What mattered #11 - Winners and Winners

The markets are churning out winners and winners.

Disclosure: None of the securities mentioned in this article should be considered investment advice. I may or may not be holding positions in them. Please conduct your own due-diligence.

Welcome to another edition of What mattered. A collection of narratives and stories driving the world of technology and investing, and why it matters for Atomic Investors.

A tiny programming update - What mattered has now been moved to a monthly update. Weekly stories are interesting, but extending the time period to a month makes it easier to identify the broader narratives and trends and spot the driving forces behind them. More signal, less noise.

Ideas are more useful when they are put to work, learn via every iteration and incorporate feedback. Therefore, I'll be sharing less complex ways to do that for the Atomic Investors out there via ETFs and other securities.

After the stellar run we've had this year, you could have expected the markets to take a breather this August, go on a summer break maybe. It was hardly the case.

The S&P 500 and the Nasdaq continued on their upwards trajectory with impressive gains as large cap tech names staged a comeback. This was on the back of a great earnings season with upgrades and upward revisions across the board. The macro backdrop has turned favorable too with less aggressive tone from the Fed chair at the Jackson Hole meeting and no negative surprises.

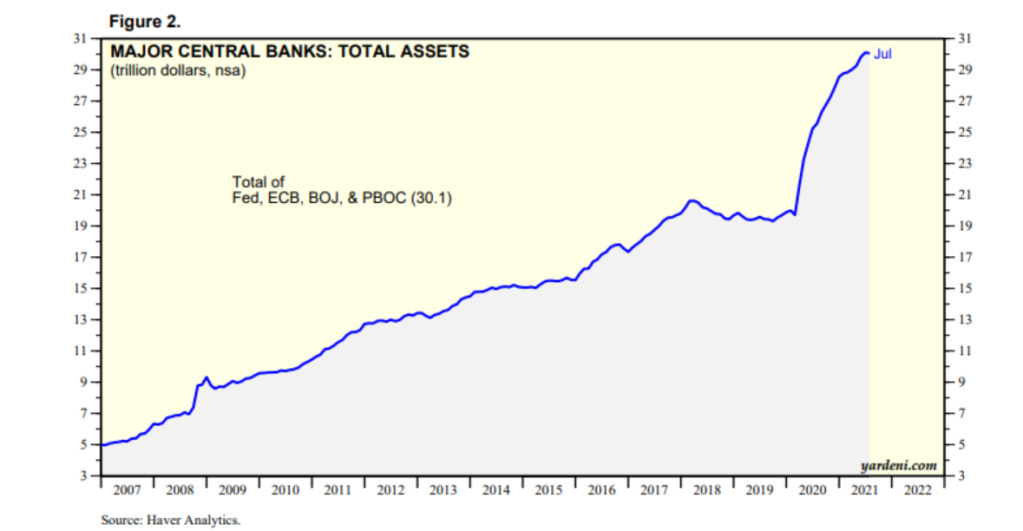

The markets tend to move from one set of expected outcomes to the next one and expectations for dialed down taper talk at the meeting were already being set. The major economies have yet to show accelerating inflation numbers which has allowed central bankers around the world to leave the liquidity spigots on, therefore capping yields within a low narrow range and keeping asset prices high.

European markets have had a similar run with the both large cap and small cap indices raking in incremental gains. The commentary in Europe was similar, with the ECB maintaining the status quo for its bond buying program even after record inflation numbers and strong industrial and manufacturing activity picked up. The message remains clear - Inflation is transitory and we are still a few steps away from full economic recovery amid the delta variant surge.

Bank of England has been one of the very few major central banks that sounded like an alarmist after CPI accelerated in the UK, but so far the markets seem to be churning out only winners and...winners. By winners, I do not mean that the sector or the asset has outperformed every other security out there. All I'm saying is that if you were invested in any one of these areas, you would have had some decent gains to show for.

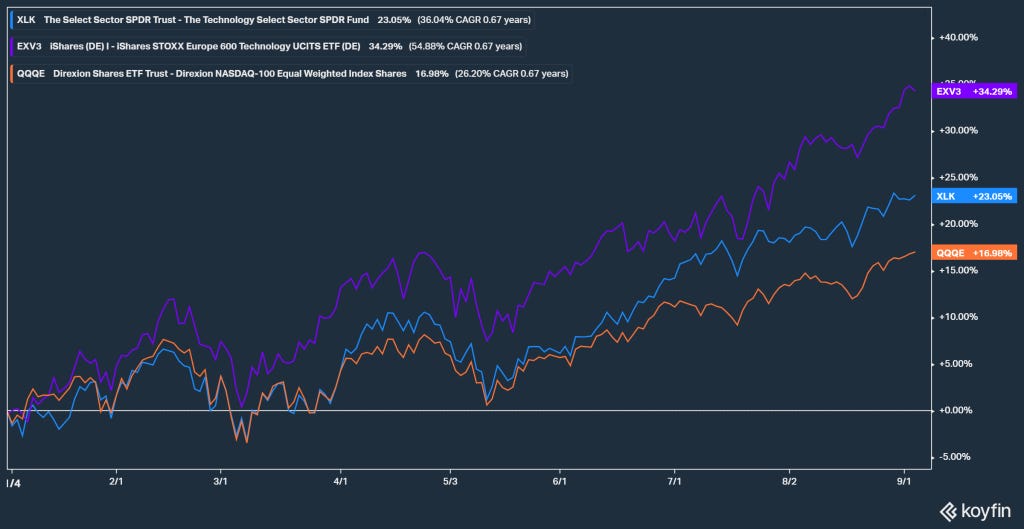

Technology is winning

While the big tech trade has seemed to fizzle out in the year, investors keep coming back to the proven winners both in the short and the longer 'secular' terms. Market cap weighted index has outperformed the equal weighted counterpart which clearly shows where how strong large cap tech has been this year.

Put this to work via:

QQQ: Invesco QQQ large Cap U.S Technology ETF

EXV3: iShares STOXX Europe 600 Technology UCITS ETF

Economically sensitive sectors are winning

Energy and financials, which are almost like levered plays on the economy have been phenomenal this year. Whatever you want to call it, value plays or reopening plays, these sectors have lead throughout the year due to lower loan provisions, lower defaults and continued central bank support (for financials).

Put this to work via:

XLF: SPDR U.S Financial Select Sector Fund ETF

XLE: U.S Energy Select Sector SPDR Fund ETF

EXV1: iShares STOXX Europe 600 Banks UCITS ETF

OIL: Lyxor STOXX Europe 600 Oil & Gas UCITS ETF

Growth...and value are winning

Growth and value names are often cited on the opposite ends of the pole, with winners and losers on either side. This year has been slightly different.

Put this to work via:

IWF: Russell 1000 U.S Growth ETF

IWD: Russell 1000 U.S Value ETF

IDJG: iShares EURO Total Market Growth Large UCITS ETF

IEVL: iShares Edge MSCI Europe Value Factor UCITS ETF

Now onto some other important themes that have been playing out over the last month:

Jackson hole and the economic backdrop:

As mentioned above, the meeting was widely awaited to get a sense of the timeline of the tapering (slowing down the bond buying by the central bank). There were no negative surprises and the markets continued its run over to September. For context, there has been $32tn of monetary and fiscal stimulus since March 2020, which amounts to $834mn spent by central bankers per hour.

More stimulus means more liquidity, and put that together with all the negative yielding debt, you see investors being pushed to extreme ends of the risk curve into speculative assets and high risk alternatives.

We've seen that play out already with increasing private AUM's, higher VC funds amidst even higher valuations and of course a barrage of speculative assets in the crypto space.

Put this to work via:

Moving further across YOUR risk curve, but being invested is the key.

Supply chain issues and implications:

One of the themes that has surfaced repeatedly over the last few months has been supply chain problems and raw material shortages around the globe. Raw material prices are through the roof, with shipping container prices surging as well. This is being touted as the primary driver of inflation and expected to last till 2022. As mentioned in this Bloomberg piece,

Manufacturers reeling from shortages of key components and higher raw material and energy costs are being forced into bidding wars to get space on vessels, pushing freight rates to records and prompting some exporters to raise prices or simply cancel shipments altogether.

With commodities in a bullish cycle of their own, investors are already positioning themselves for higher inflation with more commodities and real assets exposure.

Put this to work via:

BOAT: SonicShares Global Shipping ETF

PDBC: Invesco Optimum Yield Commodity tracking fund

Earnings growth and valuations

Its hard to ignore the improvement in fundamentals across the board both in the U.S and Europe.

In the S&P 500, 87.7% of the companies reported earnings above estimates compared to a long-term average of 61%, whereas in Europe 64% of the companies reporting till date beat estimates as compared to an average of 51% per quarter. And stocks tend to follow earning estimate trends more often than not.

Investors are worried about valuations nearing dot-com period levels (1999-20). But if you consider where rates are, and look at the upward trending earning estimates in both the U.S and Europe, valuations might start making a bit more sense.

The markets are not undervalued by any means, but valuations at these levels shouldn't keep you away. Most positive outcomes seem to be priced in already, but as they say there will always be pockets where you could generate ideas and compound your capital.

Next month's edition would feature two additional sections:

Where the flows are

A section dedicated to the world of ETFs including developments that matter and interesting new launches.

Decrypted

Observations from the Crypto world, interesting project launches and stuff that matters.

Until next time,

The Atomic Investor