Down year vintages age like fine wine

The 'down years' vintages, when PE returns remain subdued for a while have a record of outperforming funds from when the times are good. But why is it the case?

The S&P 500 being up 20%+ this year is like a weird dichotomy. If you look around in the real economy, both consumers and businesses are now starting to feel the pain at the edges as the effects of high interest rates and lower liquidity in the system start setting in.

In the PE land, this environment is creating all sorts of challenges across the PE flywheel of raise-invest-grow-exit-repeat. It is not only impacting deploying capital and entering new businesses, but also making it much harder to operate existing portcos.

PE-backed companies tend to be rated lower than investment grade due to having higher leverage levels and being much smaller in size on average. Higher rates and tight credit conditions are pushing up the cost of debt financing to levels not seen by these companies in a long time.

10-12% floating rate loans are becoming the norm for an average PE backed company, which pushes interest costs to levels where they start eating into your cash flows that drive your investment returns.

Moody’s issued a warning to the private credit industry this week, mentioning Ares and Owl Rock’s (the two of the largest private credit players) funds and highlighting the riskiness of the loans issued to mid-market companies due to their declining interest coverage ratios. With a deluge of debt coming up for refinancing, this could create a whole host of problems for the portcos and their sponsors.

With both Private credit and syndicate lenders under some form of duress, one could expect the dealmaking environment to remain subdued.

While PEs are trying to find workarounds to get deals done, the overall market conditions are likely to dampen returns for a while. This period, typically called ‘down years’ are rarely easy to navigate even for experienced GPs. It stops the flywheel in its tracks and hurts forward fund returns as the positive feedback loop suddenly turns into a negative spiral.

However, PE vintages from down years have a great track record of outperforming the markets, ageing like fine wine. This time around too, 2023 and 2024 vintages (which is when the probability of a recession is high) are expected to do well, according to Coller Capital’s PE barometer.

I tried following this train of thought this week, looking at other down year vintages and what might be driving this outperformance during tougher economic environments.

PE vintages during a recession/slowdown

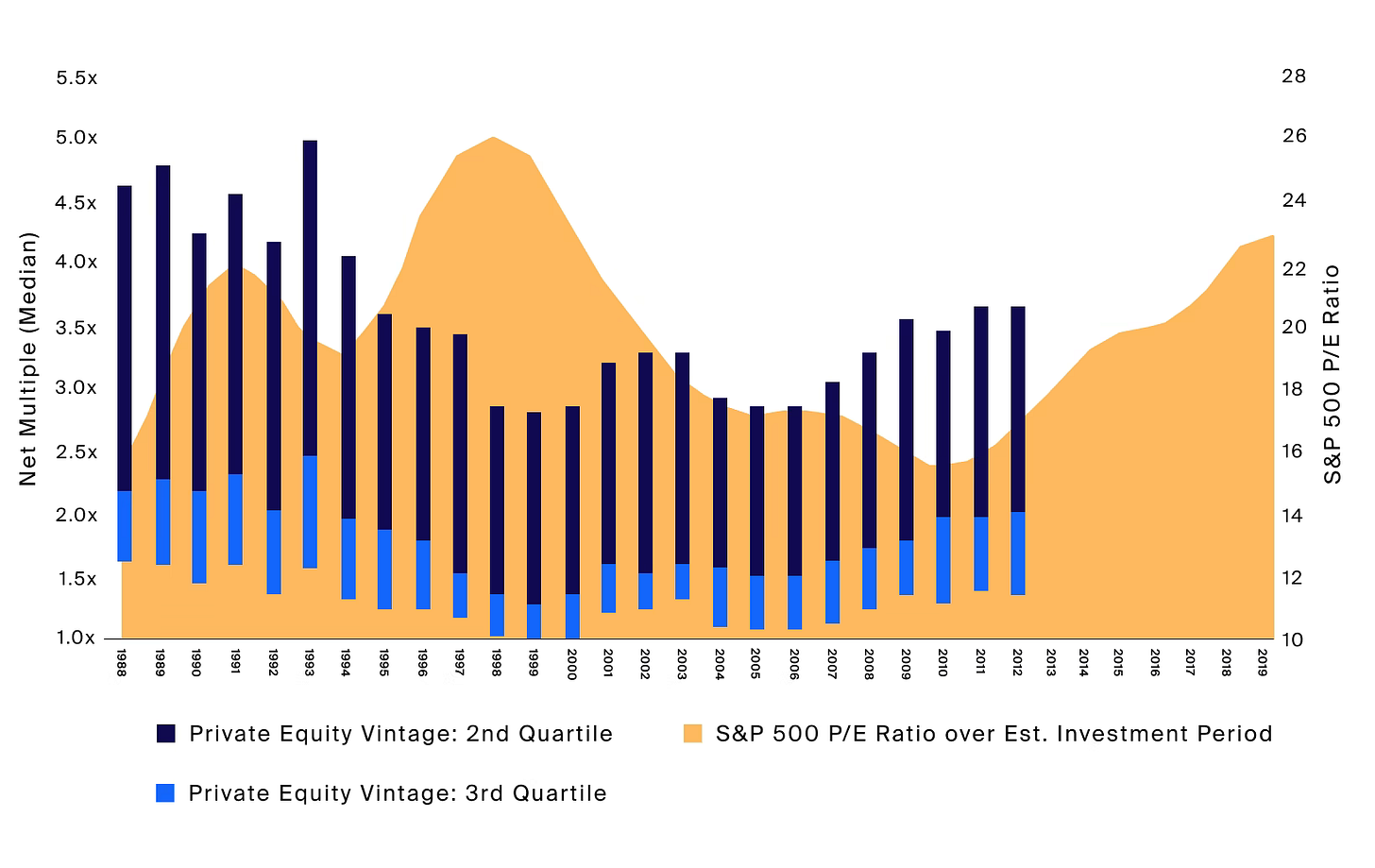

Private Equity funds of vintages coming right out of a recession have delivered a strong performance historically. Although it only looks at the last two bear markets (2000-01 and 2008-09), it is an indicator of strong outperformance during a period when public market returns and the economy are facing a tough time.

But absolute returns mean little when looked at in isolation. Every asset class has an opportunity cost, which for most of the times for PE is public markets.

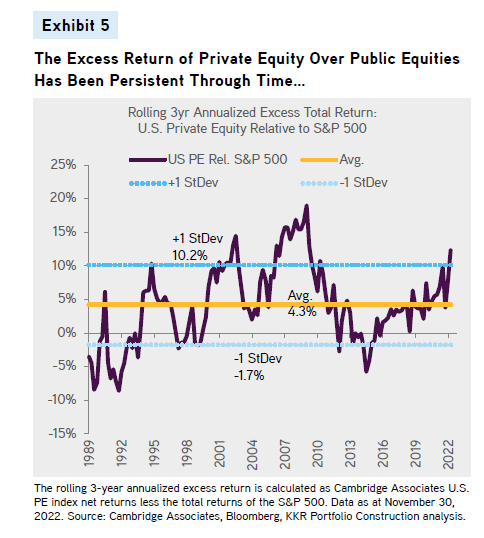

Here’s an interesting analysis from KKR’s 2023 report on the Regime Change in Private Equity. According to the findings, PE’s excess returns over public markets are the greatest when public equities deliver low returns.

Another interesting piece of analysis from StepStone indicates that during down cycles, PEs capture less of the downside during the period and much higher upside coming out of the cycle as compared to the public markets.

The down year vintages, therefore, look more attractive even when risks are higher for investors across the public and private markets spectrum. But why is it the case?

Deploying at cheaper valuations

A recession, especially the one driven by high inflation-low growth scenarios, has a significant impact on valuations which lowers purchase price multiples across the board. Sentiment drives prices for high quality assets lower as well, which pushes up future returns for those investments if an investor can snap them up at attractive prices.

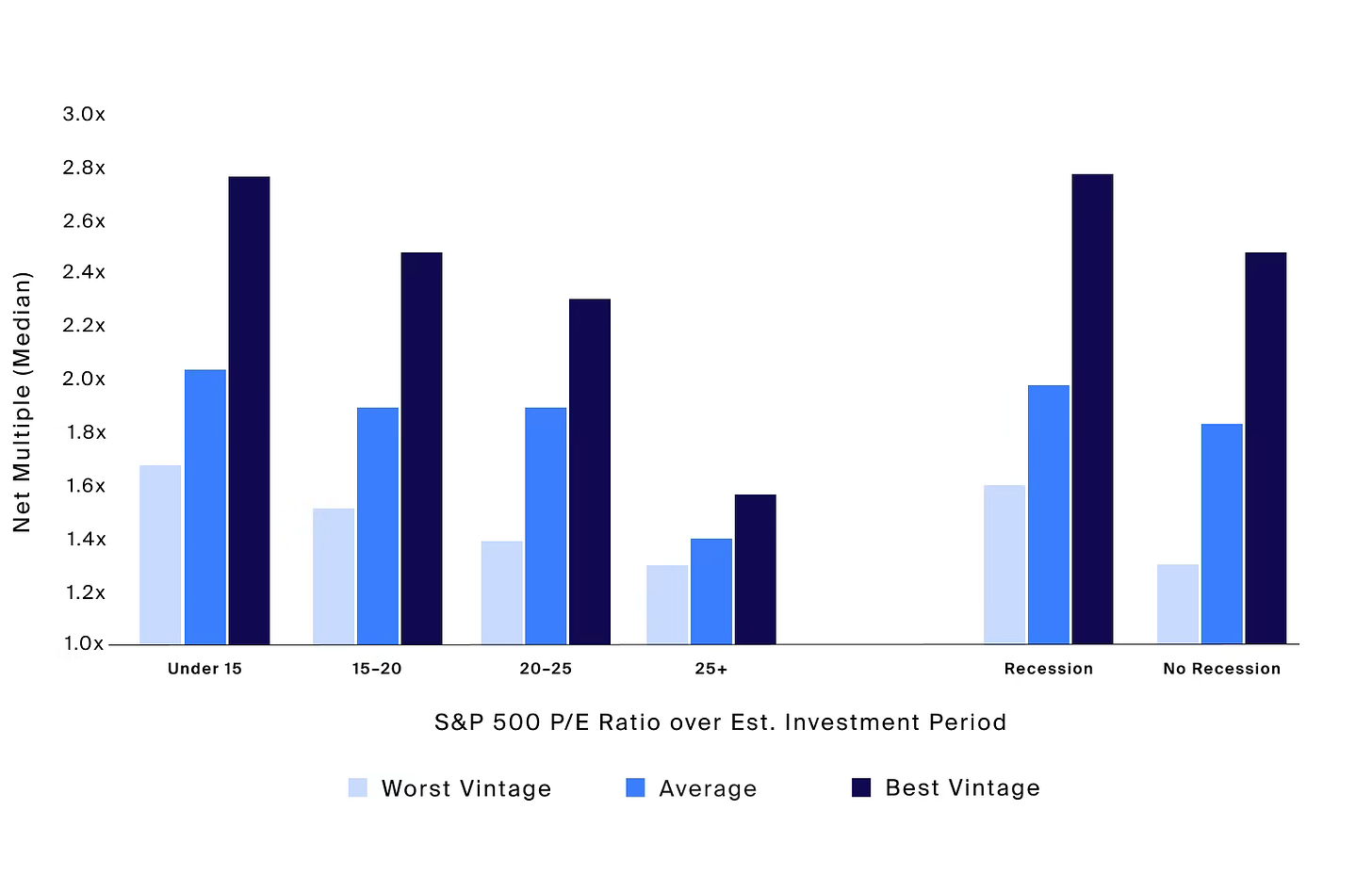

According to CAIS’ deep dive on impact of purchase price multiples and deployment timing, funds that deployed during environments where multiples were lower tended to outperform those which deployed in environments with rich purchase price multiples (they’ve used S&P 500 P/E multiples, but since EV/EBITDA in private markets tend to follow public markets directionally, it should produce a similar effect).

Now, there was plenty of capital deployed during the exuberance of 2020-2021. But disciplined managers usually spread deploying over a number of years, and try to take advantages of dislocations to buy quality assets at lower prices and sell them in an environment when prices have normalised. Given how sensitive fund IRRs are to entry and exit multiples, deploying at low multiples is a strong driver of performance for down year vintages.

Less competition for riskier assets

Just as in a bull market, competition for assets goes up as abundant capital chases assets to invest in, a bear market reduces competition for assets as risk apetites falter and investors look for more safer bets. Lower competition creates more favourable deal conditions both in terms of price and otherwise for riskier (the ones with a higher potential reward) assets.

While in such an environment the highest quality assets are in even high demand, sectors where other investors are not looking or assets that are complex to operate and turnaround is where competition is much lower. These are the ones that have a higher likelihood of turning into great deals coming out of a bear market. Hospitality and Leisure assets during the pandemic is a clear example of such deals. That said, the manager needs to do a lot more than just buying up businesses that the peers do not want to own.

Sector tilts

Many of us ignore or fail to take into account the sector allocation of PEs which goes a long way to impact returns both during an up cycle and a bear market. This sector allocation graphic from KKR is a great example of how managers can lean into sectors which have higher chances of coming out of the cycle in better shape (or stronger) and cutting back exposures to the ones which might not.

The flexibility to deploy across sectors and change the exposures up (especially for managers with the scale and resources to deploy) comes in quite handy when facing challenging times.

Active involvement with portcos

Recessions force both managers and businesses to get fitter, optimise operations and develop newer playbooks which are more suited for the new set of conditions. The value creation teams step in to help portcos develop and strengthen capabilities across the board and transform how they operate both from growth and cash generation perspective. Today, most large cap and middle market PEs have dedicated operations teams to help portcos ensure survival, get fit and drive growth coming out of the cycle.

This active involvement and a hands-on approach is key for PEs, especially when facing such tailwinds.

Resilient businesses are built during downturns

Downturns are like inflection points in a business cycle, where the prevailing conditions set the stage to put the new cycle in motion. In an environment where capital is restrained and risks to survival are aplenty, operators and owners are forced to develop new set of ways which are more resilient, allowing them to do a lot more with a lot less. They focus on efficient and sustainable ways to grow, hire the best talent with the skill sets and the tenacity to survive and cut the excesses and complacency that sets in during the good times.

Most large tech companies of today emerged out of the dot-com crash and the GFC, and as I opined in a recent post on big tech, being put up against the test of being as efficient during times when capital is scarce and growth is limited is preparing them to win the next cycle.

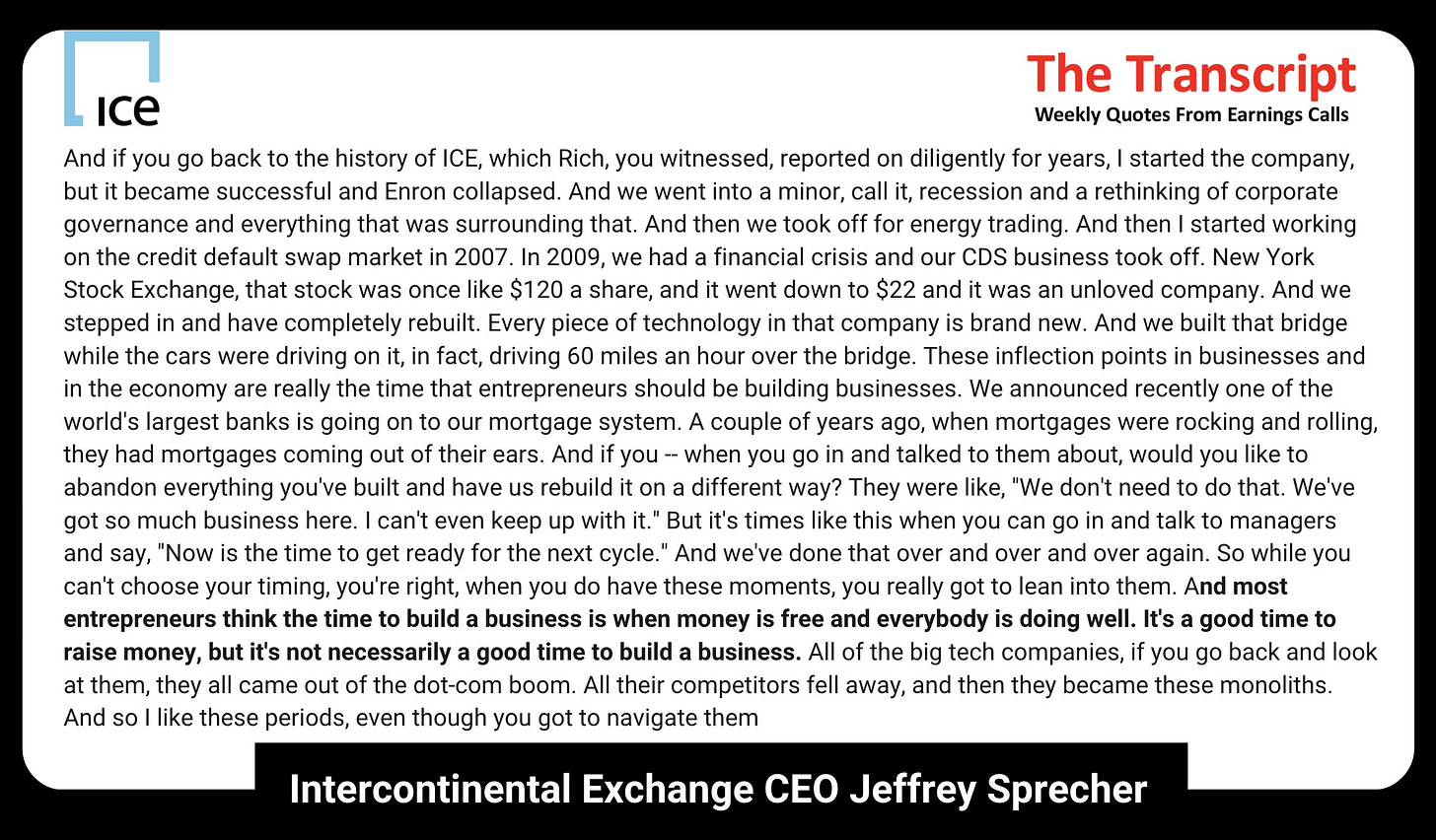

This quote from International Continental Exchange’s recent earnings call really drove this point home (more context in the image)

“Most entrepreneurs think the time to build the business is when money is free and everybody is doing well. It’s a good time to raise money, but it’s not necessarily a good time to build a business.

Resilient businesses are great assets to own for PEs as they can grow during different kinds of business cycles and that creates immense value for both owners and operators.

The next couple of years are going to be quite interesting in the PE space as GPs try to capitalise on the current market conditions. Just like the last ones, the fittest of them lot with playbooks designed for the current environment will emerge out of it much stronger than the rest of the group, with more capital, better deployment opportunities and deals and higher returns. The fine wine-like vintages that everyone loves.

Until next time,

The Atomic Investor