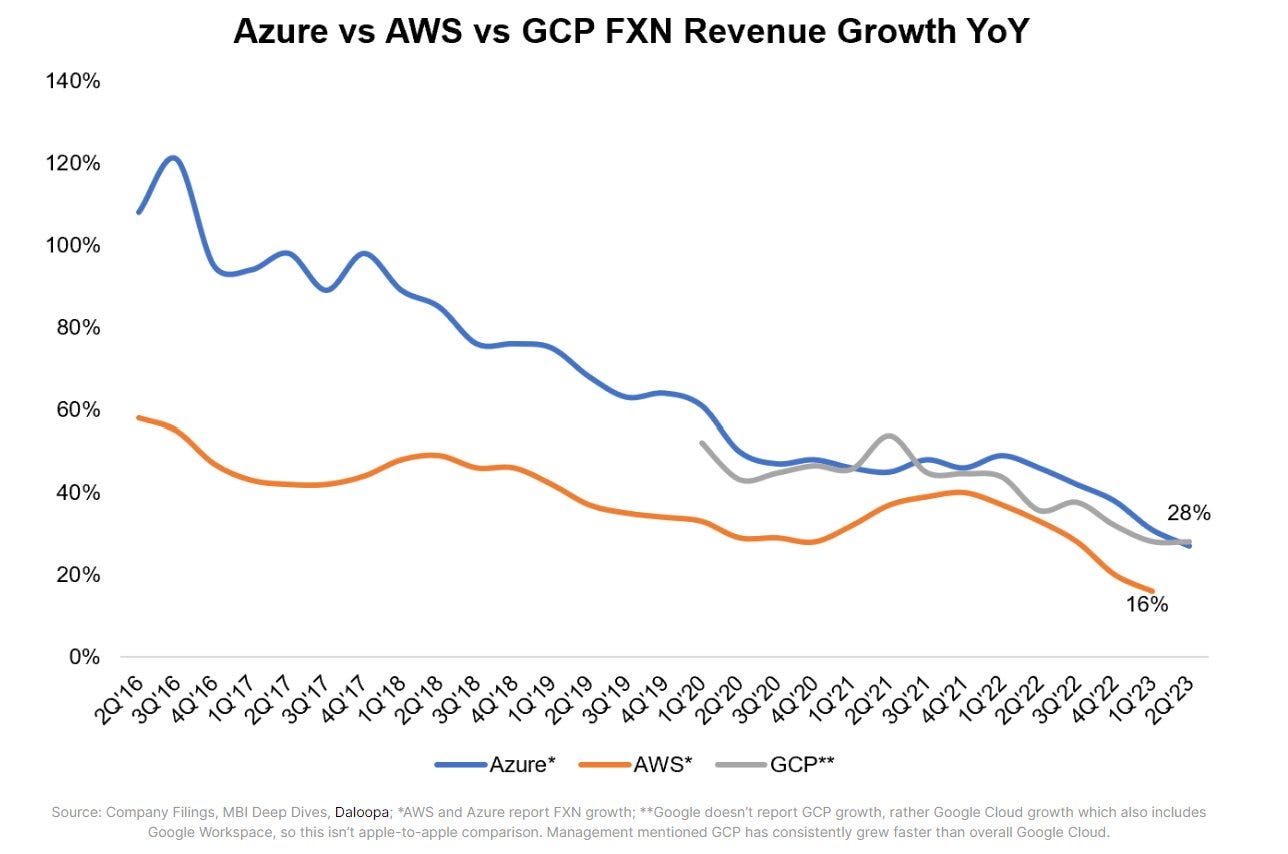

MSFT grew revenues by 8% (with Azure still growing by 27%) while increasing opex by just 2%, operating cash flow increased 17% and FCF increased 12% YoY. It also kept headcount flat allowing it to expand operating margins.

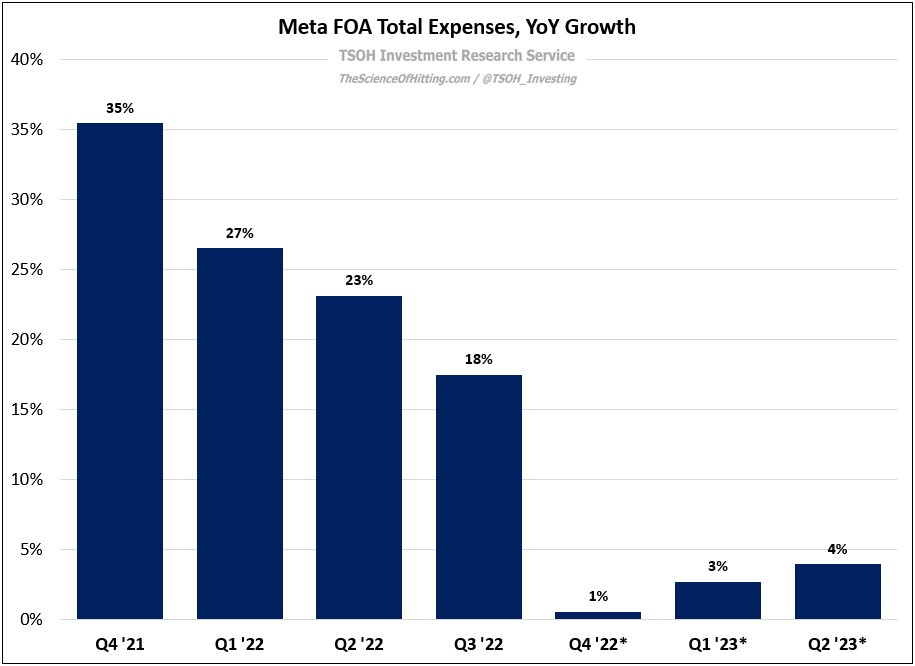

META continued to execute its “Year of efficiency” program. It decreased its headcount by 7%, and lowered its capex forecast by another $3bn and added an extra $4.8bn of free cash flow (on a TTM basis), all this while growing its revenues by 11%. Core business expense growth was also much lower than revenue growth.

GOOG increased its top line by 9% (with Google Cloud growing by 28%) while growing opex by 4%. It also reduced headcount by more than 9000 employees. YTD it has added more than $8bn of FCF additionally.

AMZN saw 11% growth in revenues and further reduced its capex spend to get back into positive FCF territory of almost $8bn.

Investors love to see this. Revenue growth is picking up again from the lows of 2022. Big Tech continues to get leaner and is prioritising spend which is directed towards where the puck is going. They’re also generating higher cash flows in the short term which investors are putting a much higher value on.

To put it in context, we’re paying 23x-40x LTM free cash flows for these stocks today.

The balancing act might not last for long, but this is what it takes

The companies also reiterated how their spend will pick up again as they further invest in building their AI related infrastructure and other tools to support their highest growth areas. These excerpts from their earnings reports/calls made it pretty clear.

“To support our Microsoft Cloud growth and demand for our AI platform, we will accelerate investment in our cloud infrastructure. We expect capital expenditures to increase sequentially each quarter through the year as we scale to meet demand signals.” - MSFT

"We expect elevated levels of investment in our technical infrastructure, increasing through the back half of 2023 and continuing to grow in 2024. The primary driver is to support the opportunities we see in AI across Alphabet...” - GOOG

“We expect higher infrastructure-related costs next year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint.” - META

If the macro environment does not change and rates are still high around the same time next year, I would not be surprised to see much higher spends by Big Tech giving the market shudders, like they did last year. However, I believe a prolonged focus on short term cash flows over long-term growth is real risk for these companies and their shareholders.

The flattish trend in their revenue growth rates is hard to ignore. It is not only a sign of the scale at which they operate now, but also of their core business being mature or close to maturity.

One could take the other side of the argument above and mention growth rates and the potential for Cloud, but the trend is directionally similar.

At this point in their corporate lifecycle, I’d rather these companies spend and invest in high growth opportunities (prudently, of course) than spit out higher cash flows consistently. These are exceptional businesses with robust core markets that put them in a position to outspend the rest.

Their ability to spend for growth at every point in the business/economic cycle is one of their strongest “moats”, which allows them to stay ahead entering into new tech cycles.

This is what it takes

In Big Tech’s Biggest Bets (a must read essay if you follow these companies), Matthew Ball shares some fascinating insights into the gargantuan $$ amounts it took for Big Tech to get where they are right now.

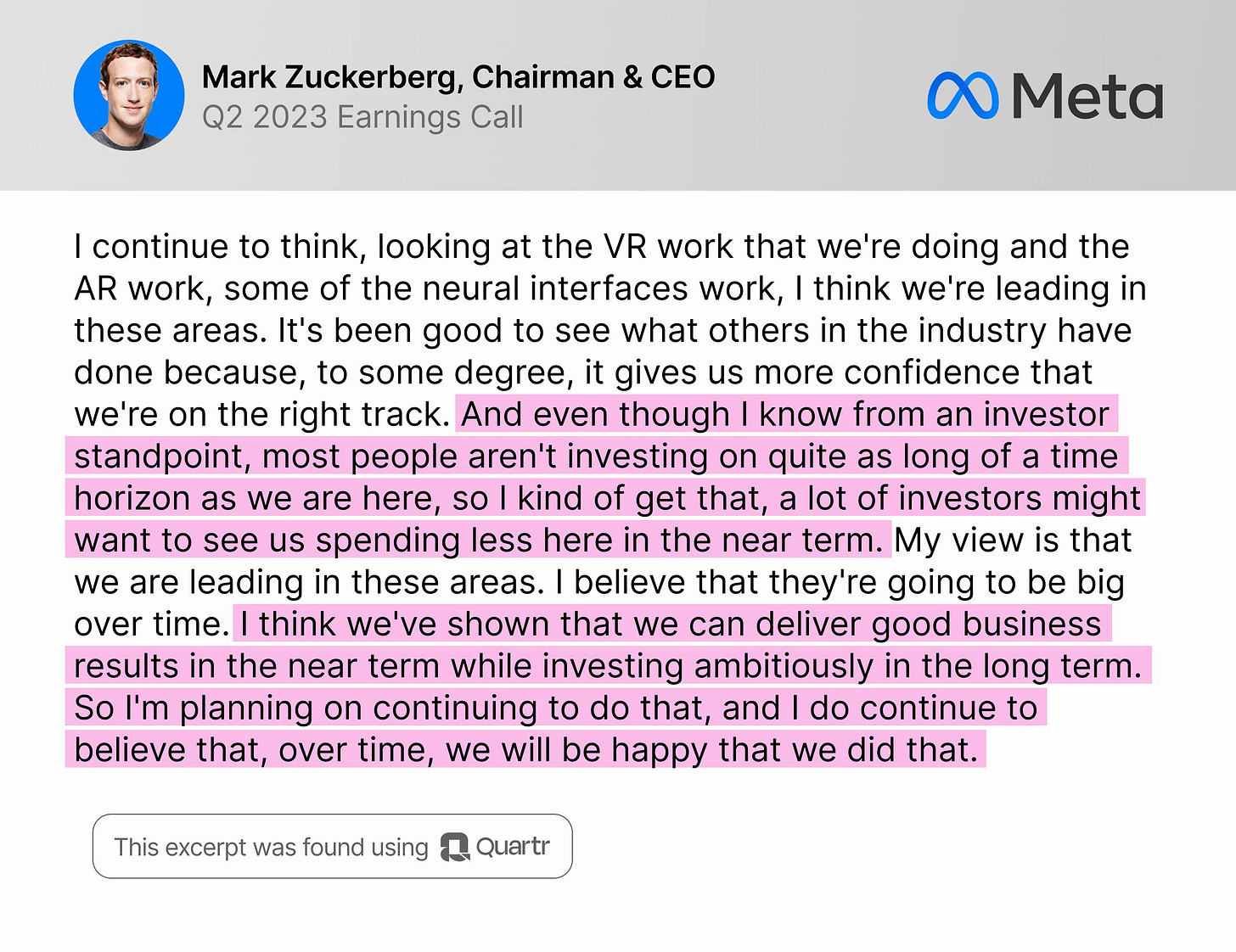

Meta has spent approximately $56bn on its AR/VR Reality Labs division while generating $7bn in revenues in the segment on a cumulative basis. Its cash gushing core advertising business on its social media platforms allow it to do that.

Amazon has spent more than $35bn on content alone. Does Prime Video generate billions in cash flows by itself? Nope. But it provides its now enormous $40bn Ads business even more ad inventory to keep growing. AWS took tens of billions just to get started, and has a run rate of $90bn with more than $20bn of operating profits alone. It further allowed it to invest in products like Alexa, which had cumulative losses of more than $20bn from 2012-2022.

Google has racked up cumulative losses of $35bn in its Cloud division which is now finally profitable and it now expands the TAM for its product ecosystem massively.

Microsoft has already spent almost $20bn on AI since 2019, and recently offered to buy Activision out for $75bn for its gaming division.

There are numerous other examples of successes and failures of Big tech spending big money to find the next growth platform. But this is what it takes to create trillions in shareholder value.

Jeff Bezos put it perfectly in a shareholder’s letter in 2017,

“As a company grows, everything needs to scale, including the size of your failed experiments. If the size of your failures isn’t growing, you’re not going to be inventing at a size that can actually move the needle.”

As these companies ramp up spending again, it is still unclear when the returns on these AI investments will materialise. AI infrastructure seems to be best positioned to win today, but would it be the next platform for big tech for sustainable growth?

Mark Zuckerberg’s answer to the question around Reality Labs losses is how we should be thinking about the billion dollar bets these companies tend to make, like the current one on AI.

The balancing act of today might not last for long. But for those who are concerned, this is what it takes.

Until next time,

The Atomic Investor

Excellent as always.

Before reading, I would have thought the cost control environment would take (at least) a few years to mould into anything more balanced. But you've got me thinking.

My only counter argument: I still think, at least for big tech, there's a great deal of juice to be squeezed from the (reduced in size) lemon.