Investing in the beautiful game

Football, by design, has a challenged business model which needs a lot more than just making money to make it work. But despite the challenges, we're seeing a flood of capital coming into the sport.

When Pele popularised the phrase ‘The Beautiful Game’ for the game of football in his autobiography in 1977, he probably wouldn’t have imagined that it would evolve into global phenomenon of this scale a few decades down the line. There are more than 5 billion football fans today, amounting to roughly 60% world’s population.

For the majority of them, the sport is about much more than being a casual fan. Football has become a part of cultural zeitgeist. A force that is almost as powerful as religion, uniting and dividing families, societies and countries when a game is on. Its rich history is embedded deeply into people’s lives, the love for which is passed along generations of football fans.

One must wonder that football clubs, operating in the world of a storied sport and a loyal and ardent customers (fans) would be wonderful businesses to own. Quite the contrary. If you held the stocks of publicly listed football clubs since their IPO, or even bought them when the club was doing well on the pitch, you would have either lost some of your capital or severely underperformed a cheap total market ETF.

The clubs in this chart have had great success on the pitch, and some of them also make handsome sums of money by developing talent and selling them to larger clubs (the likes of Ajax and Dortmund). But even then, the performance in the markets has been hard to come by. Clubs rarely make money over a complete cycle and have low earnings durability.

Football, by design, has a challenged business model which needs a lot more than just making money to make it work.

Unattractive business fundamentals

A club’s core assets, its football players are also the largest expense centre of the business. Player wages keep going up year after year, but an inflated wage budget does not guarantee success on the pitch. A bottom of the table club like Leicester City has wage to revenue ratio north of 80%. Even the best run clubs like Bayern Munich (and some outside fans would say Man. City) pay out 50-60% of their revenues (not profits) as wages.

On the other side of the equation, matchdays, a large source of revenues for a club, have little growth potential given an upper limit on the number of games played over a season. Clubs do raise ticket prices every now and then to grow their matchday revenues, but they risk the ire of their fans by doing that. Sponsorships and broadcasting, the other major sources of revenue, consist of long-term contracts with fixed payment terms which are tied to the commercial success of the club and its ability to attract eyeballs. In most leagues, the top 4-5 clubs take majority of this share. The other revenue source, merchandising, can be quite volatile in itself.

Unlike leagues like the NBA or the NFL, the top football leagues do not have a wage cap or wage limit which allows the largest clubs to pay massive wages to players to attract them. Additionally, the teams are not protected against relegation. They can be booted to lower leagues if they fail to perform which puts clubs at a risk of severe financial duress due to lack of sufficient revenues. The cost structure of a club, on the other hand, is hard to change in a short time period.

Commercial success and success on the pitch are not always aligned

An investor in a football club looking at avenues for commercial success would need to convince the fans that these changes are in the best interests of what they want. But commercial interests are not always aligned to success on the pitch. You can buy star players who sell the most tickets and shirts and do great commercially, but it is not a guarantee of footballing success. All fellow Man. United fans would certainly attest to that.

Massive reinvestment needs

Clubs today have massive reinvestment needs to even stand a chance to go for the biggest trophies. You need a state of the art stadium and exceptional training facilities along with large transfer budgets to build your squad. Tottenham Hotspurs’ new stadium cost them more than a billion pounds. Real Madrid is shelling out more than €900mn for the stadium revamp, whereas FC Barcelona has reportedly lined up €1.4bn of financing for its stadium overhaul. Chelsea spent more GBP 500mn on transfers alone last season, and still ended up finishing 12th in the league.

There’s always the right way to spend, but reinvestments in the squad and infrastructure at multiples of your revenues are almost a bare minimum if you want to compete for the biggest trophies.

Other problems

Running a football club is not easy. A modern day club needs specialists at the wheel, not just business operators to ensure continued success. We’ve seen plenty of clubs in the past ending up in the hands of billionaires and becoming trophy assets. In other cases, clubs owned by entities with an eye on making a return on their investment pay little attention to putting the right structure in place, and cripple the clubs with too much debt for short term gains, ultimately taking away its ability to spend and build for success in the future.

But despite all these challenges, we’re seeing football being flooded with outside capital lately.

Big money game

The pandemic kickstarted an investment spree in football assets when most clubs were under severe financial stress and needed an emergency liquidity injection. The lockdowns wiped out their matchday revenues completely and investors used this as an opportunity to get in at cheaper valuations.

Additionally, the patterns of consumption and distribution of football have since changed considerably, which has expanded the commercial opportunity set in football, therefore improving the prospects of the business.

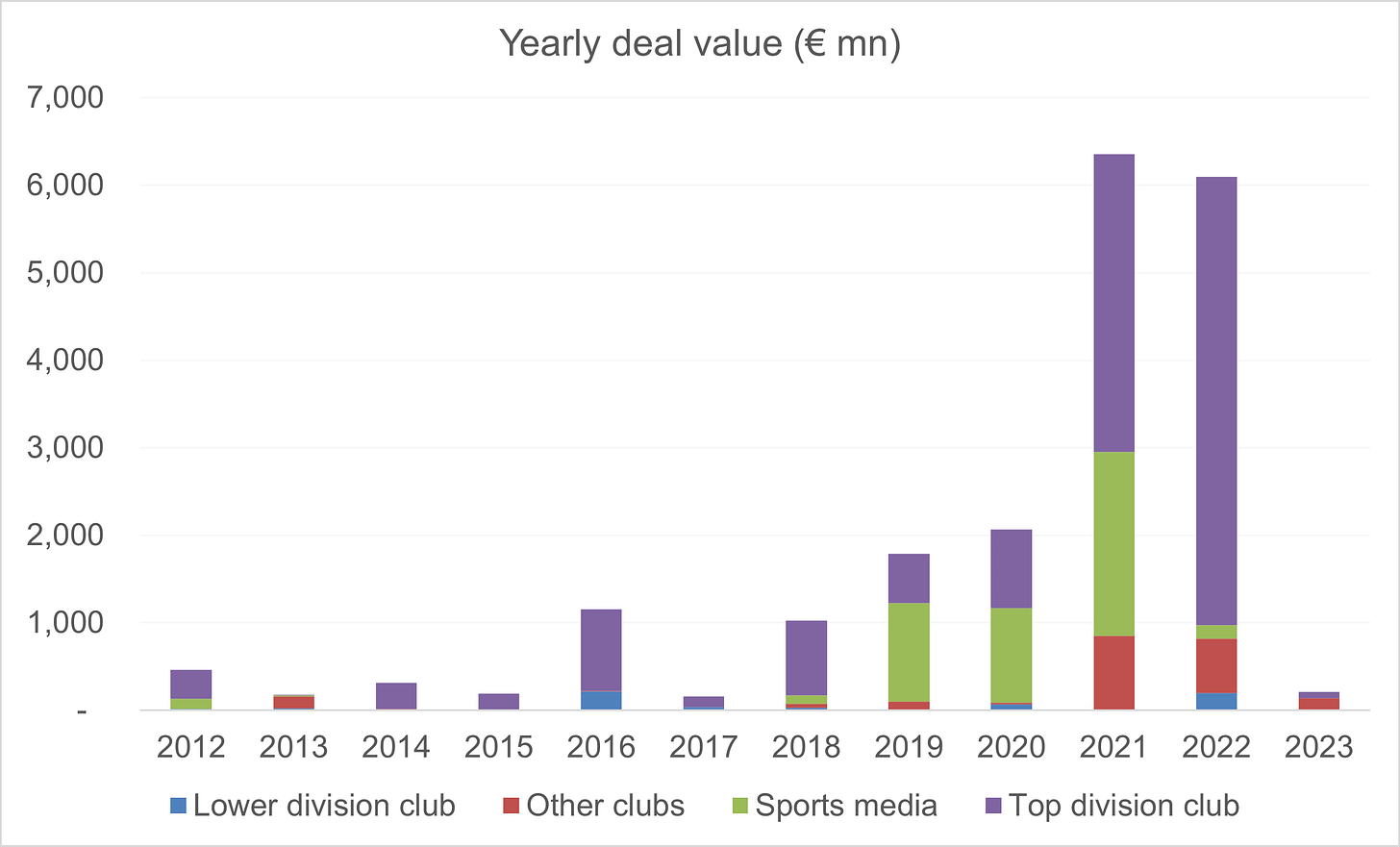

I looked at the top 500 deals (financing, mergers, investments, buyouts) in football since 2012, involving clubs, media and other football related businesses. Around 130 of those included clubs and media assets. Here are some noteworthy stats.

Almost €20bn worth of deals were completed since 2012 and 64% of total deal amount involved top division European clubs, 3% of it lower division European clubs and 10% of it Non-European clubs. What is fascinating is that only €5.25bn came in from 2012-19, the rest of it just in the last 3 years.

Some of the deals that made the headlines recently were Chelsea’s $5.3bn buyout by Todd Boehly and Clearlake Capital, AC Milan’s €1.2bn buyout by RedBird Capital, Ares’ 34% stake in Atletico Madrid, Oaktree’s 31% stake in Inter Milan, Silver Lake’s 10% stake in City Football Group, Newcastle United’s take over by the Public Investment Fund of Saudi Arabia and so on.

But what’s interesting to also note that we do not see or hear about enough is the increasing number of investments in smaller lower division European or other non-European clubs. While the deal value is much smaller, roughly 42% of all deals since 2012 involved these two types of clubs.

Investing in football during the pandemic was part opportunistic, but these trends are likely to continue as there are clear growth drivers that are changing the football business landscape.

Expanding its borders

Football has spread its wings slowly across the world, from the U.S to Asia and beyond. Clubs now have a much more global fan base allowing them to reach millions of people. A broader audience is fuelling a growth in commercial revenues outside the home countries of clubs, whereas more eyeballs for broadcasts is presenting a number of opportunities to clubs and leagues to commercialise their revenue streams via sponsorships and other partnerships.

The Premier League is expected to earn more than 5 bn pounds for the next three years, just from international rights.

Direct to consumer

Large streaming and tech companies have jumped into the fray, bidding up the value of football media assets. Amazon paid more than 800 million pounds to broadcast the Champions League in the UK for 11 years in 2022. The likes of Amazon, Disney, Dazn, NBC are now the new constants in football streaming.

It is also opening up other content monetisation opportunities, like documentaries, enhancing the brand image and value of the club’s assets. Amazon signed up Man. City, Arsenal and Tottenham for a multi-million pound deal for its All or Nothing documentary series featuring these clubs. Recently released Welcome to Wrexham documentary featuring Ryan Reynolds’ Wrexham AFC was almost like a masterstroke, and has given the club and the surrounding area a big commercial boost.

Other avenues

Football clubs have a rich history and a ton of content that fans could watch for forever. The best goals, the winning moments, the comebacks and their favourite players. Now the clubs have found another avenue to monetise all of by creating digital collectibles and memorabilia (very similar to NFTs), which opens up a whole new opportunity set to commercialise content with the possibility of a separate revenue stream. Manchester United recently partnered with Tezos to set up its digital collectibles unit which are now being sold to the fans. FC Barcelona is reportedly looking at carving out its digital assets unit for a valuation of more than €1bn.

Additionally, increasing use of digital and social media platforms have also allowed asset owners to expand their commercial inventory and enhanced the global appeal of football assets. They can now better understand their audiences and use data driven decisions for their commercial activities.

There is a lot going on in the world of business of football right now. Newer, more complex ownership structures are emerging. Football assets are being bought out by state-owned entities. The face of the game is changing as billions get poured into the game. The divide between the largest clubs and the rest of the pack is getting wider.

Nonetheless, more investors and different kinds of playbooks are constantly emerging to invest in the beautiful game. I might cover that in another post soon.

Until next time,

The Atomic Investor

Fascinating read. As a football fan, it is a very unpredictable and unprecedented time to support a club.

what an amazing read! the ever growing world of ⚽️ spanning over billions with dismal profits to the clubs!! Middle east investing big moolah here is another feather in the cap